-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

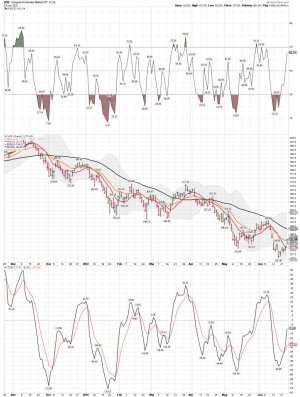

Weekly Swing Low

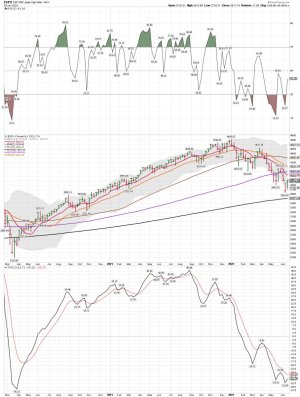

Stocks closed above the declining 10 day MA on Thursday then delivered bullish follow through on Friday to signal that day 19 was an early DCL.

Stocks printed their lowest point the previous week, which was week 36, placing them very deep in their timing band for an intermediate cycle low. Stocks formed a weekly swing low this week. Only 1 time in the last 13 years did an intermediate cycle exceed 32 weeks. So the odds are high that this weekly swing low signals the new intermediate cycle. We still need to see a close above the declining 10 week MA in order to label week 36 as the ICL. Stocks are currently in a weekly downtrend. They will remain in their weekly downtrend unless they can close back above the upper weekly cycle band.

https://likesmoneycycletrading.wordpress.com/2022/06/25/weekly-swing-low-2/

Stocks closed above the declining 10 day MA on Thursday then delivered bullish follow through on Friday to signal that day 19 was an early DCL.

Stocks printed their lowest point the previous week, which was week 36, placing them very deep in their timing band for an intermediate cycle low. Stocks formed a weekly swing low this week. Only 1 time in the last 13 years did an intermediate cycle exceed 32 weeks. So the odds are high that this weekly swing low signals the new intermediate cycle. We still need to see a close above the declining 10 week MA in order to label week 36 as the ICL. Stocks are currently in a weekly downtrend. They will remain in their weekly downtrend unless they can close back above the upper weekly cycle band.

https://likesmoneycycletrading.wordpress.com/2022/06/25/weekly-swing-low-2/

Attachments

robo

TSP Legend

- Reaction score

- 471

Attachments

robo

TSP Legend

- Reaction score

- 471

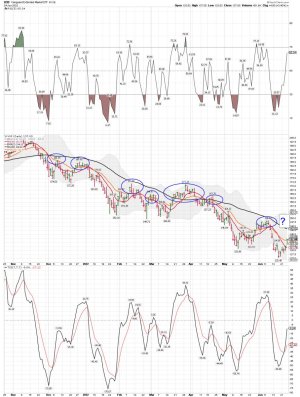

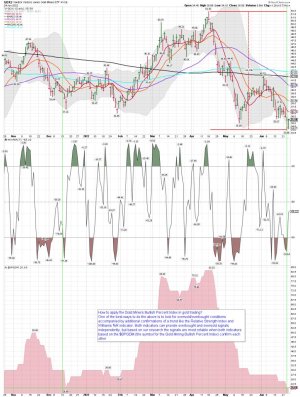

Gold Miners: Odds improving for a possible bottom in play!

https://www.sunshineprofits.com/gold-silver/dictionary/gold-miners-bullish-percent-index/

https://www.sunshineprofits.com/gold-silver/dictionary/gold-miners-bullish-percent-index/

Attachments

robo

TSP Legend

- Reaction score

- 471

Before Friday's move up!

Jun 24, 2022 Gold Stock Doldrums: Key Tactics Now Morris Hubbartt 321gold ...inc ...s

Jun 24, 2022 Gold Stock Doldrums: Key Tactics Now Morris Hubbartt 321gold ...inc ...s

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

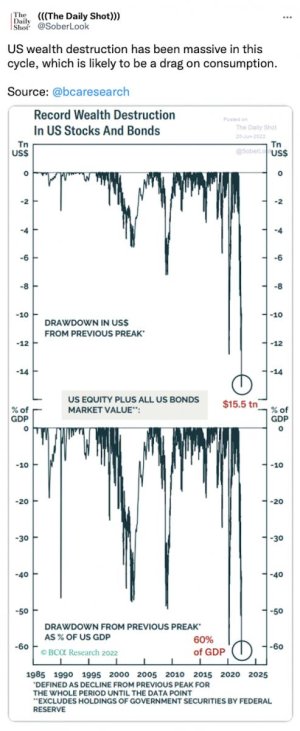

Hmmmm.....

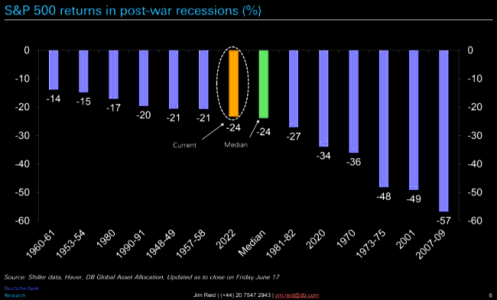

Where are we in this bear market?

The "correction" is now at a median level

https://themarketear.com/

Where are we in this bear market?

The "correction" is now at a median level

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

robo

TSP Legend

- Reaction score

- 471

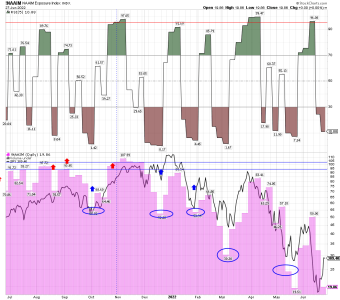

SevenSentinels Retweeted

CyclesFan

@CyclesFan

Jun 25

Next week will be critical for $SPX too. If it closes above the 10 week MA an early weekly cycle low on week 16 will be confirmed and it will retrace 50-62% of the April-June decline. Another rejection at the 10 WMA will likely lead to a decline to the 200 week MA in July.

CyclesFan

@CyclesFan

Jun 25

Next week will be critical for $SPX too. If it closes above the 10 week MA an early weekly cycle low on week 16 will be confirmed and it will retrace 50-62% of the April-June decline. Another rejection at the 10 WMA will likely lead to a decline to the 200 week MA in July.

Attachments

robo

TSP Legend

- Reaction score

- 471

So when will the Fed start cutting rates again? LOL.... "Recession risks have started to trump the inflation narrative"

David Rosenberg

@EconguyRosie

·

Jun 24

Memo to the uninitiated: it is the change in jobless claims and not the level that presage the recession call -- and the move off the cycle trough says we're more than 80% of the way towards heading there.

#RosenbergResearch #Economy

David Rosenberg

@EconguyRosie

·

Jun 24

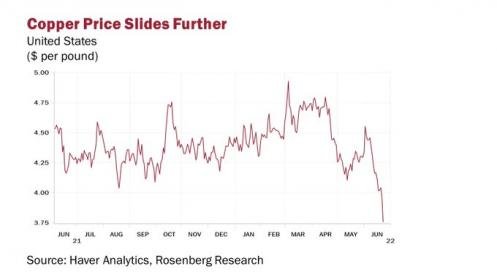

Copper below $4 per pound, down over 24% from the highs (bear market), and down to a 16-month low tells me that “recession” risks have overtaken “inflation” risks.

#RosenbergResearch

David Rosenberg

@EconguyRosie

·

Jun 23

The S&P Global mfg PMI dove to 52.4 in June from 57.0 & services were even weaker. Recession risks have started to trump the inflation narrative -- the stock market figured it out first & now the bond market is catching up. The Fed has one more hike left in July & then it’s over.

https://twitter.com/EconguyRosie?lang=en

Mohamed A. El-Erian

@elerianm

"I’ve covered the #markets and the #economy for four decades, and I can’t recall a time when more people—or at least prognosticators, economists, and bankers—were more certain that an economic downturn was imminent."

What to expect from a recession 'everyone' sees coming: Morning Brief

Recessions seems to be the talk of the town these days. So: if "everyone" knows a recession is coming, does that change what the

What to expect from a recession 'everyone' sees coming: Morning Brief

Andy Serwer with Dylan Croll

Sat, June 25, 2022, 5:00 AM·6 min read

https://finance.yahoo.com/finance/morning-brief-june-25-2022-110003339.html

David Rosenberg

@EconguyRosie

·

Jun 24

Memo to the uninitiated: it is the change in jobless claims and not the level that presage the recession call -- and the move off the cycle trough says we're more than 80% of the way towards heading there.

#RosenbergResearch #Economy

David Rosenberg

@EconguyRosie

·

Jun 24

Copper below $4 per pound, down over 24% from the highs (bear market), and down to a 16-month low tells me that “recession” risks have overtaken “inflation” risks.

#RosenbergResearch

David Rosenberg

@EconguyRosie

·

Jun 23

The S&P Global mfg PMI dove to 52.4 in June from 57.0 & services were even weaker. Recession risks have started to trump the inflation narrative -- the stock market figured it out first & now the bond market is catching up. The Fed has one more hike left in July & then it’s over.

https://twitter.com/EconguyRosie?lang=en

Mohamed A. El-Erian

@elerianm

"I’ve covered the #markets and the #economy for four decades, and I can’t recall a time when more people—or at least prognosticators, economists, and bankers—were more certain that an economic downturn was imminent."

What to expect from a recession 'everyone' sees coming: Morning Brief

Recessions seems to be the talk of the town these days. So: if "everyone" knows a recession is coming, does that change what the

What to expect from a recession 'everyone' sees coming: Morning Brief

Andy Serwer with Dylan Croll

Sat, June 25, 2022, 5:00 AM·6 min read

https://finance.yahoo.com/finance/morning-brief-june-25-2022-110003339.html

Attachments

robo

TSP Legend

- Reaction score

- 471

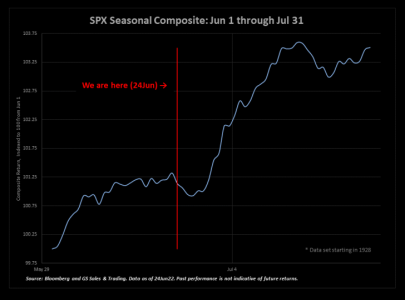

FOMO is here

Has sell the rip transformed into a FOMO chase? Friday was a very powerful day and most that "planned" to buy "cheap" stuff missed buying post the first move higher on June 21. Expecting things to come down again, they were shocked by Friday's px action. The psychological set up here is very powerful. Goldman's Flood sums it up well: "Today felt like a potential pivot point with bid getting healthier as we finally saw L/Os come in and passively buy (they have been net sellers on every single trading session since 6/7). FOMO is real at the moment (MFs currently sitting on well over $200b in cash right now and buying will intensify on moves higher). This community also took advantage (as buyers) of the abundance of liquidity on the closing bell today.... Today is not an all clear but I would certainly be more patient selling this pop as it was highest quality rally I have seen in over a month". Don't forget there is some month end re balancing stuff to be executed (approx $33bn says GS), as well as other supportive flow (here).

July FOMO

Did we start the front running on Friday?

https://themarketear.com/

Has sell the rip transformed into a FOMO chase? Friday was a very powerful day and most that "planned" to buy "cheap" stuff missed buying post the first move higher on June 21. Expecting things to come down again, they were shocked by Friday's px action. The psychological set up here is very powerful. Goldman's Flood sums it up well: "Today felt like a potential pivot point with bid getting healthier as we finally saw L/Os come in and passively buy (they have been net sellers on every single trading session since 6/7). FOMO is real at the moment (MFs currently sitting on well over $200b in cash right now and buying will intensify on moves higher). This community also took advantage (as buyers) of the abundance of liquidity on the closing bell today.... Today is not an all clear but I would certainly be more patient selling this pop as it was highest quality rally I have seen in over a month". Don't forget there is some month end re balancing stuff to be executed (approx $33bn says GS), as well as other supportive flow (here).

July FOMO

Did we start the front running on Friday?

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

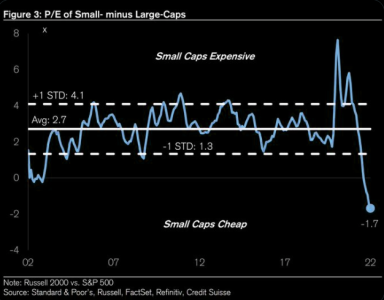

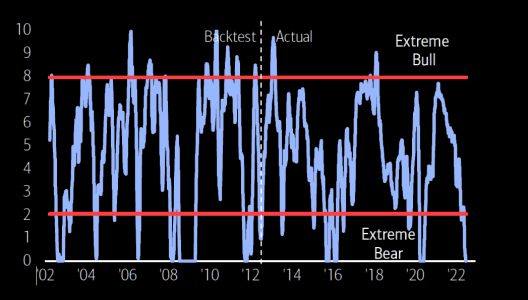

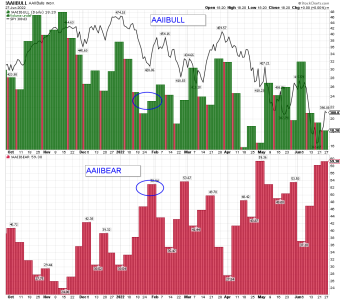

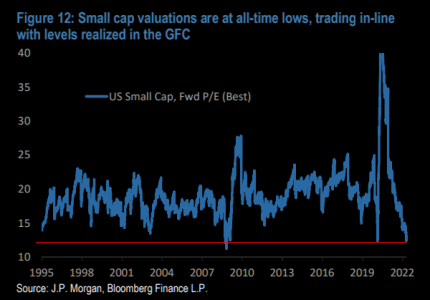

Small-caps record cheap

P/E of Small craps - Large caps.

Sentiment: STRONG BUY

BofA Bull & Bear Indicator since 2002

https://themarketear.com/

P/E of Small craps - Large caps.

Sentiment: STRONG BUY

BofA Bull & Bear Indicator since 2002

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

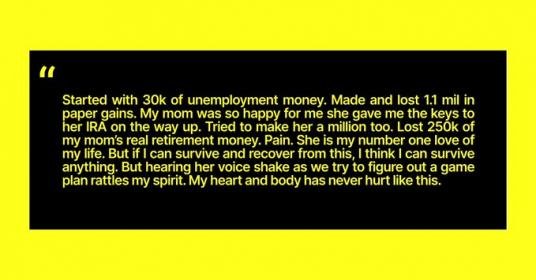

Jesse Felder Retweeted

Coinfessions

@coinfessions

·

Jun 25

Hearing her voice shake as we try to figure out a game plan rattles my spirit.

Jesse Felder Retweeted

Macro Charts

@MacroCharts

·

Jun 25

New record low.

https://twitter.com/jessefelder

Coinfessions

@coinfessions

·

Jun 25

Hearing her voice shake as we try to figure out a game plan rattles my spirit.

Jesse Felder Retweeted

Macro Charts

@MacroCharts

·

Jun 25

New record low.

https://twitter.com/jessefelder

Attachments

robo

TSP Legend

- Reaction score

- 471

No recession - what is the trade?

What if the recession doesn't materialise? JPM writes: "...if a recession does not materialize (as is our base case), then the market will see a rotation out of defensives and into oversold higher beta and smaller cap market segments".

The investment bank recommends buying the Russell 2000 3M 105-115% call spreads for around 2.65% of notional indicatively. That gives you a 4x max pay out ratio. Russell volatility isn't overly rich on a relative basis.

https://themarketear.com/

What if the recession doesn't materialise? JPM writes: "...if a recession does not materialize (as is our base case), then the market will see a rotation out of defensives and into oversold higher beta and smaller cap market segments".

The investment bank recommends buying the Russell 2000 3M 105-115% call spreads for around 2.65% of notional indicatively. That gives you a 4x max pay out ratio. Russell volatility isn't overly rich on a relative basis.

https://themarketear.com/