-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

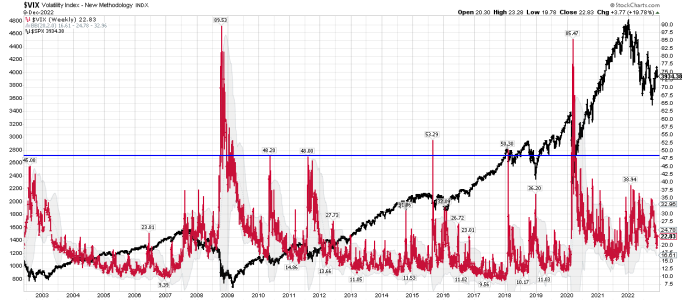

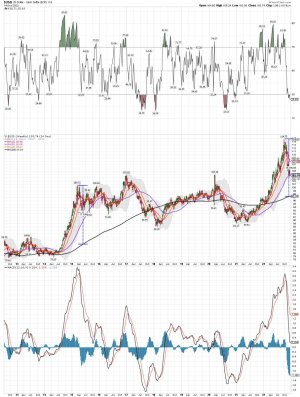

$VIX weekly: If this is a Bear Market then the VIX has a huge move coming next couple of years. What does it all mean.... Stay nimble, and don't fall in love with your positions.

Based on this historical data on this chart below, one would expect to see the VIX hit 50ish or higher before this Bear is done mauling investors.

Based on this historical data on this chart below, one would expect to see the VIX hit 50ish or higher before this Bear is done mauling investors.

Attachments

robo

TSP Legend

- Reaction score

- 471

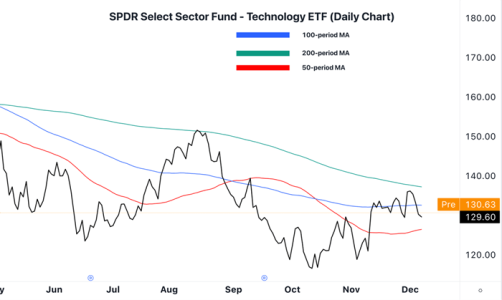

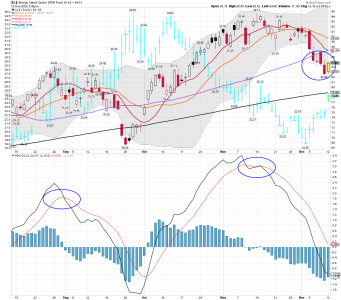

Why the Tech Sector Is Still at a Crossroads

Imre Gams | Dec 12, 2022 | Market Minute

In the case of XLK, the parameters are straightforward:

The market is more likely to strengthen if it can eventually clear the 100- and 200-period resistance zone.

The market is more likely to sell off if it breaks below the 50-period MA.

Right now, we’re still in no-man’s land. And that’s the most dangerous area to be taking a trade.

I’ll be keeping a close eye on XLK to see which set of parameters the market is going to fulfill, and I’ll update you when that happens.

Happy trading.

Imre Gams

Analyst, Market Minute

https://www.jeffclarktrader.com/market-minute/why-the-tech-sector-is-still-at-a-crossroads/

Imre Gams | Dec 12, 2022 | Market Minute

In the case of XLK, the parameters are straightforward:

The market is more likely to strengthen if it can eventually clear the 100- and 200-period resistance zone.

The market is more likely to sell off if it breaks below the 50-period MA.

Right now, we’re still in no-man’s land. And that’s the most dangerous area to be taking a trade.

I’ll be keeping a close eye on XLK to see which set of parameters the market is going to fulfill, and I’ll update you when that happens.

Happy trading.

Imre Gams

Analyst, Market Minute

https://www.jeffclarktrader.com/market-minute/why-the-tech-sector-is-still-at-a-crossroads/

Attachments

robo

TSP Legend

- Reaction score

- 471

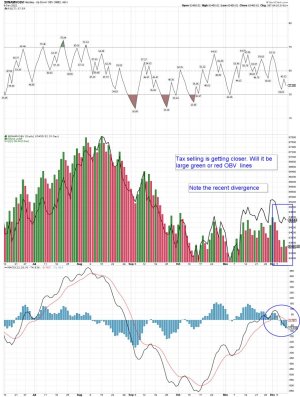

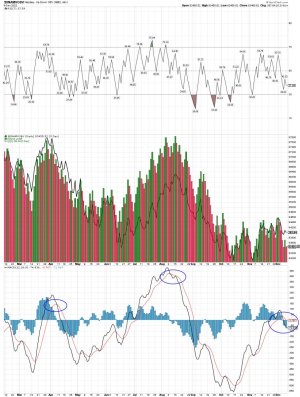

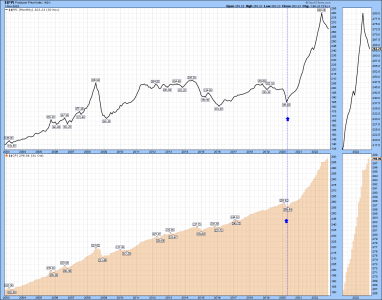

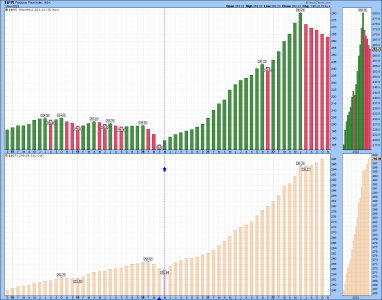

QQQ and the OBV: Not sure what the divergence means going into 2023, but it should get resolved soon.... It could go either way..... My magic 8 Ball is broken so I will just watch the show. (Tax selling season???)

Some traders use volume indicators for trading. I look for extremes and divergences in chart patterns for possible trade setups.

On Balance Volume (OBV) measures buying and selling pressure as a cumulative indicator, adding volume on up days and subtracting it on down days. OBV was developed by Joe Granville and introduced in his 1963 book Granville's New Key to Stock Market Profits. It was one of the first indicators to measure positive and negative volume flow. Chartists can look for divergences between OBV and price to predict price movements or use OBV to confirm price trends.

( small chart on the right goes with this tweet)

thomas

@VolumeDynamics

3m

A print over 105 $DX could set off a round of short-covering...

Quote Tweet

thomas

@VolumeDynamics

24m

$DX session highs... be very careful.

https://twitter.com/VolumeDynamics

Some traders use volume indicators for trading. I look for extremes and divergences in chart patterns for possible trade setups.

On Balance Volume (OBV) measures buying and selling pressure as a cumulative indicator, adding volume on up days and subtracting it on down days. OBV was developed by Joe Granville and introduced in his 1963 book Granville's New Key to Stock Market Profits. It was one of the first indicators to measure positive and negative volume flow. Chartists can look for divergences between OBV and price to predict price movements or use OBV to confirm price trends.

( small chart on the right goes with this tweet)

thomas

@VolumeDynamics

3m

A print over 105 $DX could set off a round of short-covering...

Quote Tweet

thomas

@VolumeDynamics

24m

$DX session highs... be very careful.

https://twitter.com/VolumeDynamics

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

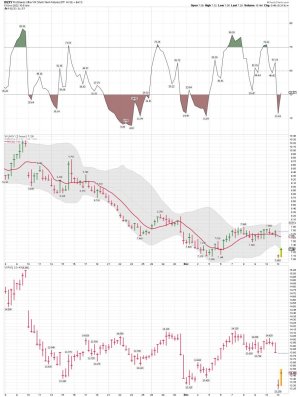

XLE daily and the VIX: Hmmmm..... Both moving higher..... We shall see how it plays out the rest of the week.

XLE remains below the 10, 20 and 50 day MA's. NOT bullish as it remains in a down trend. We shall if the CPI data tomorrow causes any trend changes or XLE heads lower to tag its 200 day MA.

XLE remains below the 10, 20 and 50 day MA's. NOT bullish as it remains in a down trend. We shall if the CPI data tomorrow causes any trend changes or XLE heads lower to tag its 200 day MA.

Attachments

robo

TSP Legend

- Reaction score

- 471

SPX daily: The 200 day MA remains resistance. We shall see if the CPI data tomorrow can push the SPX back above the 200 day MA.

I Remain Skeptical

Stocks are deep in their timing band for a DCL and they printed a bullish candle on Monday, rallying for 1.43% to indicate that the DCL has formed. However — I remain skeptical.

We need to keep in mind that stocks have not formed a daily swing low and that they remain below the 10 day MA.

Furthermore, stocks did not even retrace to the 38% fib level. There is still a chance that stocks could be rejected by either the 10 day MA or the 200 day MA to extend their daily cycle decline. However, we need to recognize that stocks are in a daily uptrend. A close above the 200 day MA will indicate a continuation of the daily uptrend and signal a cycle band buy signal. In which we would then label day 37 as the DCL

I Remain Skeptical

Stocks are deep in their timing band for a DCL and they printed a bullish candle on Monday, rallying for 1.43% to indicate that the DCL has formed. However — I remain skeptical.

We need to keep in mind that stocks have not formed a daily swing low and that they remain below the 10 day MA.

Furthermore, stocks did not even retrace to the 38% fib level. There is still a chance that stocks could be rejected by either the 10 day MA or the 200 day MA to extend their daily cycle decline. However, we need to recognize that stocks are in a daily uptrend. A close above the 200 day MA will indicate a continuation of the daily uptrend and signal a cycle band buy signal. In which we would then label day 37 as the DCL

Attachments

robo

TSP Legend

- Reaction score

- 471

"""Today is likely to be a wild day in the stock market. Gamblers who bet on the right direction will profit. Gamblers who bet wrong will lose.

But most traders are better off avoiding the casino – for today.""""

The consumer price index (CPI) – a widely followed measure of inflation – for November will release at 8:30 a.m. ET.

Minimizing Risk During a Big Market Move

Today could be a wild session for the stock market…

The consumer price index (CPI) – a widely followed measure of inflation – for November will release at 8:30 a.m. ET.

And today’s report may give traders a glimpse at the future direction of interest rates.

The blue arrows point to the action following the past three CPI reports. Those were some of the biggest one-day moves we’ve seen all year.

The stock market was rallying going into the release of the CPI report on September 13. The index lost 180 points that day – the stock market’s worst day in two years.

And the S&P 500 was falling going into the October 13 release of the CPI report. The index gained 90 points following a hot report. It gave up most of those gains the next trading day.

In November, the CPI report showed inflation was cooling off. The S&P 500 exploded 200 points higher – logging the best day of the year for the stock market…

So today’s report is likely to be the catalyst for a big move.

The question of course is… Which way? I don’t see an edge to either direction.

A “hot” report showing persistent inflation will keep pressure on the Fed to raise interest rates even more. A “cold” report showing a lower-than-expected CPI, could give the Fed a reason to pause.

Either way, today’s number is likely to spark a big move in the stock market – in one direction or the other.

Take a look at this chart of the S&P 500…

https://www.jeffclarktrader.com/market-minute/minimizing-risk-during-a-big-market-move/

But most traders are better off avoiding the casino – for today.""""

The consumer price index (CPI) – a widely followed measure of inflation – for November will release at 8:30 a.m. ET.

Minimizing Risk During a Big Market Move

Today could be a wild session for the stock market…

The consumer price index (CPI) – a widely followed measure of inflation – for November will release at 8:30 a.m. ET.

And today’s report may give traders a glimpse at the future direction of interest rates.

The blue arrows point to the action following the past three CPI reports. Those were some of the biggest one-day moves we’ve seen all year.

The stock market was rallying going into the release of the CPI report on September 13. The index lost 180 points that day – the stock market’s worst day in two years.

And the S&P 500 was falling going into the October 13 release of the CPI report. The index gained 90 points following a hot report. It gave up most of those gains the next trading day.

In November, the CPI report showed inflation was cooling off. The S&P 500 exploded 200 points higher – logging the best day of the year for the stock market…

So today’s report is likely to be the catalyst for a big move.

The question of course is… Which way? I don’t see an edge to either direction.

A “hot” report showing persistent inflation will keep pressure on the Fed to raise interest rates even more. A “cold” report showing a lower-than-expected CPI, could give the Fed a reason to pause.

Either way, today’s number is likely to spark a big move in the stock market – in one direction or the other.

Take a look at this chart of the S&P 500…

https://www.jeffclarktrader.com/market-minute/minimizing-risk-during-a-big-market-move/

Attachments

robo

TSP Legend

- Reaction score

- 471

Gap trades using the 2 hour chart: Trading UVXY and PSQ.... I was flat going into the report, and I'm now ST trading the news.... I MIGHT hold my PSQ position, but will sell my UVXY position soon.... Beer Money trades... We shall see how the rest of the week goes....

Making a few bucks so far....

12/13/2022 08:41:59 Bought PSQ @ 13.29

12/13/2022 09:33:5 Bought UVXY @ 7.075

Making a few bucks so far....

12/13/2022 08:41:59 Bought PSQ @ 13.29

12/13/2022 09:33:5 Bought UVXY @ 7.075

Attachments

robo

TSP Legend

- Reaction score

- 471

robo

TSP Legend

- Reaction score

- 471

SPX daily after the close: The 200 day MA remains resistance. We shall see how the rest of the week plays out.

Fat and flat

This market lacks a new trend. Trade it with a mean reversion mind. SPX is now back to the 200 day moving average, having managed getting some people long at very wrong levels today...

Fat and flat

This market lacks a new trend. Trade it with a mean reversion mind. SPX is now back to the 200 day moving average, having managed getting some people long at very wrong levels today...

Attachments

robo

TSP Legend

- Reaction score

- 471

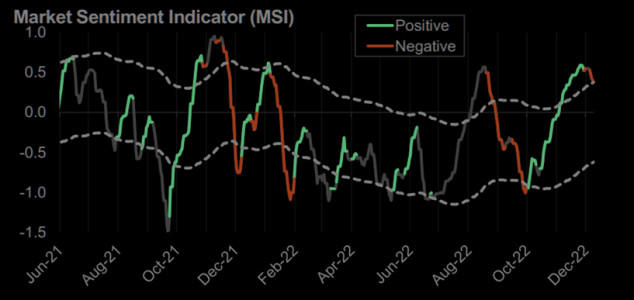

This indicator turned seller again

Andrew Sheets (cross-asset guru at MS) highlights that the Cross-Asset Strategy Team’s Market Sentiment Indicator (MSI) returned to a negative signal last week after briefly turning neutral. This was driven by volatility metrics as VIX spiked from 19.1 last week to 22.8 currently and the put-call ratio climbed from 0.8 to 1.2.

https://themarketear.com/

Andrew Sheets (cross-asset guru at MS) highlights that the Cross-Asset Strategy Team’s Market Sentiment Indicator (MSI) returned to a negative signal last week after briefly turning neutral. This was driven by volatility metrics as VIX spiked from 19.1 last week to 22.8 currently and the put-call ratio climbed from 0.8 to 1.2.

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

SPX daily: The 200 day MA remains resistance....

SPX - king of ranges

SPX remains stuck inside the relatively tight range that has held since that massive November inflation print. Note we are practically on the 200 day moving average. No excitement from us until this breaks out of the range.

https://themarketear.com/posts/c4S-d7N5Eu

SPX - king of ranges

SPX remains stuck inside the relatively tight range that has held since that massive November inflation print. Note we are practically on the 200 day moving average. No excitement from us until this breaks out of the range.

https://themarketear.com/posts/c4S-d7N5Eu

Attachments

robo

TSP Legend

- Reaction score

- 471

I always have my eye on the dollar....

Keeping An Eye On The Dollar

After peaking in September, the dollar has been declining into its yearly cycle low.

The dollar broke below a multi decade support level in December.

It appears that the dollar is in the process of forming a bullish monthly reversal. In the Weekend Report I plan to discuss this and what this means for the dollar’s yearly cycle and 3 year cycle.

https://likesmoneycycletrading.wordpress.com/2022/12/15/keeping-an-eye-on-the-dollar-3/

Keeping An Eye On The Dollar

After peaking in September, the dollar has been declining into its yearly cycle low.

The dollar broke below a multi decade support level in December.

It appears that the dollar is in the process of forming a bullish monthly reversal. In the Weekend Report I plan to discuss this and what this means for the dollar’s yearly cycle and 3 year cycle.

https://likesmoneycycletrading.wordpress.com/2022/12/15/keeping-an-eye-on-the-dollar-3/

Attachments

robo

TSP Legend

- Reaction score

- 471

robo

TSP Legend

- Reaction score

- 471

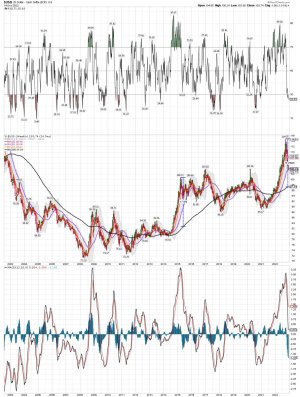

USD weekly: A 10 year historical data chart below... We shall see how the dollar plays out in the next few years. I trade in very short time frames so I like the big moves for ST trading. These moves are classic in a Bear Markets. Huge swings in both directions based on news events. NOT GOOD for investors. At some point the USD will move closer to the mean and back below the 200 week MA. However, in my opinion timing is everything if you are a trader in a market like this one. Bull Markets are easy if you are early, as they will correct your loses. Bear Markets can really hurt your account. Not a good thing if you are getting close to retirement.

USD weekly: A 20 year look at the weekly data.... (Last chart)

USD weekly: A 20 year look at the weekly data.... (Last chart)