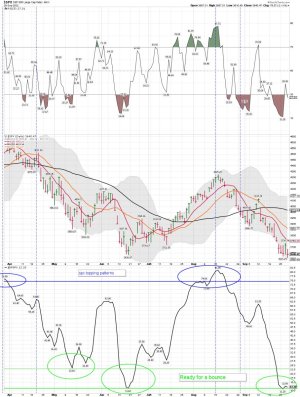

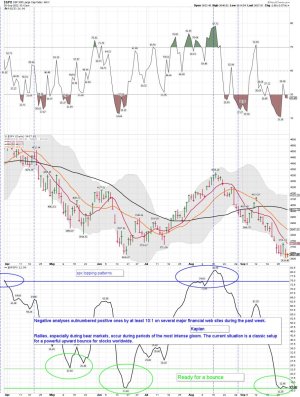

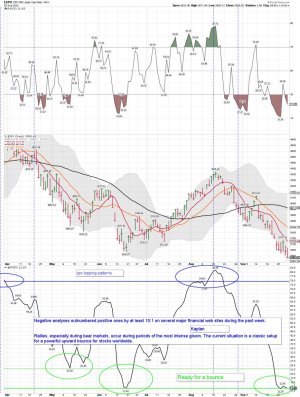

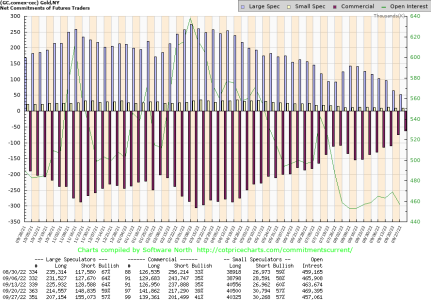

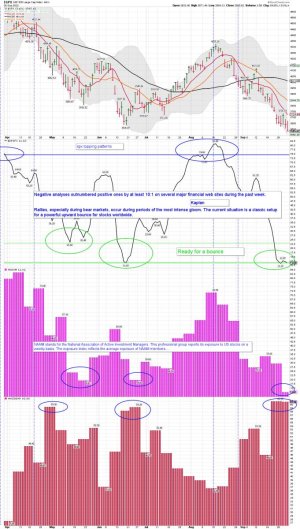

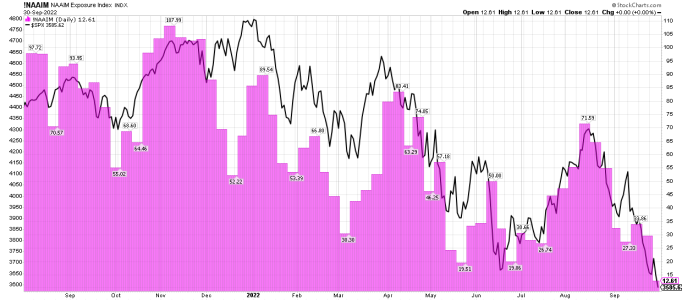

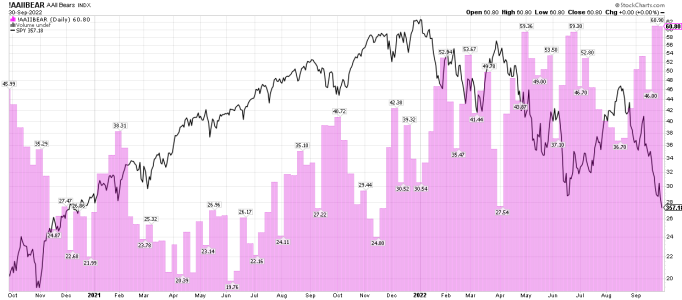

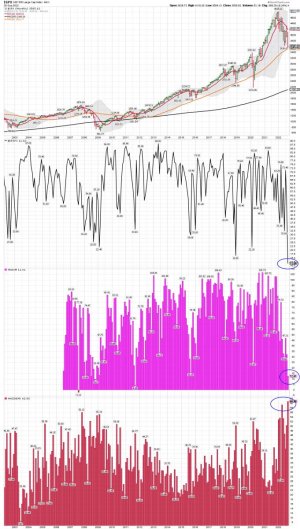

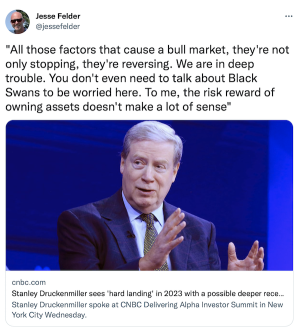

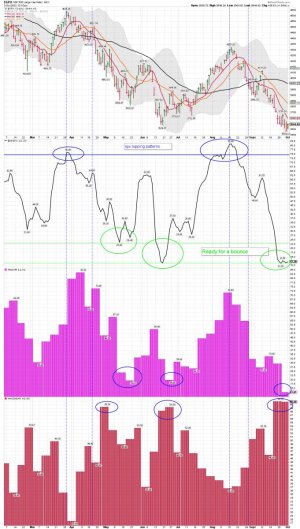

VXF daily ( S fund). Impossible to trade TSP in a market like this one ( Bear Market). The moves are more about luck, since the Bull can't save you it can get really ugly. You try and hold on and hope for a bounce to get back out or even. Sleepless nights etc...... Been there and done that. My final indicator was the VIX. I was waiting for the VIX to move back inside the upper BB for my final indicator. I don't now how this trade/move in TSP will play out, but for now I have a short-term (ST) buy signal. We shall see if the VIX moves back down to around 20ish again and the market trends up for several days. After that the normal trend which is currently down should resume. Don't look for a FED save anytime soon.

I added VXF Friday at Vanguard, but couldn't move TSP funds because no moves left. TSP is great during Bull Markets, but Bears will chop up your account if you are not careful. I traded the 2000, and 2008 Bears and took Big HITS...... LOL... Not this time..... This is still a high risk trade, but I just trade my indicators and IGNORE all the noise and comments on CNBC...etc....

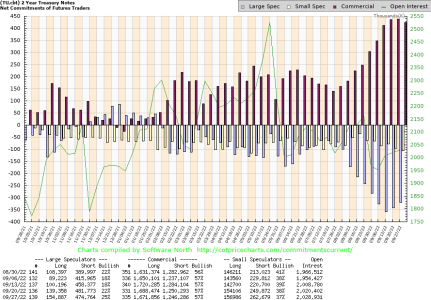

Good trading to all those trying to make money in this market. 2 year notes making around 4% now.... and some CD's close to that. That is were most of our retirement money is right now.

For the record: I only use 100k for making TSP moves. A 25% move for me is 25k, and a 100% move is 100k. At Vanguard I can buy or sell whenever I want during the trading day.

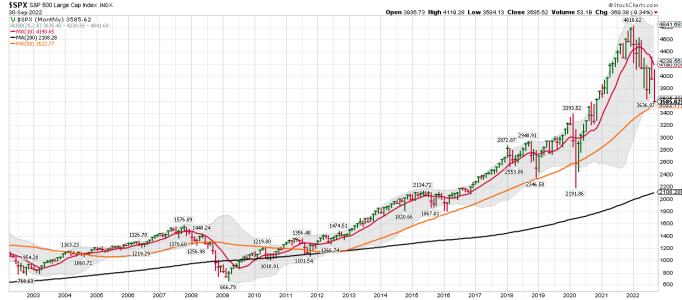

LOL.... Risk taker is really not my account name at Vanguard, but if you are going long during a Bear Market you had better KNOW you are taking a BIG RISK! NO ONE KNOWS for sure how this will play out. However, if you look at the historical charts above I posted we have a long waaaaay to go before the SPX tags its 200 month MA again. That is a normal tag/move down during a Bear Market which could take a couple of years to complete.

Dear Risk Taker

The following order executed on 09/29/2022 at 9:53 AM, Eastern time:

Account: Risk Taker

Transaction type: Buy

Order type: Market

Security: VANGUARD EXTENDED MARKET ETF (VXF)

Quantity: 100 share(s)

Price:* $127.63