HO....HO....HO..... We shall see how it plays out, but I'm not betting on any rally right now anyway. If the SPX setup changes then so will I.

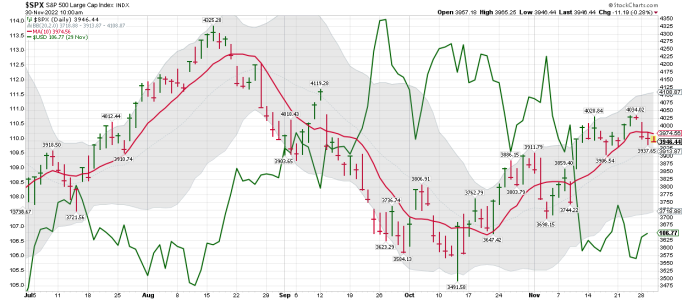

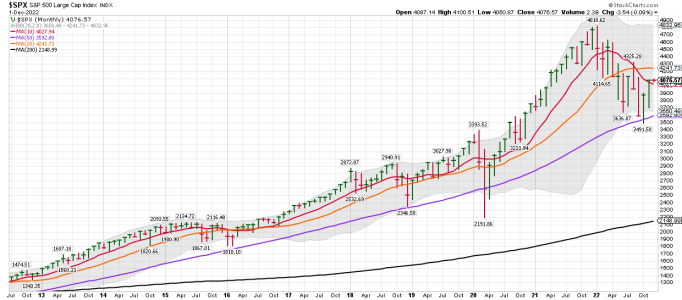

SPX daily: The bottom Line is the SPX failed to move above the 200 day MA, and has now moved back below the 10 day MA. Waiting to see how this plays out....

Nov 29, 2022 | Market Minute

Why We Shouldn’t Bet on a Santa Claus Rally Ahead

It’s beginning to look a lot like August…

And that’s a problem for the rest of the year.

The stock market rally that started in mid-June and lasted until mid-August was powerful.

It boosted the S&P 500 by 600 points and got most of the financial world talking about the start of a new bull market.

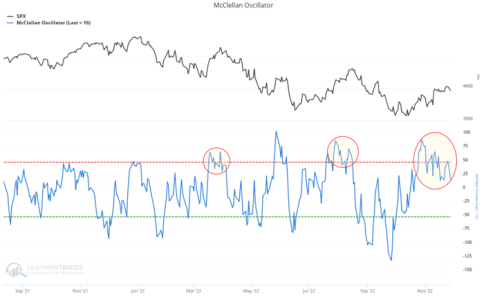

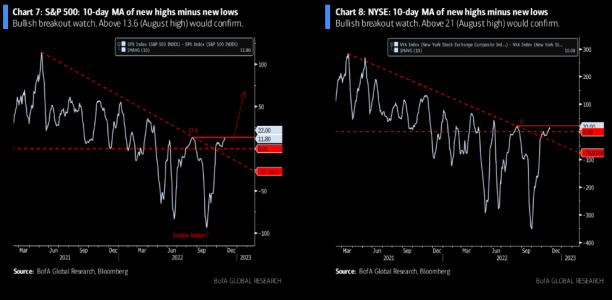

But by that time, most of the technical indicators we follow were in extremely overbought territory…

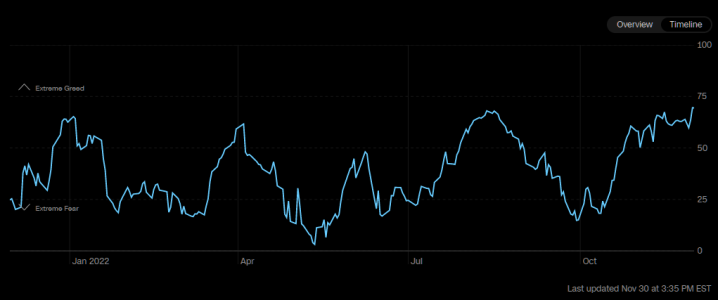

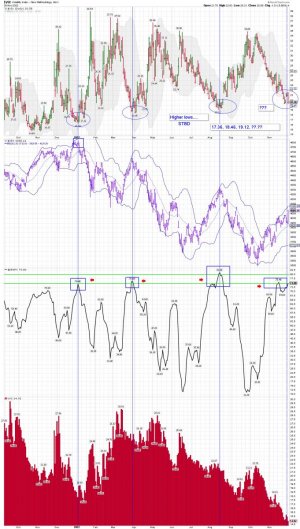

The VIX generates a broad stock market sell signal when it closes below its lower Bollinger Band and then closes back inside the bands.

Unlike VIX buy signals (which often play out right away), VIX sell signals often take several days (or even weeks) to kick into gear.

Sometimes, it takes the VIX generating a cluster of sell signals before we get a significant move lower in the stock market.

But eventually, we get the sell-off.

On August 1, the long-term monthly chart of the S&P 500 was banging into resistance. On August 8, the Bullish Percent Index for the S&P 500 (BPSPX) was on the verge of a sell signal. And by August 15, VIX option prices were screaming at investors to be careful.

Now, fast forward to today…

The stock market has enjoyed a strong, two-month-long rally. The S&P 500 is up more than 500 points from its early October low.

Just about all the financial TV talking heads are bullish again and talking about a new bull market.

But once again, most of the technical indicators we follow are in extremely overbought territory. They’re warning the market is vulnerable to a decline.

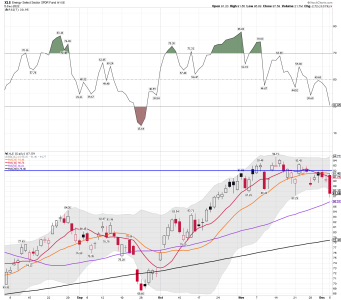

For example, the BPSPX generated a sell signal last week. And now the financial sector is lagging behind the broad stock market.

VIX option prices are predicting a much higher VIX in the weeks to come – and a higher VIX usually goes along with a falling stock market.

Perhaps most concerning, though, is the VIX just generated its third sell signal in the past six weeks.

Take a look at this VIX chart…

https://www.jeffclarktrader.com/market-minute/why-we-shouldnt-bet-on-a-santa-claus-rally-ahead/