robo

TSP Legend

- Reaction score

- 471

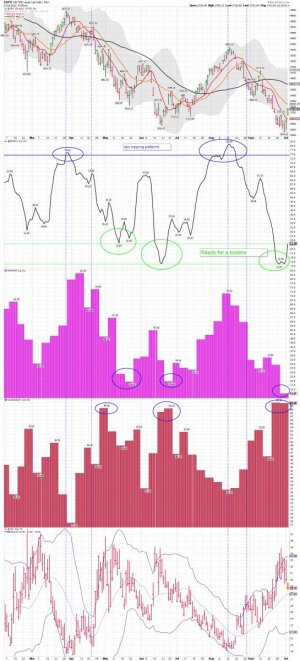

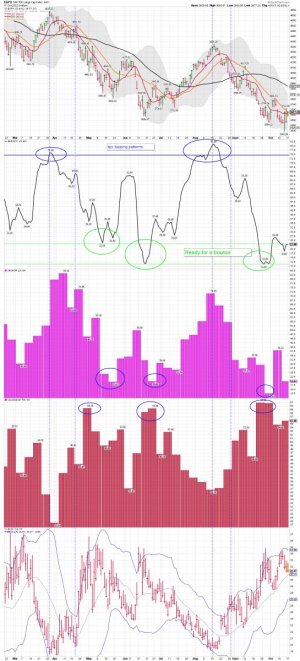

SPX daily: The pattern and current daily ST buy signal has worked out well so far. We shall see if this Bear Market rally has some legs. One would think a move up to at least the 20 dma to start, and then we can see if it can tag the 50 dma. We shall see if the VIX can move back below 23ish. I'm playing Bear Market rules for all of my trades.... My next trade will probably be to sell these long positions and buy back SDS. However, that is up to the market..... I will NOT hold any long positions once we tag the 50 DMA. That does NOT include the gold miners as I trade them differently.

Holding a much smaller position at TSP than at Vanguard. 25% at Vanguard (VXF) and 10% C Fund at TSP.

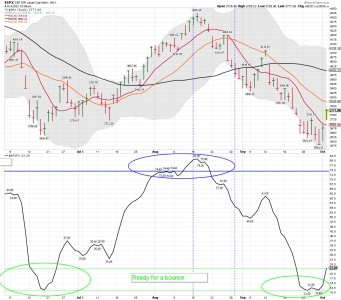

SPX daily chart and a closer look. Will we get a 50% retracement? That would take the SPX just under the 50 dma.... We shall see how it plays out....

Bottom Line: I'm trading using Bear Market rules, and I DO NOT know how far this move up will run. I be staying VERY nimble and trading mainly at Vanguard and in my other accounts.

Have a nice day..... Not much to do now, but see how all of this plays out.

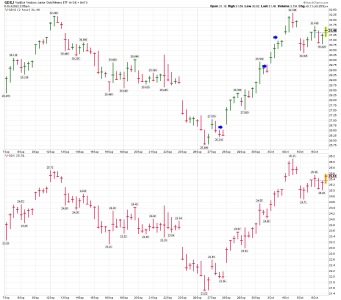

Long SPY, VXF , SSO and GDXJ.... I will be selling SSO today.

Holding a much smaller position at TSP than at Vanguard. 25% at Vanguard (VXF) and 10% C Fund at TSP.

SPX daily chart and a closer look. Will we get a 50% retracement? That would take the SPX just under the 50 dma.... We shall see how it plays out....

Bottom Line: I'm trading using Bear Market rules, and I DO NOT know how far this move up will run. I be staying VERY nimble and trading mainly at Vanguard and in my other accounts.

Have a nice day..... Not much to do now, but see how all of this plays out.

Long SPY, VXF , SSO and GDXJ.... I will be selling SSO today.

Attachments

Last edited: