-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

-

20% Off Annual Premium Subscriptions!*

Ends Jan 23... Click Here For More Information

* For new or current subscribers

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

Do you subscribe to sentimentrader? Looks like gold miner sentiment is in the toilet. Time to buy?

I no longer subscribe to Sentiment Trader. The last two years of rare extremes has caused me to move on from using sentiment for trading. I still track it, but use cycles more now.

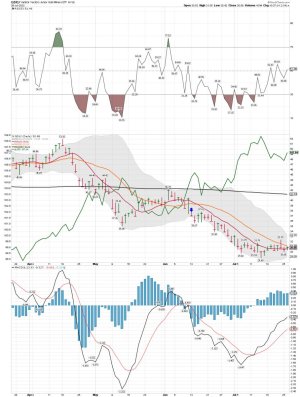

GDX daily: Remains on a sell signal. I have been mainly day-trading the miners, and I'm still holding a small position overnight..... No leverage. I only use JNUG/NUGT for daytrading, and close out those positions daily.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Miner cycle thoughts:

Miner Risk for Major Opportunity

The Miners were rejected by the 10 day MA on Friday. They went on to undercut the day 43 low on Monday to extend its daily cycle decline.

Monday was day 50 for the daily Miner cycle, making it severely overdue for a daily cycle low. After undercutting the low, the Miners could have easily went on to a 5 to 7 day bloodbath phase. But instead, they printed a bullish inside candle. That eases the parameters for forming a daily swing low. A break above 25.42 will form a swing low, Then a close above the declining 10 day MA will have us label day 50 as the DCL.

https://likesmoneycycletrading.wordpress.com/2022/07/26/miner-risk-for-major-opportunity/

Miner Risk for Major Opportunity

The Miners were rejected by the 10 day MA on Friday. They went on to undercut the day 43 low on Monday to extend its daily cycle decline.

Monday was day 50 for the daily Miner cycle, making it severely overdue for a daily cycle low. After undercutting the low, the Miners could have easily went on to a 5 to 7 day bloodbath phase. But instead, they printed a bullish inside candle. That eases the parameters for forming a daily swing low. A break above 25.42 will form a swing low, Then a close above the declining 10 day MA will have us label day 50 as the DCL.

https://likesmoneycycletrading.wordpress.com/2022/07/26/miner-risk-for-major-opportunity/

Attachments

robo

TSP Legend

- Reaction score

- 471

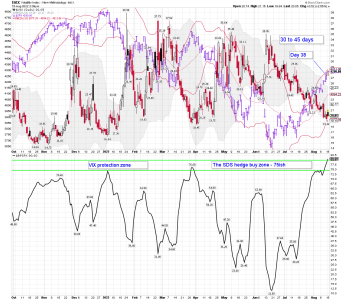

VXX/$VIX/$BPSPX/SPX/Cycles: Four indicators that has me looking to buy some SDS...

Bottom Line: Not a time to be all in based on these indicators. Unless, it's different this time, and that is always possible! I'm mainly trading the gold miners right now.

The four indicators I'm watching - Watching $BPSPX ( high) and the $VIX data ( below 20ish) as the VXX compression continues. Also, we be due a move down into the DCL. The chart pattern indicates lots of risk right now. I have NO IDEA how this will play out, but the odds of a pullback are high right now. All my trades are based on a set of odds..... I also call it Risk Management!

Bottom Line: Not a time to be all in based on these indicators. Unless, it's different this time, and that is always possible! I'm mainly trading the gold miners right now.

The four indicators I'm watching - Watching $BPSPX ( high) and the $VIX data ( below 20ish) as the VXX compression continues. Also, we be due a move down into the DCL. The chart pattern indicates lots of risk right now. I have NO IDEA how this will play out, but the odds of a pullback are high right now. All my trades are based on a set of odds..... I also call it Risk Management!

Attachments

robo

TSP Legend

- Reaction score

- 471

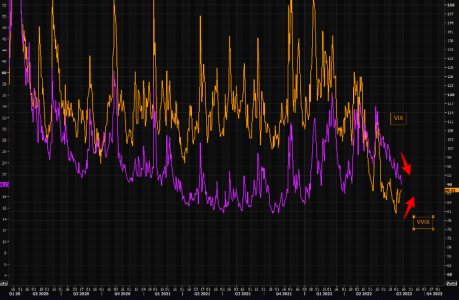

VVIX knew...but does it know?

VVIX stopped crashing a little while ago. VIX on the other hand has been busy closing the gap vs VVIX. Note the divergence between these two over the past week. VVIX ain't buying the latest VIX move lower...

https://themarketear.com/

VVIX stopped crashing a little while ago. VIX on the other hand has been busy closing the gap vs VVIX. Note the divergence between these two over the past week. VVIX ain't buying the latest VIX move lower...

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

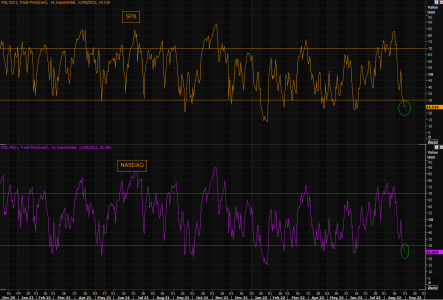

SPX/VIX daily:

You buy protection when you can...not when you must

Regular readers of TME are familiar with the above. Given the most recent "reset" of cross asset vols, but especially in equities land, the prudent investor should be looking at hedges/long volatility trades/pure speculation. To play pure VIX, we would look at relatively short dated VIX call spreads. We have Jackson Hole coming up, September is around the corner and is a "problematic" month. It is all about Fed, but will they land this the soft or the hard way? One thing is sure, you do not buy a house insurance after it has started burning, irrespective if it is going to burn or not....A thread on volatility and protection:

https://themarketear.com/

You buy protection when you can...not when you must

Regular readers of TME are familiar with the above. Given the most recent "reset" of cross asset vols, but especially in equities land, the prudent investor should be looking at hedges/long volatility trades/pure speculation. To play pure VIX, we would look at relatively short dated VIX call spreads. We have Jackson Hole coming up, September is around the corner and is a "problematic" month. It is all about Fed, but will they land this the soft or the hard way? One thing is sure, you do not buy a house insurance after it has started burning, irrespective if it is going to burn or not....A thread on volatility and protection:

https://themarketear.com/

Attachments

- Reaction score

- 2,373

New Hussman Commentary today: https://www.hussmanfunds.com/comment/mc220815/

Wall Street appears convinced that the half-point retreat from the highest core inflation in 40 years, currently at 5.9%, will encourage the Fed to “pivot” to lower rates in no time. Yet when the Federal Funds rate has been lower than core inflation, with core inflation above even 2.5%, the Fed has never shifted to easing unless recession has pushed the unemployment rate toward 6% or higher. It’s also worth noting that the only bear market low in history that occurred in the midst of a Fed tightening cycle was in 1987, at an S&P 500 forward operating P/E of less than 10, and a price/revenue multiple less than a quarter of today’s level.

robo

TSP Legend

- Reaction score

- 471

SPX/BPSPX daily warning pattern: The pattern indicates more downside ahead, but we could be getting closer to a short-term bounce. We shall see how it plays out. I haven't been posting much lately as my focus has been trading other sectors. As we all know you CAN NOT short-term trade using TSP, and that is what I'm currently doing.

SPX things to watch - 3 gaps left behind, we are getting deeper into the daily cycle, we are getting over sold, and we be heading into September.

Bottom Line: Day 8 since moving below the 10 dma which is a sell signal for me. However, I haven't been trading stocks much.... Waiting to see how this pattern plays, and will probably make a ST counter-trend move into stocks in the weeks ahead. Why I'm I calling it a counter-trend trade? Because we are in a Bear Market based on my data.

SPX things to watch - 3 gaps left behind, we are getting deeper into the daily cycle, we are getting over sold, and we be heading into September.

Bottom Line: Day 8 since moving below the 10 dma which is a sell signal for me. However, I haven't been trading stocks much.... Waiting to see how this pattern plays, and will probably make a ST counter-trend move into stocks in the weeks ahead. Why I'm I calling it a counter-trend trade? Because we are in a Bear Market based on my data.

Attachments

robo

TSP Legend

- Reaction score

- 471

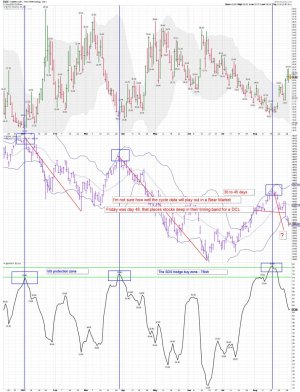

VIX/BPSPX daily:

Some good advice from another forum:

Bocomo

Wednesday 31st of August 2022 07:38:02 AM

snippet 1 As my friend Lee Adler has said: "There's no such thing as support in a bear market." I recommend taking those words to heart.

snippet 2 Countertrend trading in most markets is only recommended for experienced and highly nimble traders, and this becomes doubly true during bear markets, because bear markets are completely unforgiving of poorly-timed longs. It helps to remember that the goal of the market now is to separate longs from their money -- and then, once you've come to terms with that, ask yourself if you want to throw your lot in with them by trying to beat the primary trend for a few quick short-term scores.

snippet 3 Please don't recognize the bear and then get wiped out by trying to be a bull.

Some good advice from another forum:

Bocomo

Wednesday 31st of August 2022 07:38:02 AM

snippet 1 As my friend Lee Adler has said: "There's no such thing as support in a bear market." I recommend taking those words to heart.

snippet 2 Countertrend trading in most markets is only recommended for experienced and highly nimble traders, and this becomes doubly true during bear markets, because bear markets are completely unforgiving of poorly-timed longs. It helps to remember that the goal of the market now is to separate longs from their money -- and then, once you've come to terms with that, ask yourself if you want to throw your lot in with them by trying to beat the primary trend for a few quick short-term scores.

snippet 3 Please don't recognize the bear and then get wiped out by trying to be a bull.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

SPX - approaching big levels

We outlined our most bearish market logic on Aug 16 in our post "Are we there yet? Yeah...." Since then the SPX has fallen from 4300 to currently trade around 3930. Needless to say, that trade has played out well and is not attractive at these levels.

3900 is a very big support for the SPX, followed by the 3800 and then the June lows. Resistance is at 4k, and then the 4100. We are now well below the 200 day and have closed below the 50 day three days in a row. Time to easy some of the bearish logic soon from a short term trading view....

https://themarketear.com/

We outlined our most bearish market logic on Aug 16 in our post "Are we there yet? Yeah...." Since then the SPX has fallen from 4300 to currently trade around 3930. Needless to say, that trade has played out well and is not attractive at these levels.

3900 is a very big support for the SPX, followed by the 3800 and then the June lows. Resistance is at 4k, and then the 4100. We are now well below the 200 day and have closed below the 50 day three days in a row. Time to easy some of the bearish logic soon from a short term trading view....

https://themarketear.com/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Catching a falling knife.....

LOL.... I have caught a few over the years, but have lots of cuts trying it. Some were deep cuts.

For the record: I don't buy or sell based only on oversold and overbought data.

Never catch a falling knife...

Market went from overbought to oversold very quickly. The problem with most "pundits" talking the oversold story is that things can stay in "over" territory for longer than most think possible. Our bearish market logic from Aug 16 (here), outlined in our post "Are we there yet? Yeah...." , has played out well, but there is no rush to book profits yet, just let the p/l world for you...and possibly roll some of those puts we mentioned as great opportunities on Aug 16 as well (here).

Never catch a falling knife...

Market went from overbought to oversold very quickly. The problem with most "pundits" talking the oversold story is that things can stay in "over" territory for longer than most think possible. Our bearish market logic from Aug 16 (here), outlined in our post "Are we there yet? Yeah...." , has played out well, but there is no rush to book profits yet, just let the p/l world for you...and possibly roll some of those puts we mentioned as great opportunities on Aug 16 as well (here).

https://themarketear.com/posts/cg5wYA-22d

LOL.... I have caught a few over the years, but have lots of cuts trying it. Some were deep cuts.

For the record: I don't buy or sell based only on oversold and overbought data.

Never catch a falling knife...

Market went from overbought to oversold very quickly. The problem with most "pundits" talking the oversold story is that things can stay in "over" territory for longer than most think possible. Our bearish market logic from Aug 16 (here), outlined in our post "Are we there yet? Yeah...." , has played out well, but there is no rush to book profits yet, just let the p/l world for you...and possibly roll some of those puts we mentioned as great opportunities on Aug 16 as well (here).

Never catch a falling knife...

Market went from overbought to oversold very quickly. The problem with most "pundits" talking the oversold story is that things can stay in "over" territory for longer than most think possible. Our bearish market logic from Aug 16 (here), outlined in our post "Are we there yet? Yeah...." , has played out well, but there is no rush to book profits yet, just let the p/l world for you...and possibly roll some of those puts we mentioned as great opportunities on Aug 16 as well (here).

https://themarketear.com/posts/cg5wYA-22d

Attachments

robo

TSP Legend

- Reaction score

- 471

Thursday was day 52, pacing stocks deep in their timing band for a DCL. Since August of 2014 close to 80% of the daily cycles bottomed at or before day 52.

Site logo image Cycle Trading

Another Low Risk Opportunity

likesmoneystudies

Sep 1

Thursday was day 52, pacing stocks deep in their timing band for a DCL. Since August of 2014 close to 80% of the daily cycles bottomed at or before day 52.

Stocks formed a bullish reversal on Thursday, easing the parameters for forming a swing low. Stocks have retraced to the 50 % fib level and breached the daily cycle trend line. So if stocks form a swing low, the odds are good that will mark the DCL. A low risk entry can be taken on a swing low, using Thursday's low as the stop.

Site logo image Cycle Trading

Another Low Risk Opportunity

likesmoneystudies

Sep 1

Thursday was day 52, pacing stocks deep in their timing band for a DCL. Since August of 2014 close to 80% of the daily cycles bottomed at or before day 52.

Stocks formed a bullish reversal on Thursday, easing the parameters for forming a swing low. Stocks have retraced to the 50 % fib level and breached the daily cycle trend line. So if stocks form a swing low, the odds are good that will mark the DCL. A low risk entry can be taken on a swing low, using Thursday's low as the stop.

Attachments

robo

TSP Legend

- Reaction score

- 471

BPSPX daily: This daily pattern indicates odds still favor more downside in the weeks ahead. However, other indicators gives odds for a ST bounce before the BPSPX pattern completes. We shall see how it plays out. I tried to play the short-term bounce using TSP funds, but so far a losing trade. I kept a 10% position in the S Fund for a ST trade, based on the odds for a ST bounce. Less trading these days because of the constant whipsaws. So while I wait for a confirmed weekly buy signal, I have been going to the range more often, and shooting my Volquartsen Black Mamba.

Day 11 since the sell signal for the SPX..... You can see on the chart below why I respect the BPSPX daily pattern.

Day 11 since the sell signal for the SPX..... You can see on the chart below why I respect the BPSPX daily pattern.

Attachments

robo

TSP Legend

- Reaction score

- 471