robo

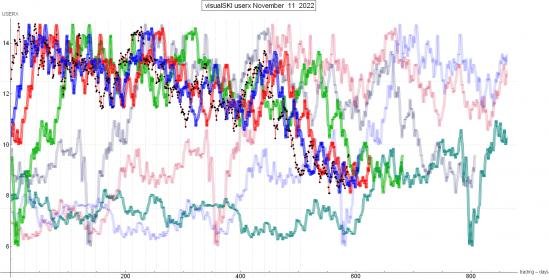

TSP Legend

- Reaction score

- 471

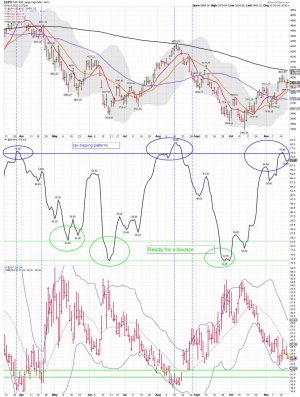

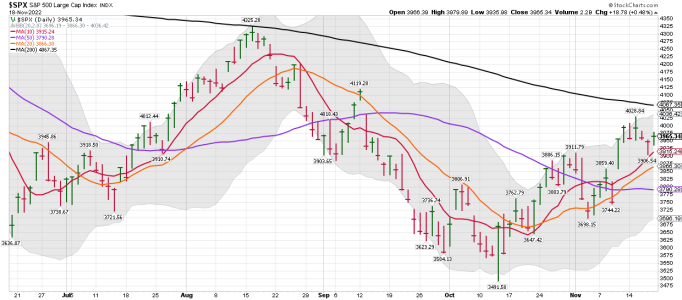

We shall see how it plays out! In my opinion - the gap between the SPX and the 200 month MA is going to get much closer in the months ahead.

SevenSentinels Retweeted

Mac10

@SuburbanDrone

·

5h

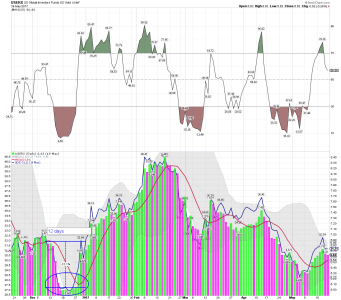

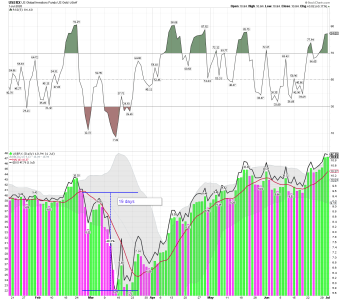

Those who are pounding the table constantly on Fed pivot should know that when the Fed pivoted in Y2K, the Nasdaq lost most of its value.

And when they pivoted in 2007, the housing bubble imploded.

Today's bulls are all waiting for the melt-up to begin.

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

SevenSentinels Retweeted

Mac10

@SuburbanDrone

·

5h

Those who are pounding the table constantly on Fed pivot should know that when the Fed pivoted in Y2K, the Nasdaq lost most of its value.

And when they pivoted in 2007, the housing bubble imploded.

Today's bulls are all waiting for the melt-up to begin.

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author