robo

TSP Legend

- Reaction score

- 471

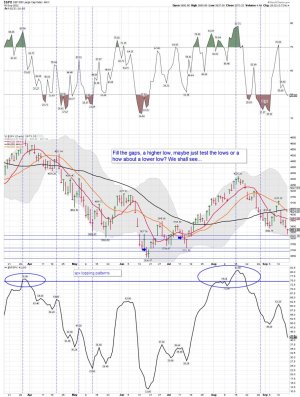

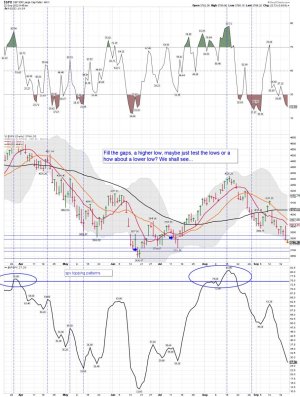

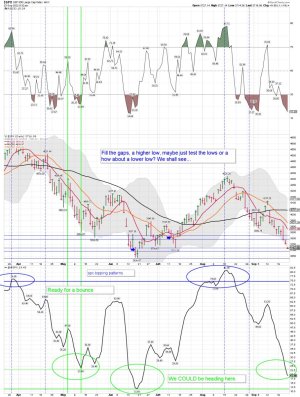

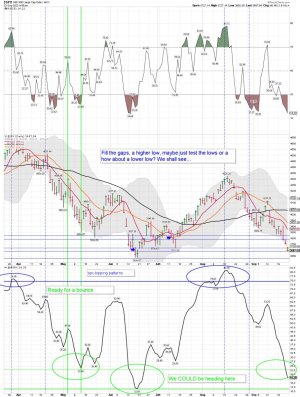

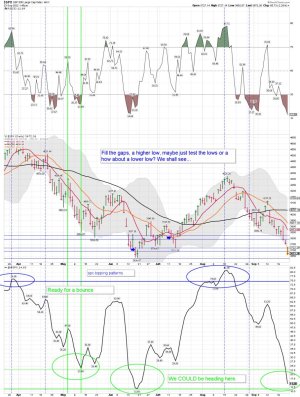

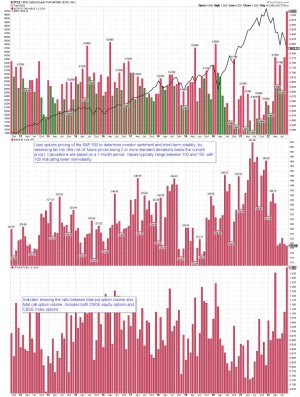

SPX daily: I still have some concerns too..... Day 4 since the SPX moved below it's 10 dma..... Well, we did get the bounce based on the pattern, but now what? We shall see how the lower BB tag plays out, and if the pattern is still in play as it indicates. The SPX could still move lower. I'm trading the MA's and cycle data, not the pattern. However, the patterns are warning signals just like sentiment data many like to use. The pattern does indicate the odds for another bounce is getting close, and the cycle data supports it. Let us not forget those lower gaps. Will they fill? They could, so one has to be careful here. LOL..... we shall see how it all plays out, and I will be trading SSO again once I like the setup. I will not be making many TSP moves as I wait for all this to play out. The Fed remains with it's foot on the gas pedal for additional rate increases and the market/investors are running for safety. If you are buying CD's or 2 year notes look for 4% rates soon.... That is what many investors are doing. If you are down big in TSP there could be some nice rips as Bear Markets are known for this, but it's impossible to trade using a TSP account with only two moves a month. TSP is great in a Bull Market, but in a Bear Market one needs to be very careful and spend time in the G Fund while you wait for the next Bull to show up. It takes rare extremes before Bear Markets end.

Attachments

Last edited: