robo

TSP Legend

- Reaction score

- 471

David Rosenberg

@EconguyRosie

·

9h

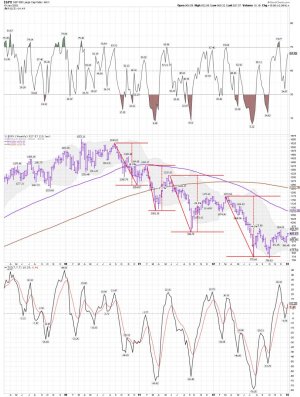

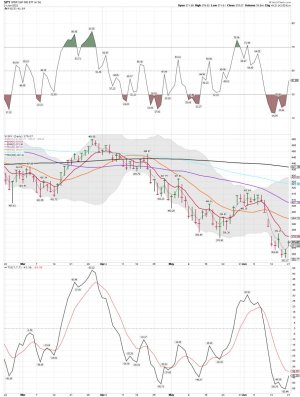

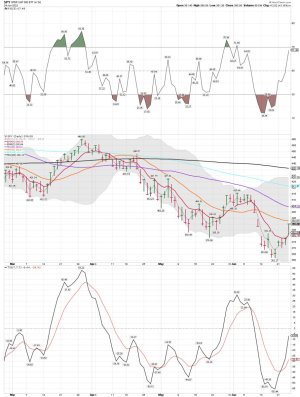

I keep getting asked when I will finally turn bullish. Answer -- the day I flip my charts upside down.

#RosenbergResearch

David Rosenberg

@EconguyRosie

·

Jun 13

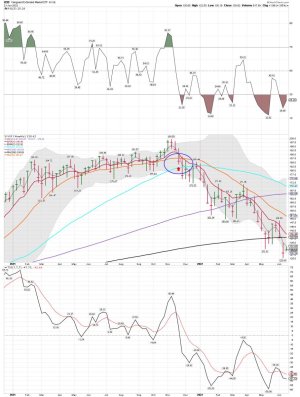

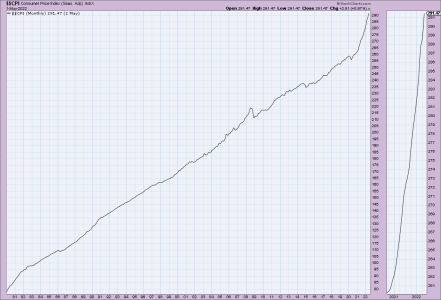

We've had 8% inflation before. Been a while, but we've had it. What we've never had before was the Fed hiking rates into an official bear market. Brand spanking new. More downside coming.

#RosenbergResearch

David Rosenberg

@EconguyRosie

·

Jun 13

Down 4% on a day with no new news. Incredible. What will tomorrow bring? I sense margin calls.

#RosenbergResearch #Markets

David Rosenberg

@EconguyRosie

·

Jun 13

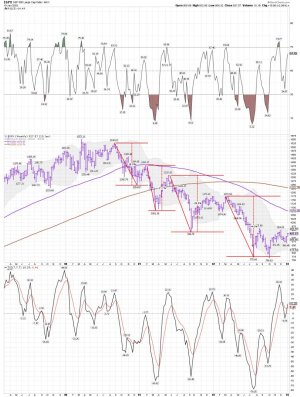

I don't know about anybody else, but this looks like a prelude to a crash. Get out of Dodge if you haven't already done so. It's not too late.

https://twitter.com/EconguyRosie?lang=en

@EconguyRosie

·

9h

I keep getting asked when I will finally turn bullish. Answer -- the day I flip my charts upside down.

#RosenbergResearch

David Rosenberg

@EconguyRosie

·

Jun 13

We've had 8% inflation before. Been a while, but we've had it. What we've never had before was the Fed hiking rates into an official bear market. Brand spanking new. More downside coming.

#RosenbergResearch

David Rosenberg

@EconguyRosie

·

Jun 13

Down 4% on a day with no new news. Incredible. What will tomorrow bring? I sense margin calls.

#RosenbergResearch #Markets

David Rosenberg

@EconguyRosie

·

Jun 13

I don't know about anybody else, but this looks like a prelude to a crash. Get out of Dodge if you haven't already done so. It's not too late.

https://twitter.com/EconguyRosie?lang=en