This Market Reveals a Strong Clue About What’s Coming Next

Frustrating.

That’s how I’d describe the Fed’s latest performance… and Fed Chair Jerome Powell has certainly made the Fed an easy target for angry investors.

You see, there are two parts to “Fed Day.”

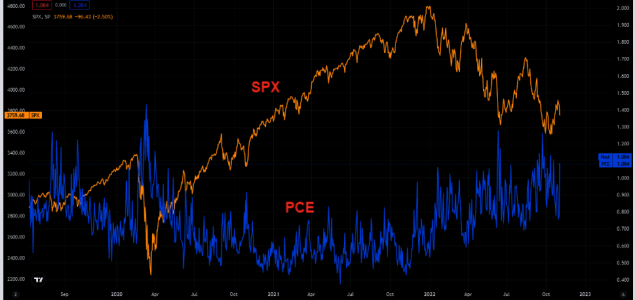

The first part is at 2 p.m. ET – when the market finds out what the Fed’s interest rate decision is.

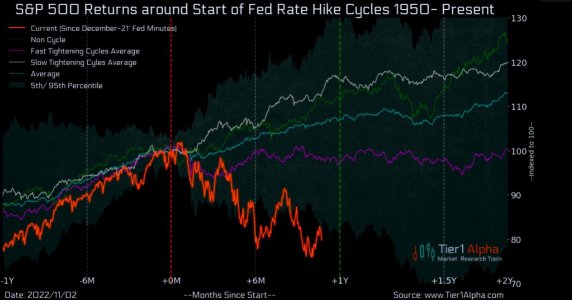

Now, I’ll give the Fed some credit. Their 75-basis point hike was well telegraphed.

The market has been expecting this interest rate hike for a while. If the interest rate increase was unexpected, then the action on Wednesday could’ve been worse.

The Fed also releases their latest policy statement at the same time as their interest-rate decision.

This allows investors to see what (if anything) has changed from the prior statement.

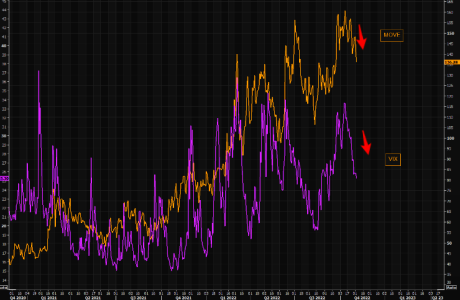

The policy statement is crucial because it can give the market insights as to what the Fed is going to do next.

The initial reaction to the new statement was quite positive and the market rallied sharply for a few minutes…

That’s because the new statement said the Fed was considering the cumulative impact of its rate hikes to date.

The market interpreted this to mean that the Fed would soon slow down the pace of future interest rate increases.

https://www.jeffclarktrader.com/mar...de-a-surging-dollar-our-best-market-clue-yet/