Face The Nation

@FaceTheNation

·

3h

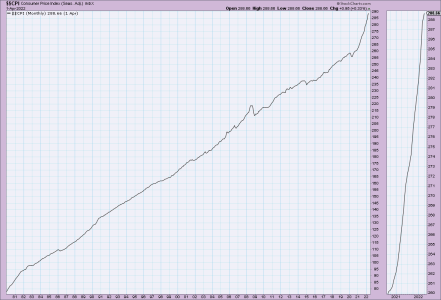

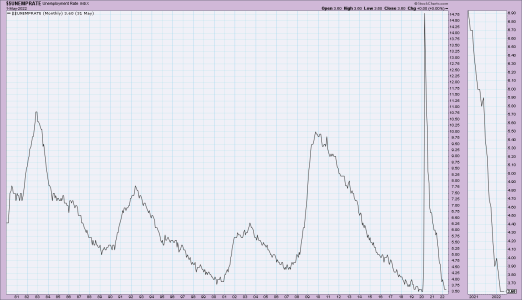

Allianz Chief Economic Adviser El-Erian says the “darkest” scenario is if inflation continues and we end up in a recession, “That will be tragic if that were to happen because, again, it is the most vulnerable segment of the population that gets hit hard.”

https://twitter.com/elerianm

Mohamed A. El-Erian

@elerianm

·

11h

The global #economy/markets' focus this week is the #Fed's policy meeting

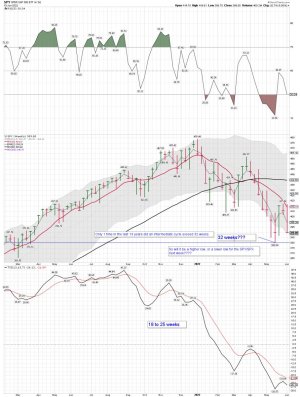

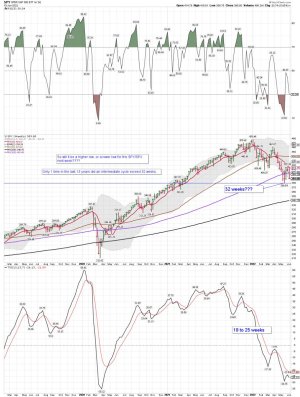

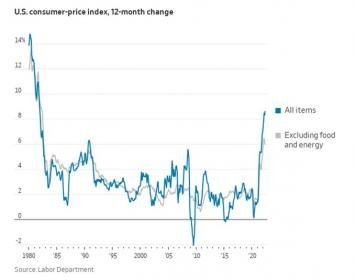

Its importance has been accentuated by last week's bad #inflation surprises, guaranteeing a 50 bps hike, fueling talk of 75, and adding to worries about recession risk

None of this is comforting for markets

Mohamed A. El-Erian

@elerianm

·

Jun 11

.

@WSJ

:"Gasoline Prices Reach[ing] $5 a Gallon Nationwide for the First Time"

This is a leading example of the twin hit to households/economy of high #inflation:

Directly via the higher price of goods/services and indirectly by destroying/redirecting demand

https://wsj.com/articles/gasoline-p...r-the-first-time-11654910506?mod=hp_lead_pos1

Mohamed A. El-Erian

@elerianm

·

Jun 11

.

@WSJ

:"Gasoline Prices Reach[ing] $5 a Gallon Nationwide for the First Time"

This is a leading example of the twin hit to households/economy of high #inflation:

Directly via the higher price of goods/services and indirectly by destroying/redirecting demand

https://wsj.com/articles/gasoline-p...r-the-first-time-11654910506?mod=hp_lead_pos1

Mohamed A. El-Erian

@elerianm

·

Jun 10

One of the clips from this morning's interaction on

@SquawkCNBC

with

@BeckyQuick

.

Thank you Becky for the conversation.

https://youtube.com/watch?v=j1yH5LZQyeM

@cnbc

#economy #markets #inflation #fed #federalreserve #centralbanks #EconTwitter

youtube.com

Fed Chair Powell is 'losing total control' of inflation narrative,...

Mohamed El-Erian, Allianz and Gramercy advisor and president of Queen’s College, Cambridge, joins CNBC's 'Squawk Box' to react to May's higher-