robo

TSP Legend

- Reaction score

- 471

We shall see how it plays out!

Daily Cycle Update

likesmoneystudies

Sep 8

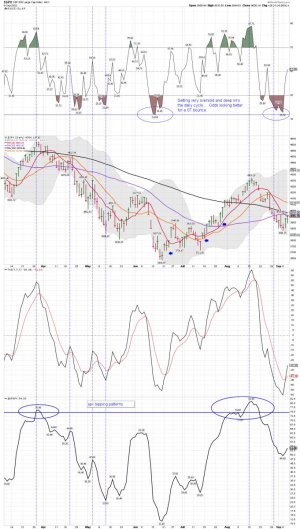

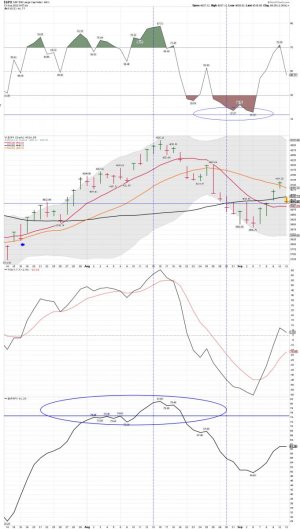

Stocks printed their lowest point on Tuesday, day 54. That places them deep in their timing band for a DCL.

Stocks formed a swing low on Wednesday then closed above the 10 day MA on Thursday to signal the new daily cycle. I would like to see a close above the 50 day MA before we day 54 as the daily cycle low. Stocks should then go on to break above the declining trend line as they rally out of the DCL. Stocks are currently in daily downtrend. They will remain in their daily downtrend unless they close back above the upper daily cycle band.

https://likesmoneycycletrading.wordpress.com/2022/09/08/daily-cycle-update/

Daily Cycle Update

likesmoneystudies

Sep 8

Stocks printed their lowest point on Tuesday, day 54. That places them deep in their timing band for a DCL.

Stocks formed a swing low on Wednesday then closed above the 10 day MA on Thursday to signal the new daily cycle. I would like to see a close above the 50 day MA before we day 54 as the daily cycle low. Stocks should then go on to break above the declining trend line as they rally out of the DCL. Stocks are currently in daily downtrend. They will remain in their daily downtrend unless they close back above the upper daily cycle band.

https://likesmoneycycletrading.wordpress.com/2022/09/08/daily-cycle-update/