-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

Wheat..... We shall see how this plays out.

Jim Rickards: “We are on the precipice”

BY DAVID HAGGITH ◆ MAY 20, 2022 3 COMMENTS

I don’t believe many people grasp the enormity of the global food crisis we’ll be facing in the months ahead. But the world could be on the verge of a massive humanitarian crisis. Let’s dive in…

29% of All Wheat Exports in Jeopardy

In the Northern Hemisphere, the planting season for 2022 is well underway. Crops were planted (or not) in March and April. Based on that, you can already form estimates of output next September and October during the harvest season (subject to some variability based on weather and other factors).

Plantings have been far below normal in 2022, either due to a lack of fertilizer or to much higher costs for fertilizer where farmers simply chose to plant less. This predictable shortage is in addition to the much greater shortages due to the fact that Russian output is sanctioned and Ukrainian output is nonexistent because it’s at war.

Russia and Ukraine together account for 29% of global wheat and 19% of global corn exports.

https://www.dollarcollapse.com/jim-rickards-on-the-precipice/

Jim Rickards: “We are on the precipice”

BY DAVID HAGGITH ◆ MAY 20, 2022 3 COMMENTS

I don’t believe many people grasp the enormity of the global food crisis we’ll be facing in the months ahead. But the world could be on the verge of a massive humanitarian crisis. Let’s dive in…

29% of All Wheat Exports in Jeopardy

In the Northern Hemisphere, the planting season for 2022 is well underway. Crops were planted (or not) in March and April. Based on that, you can already form estimates of output next September and October during the harvest season (subject to some variability based on weather and other factors).

Plantings have been far below normal in 2022, either due to a lack of fertilizer or to much higher costs for fertilizer where farmers simply chose to plant less. This predictable shortage is in addition to the much greater shortages due to the fact that Russian output is sanctioned and Ukrainian output is nonexistent because it’s at war.

Russia and Ukraine together account for 29% of global wheat and 19% of global corn exports.

https://www.dollarcollapse.com/jim-rickards-on-the-precipice/

robo

TSP Legend

- Reaction score

- 471

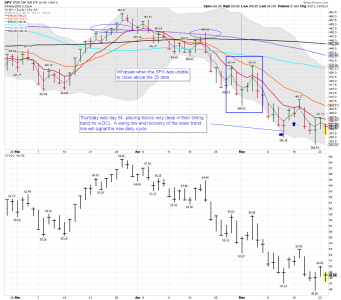

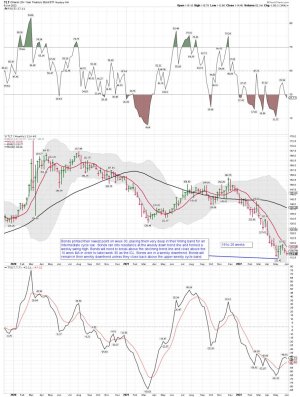

SPY daily: Still unable to close back above the 10 dma on the daily chart. The first step to starting a new trending move after a confirmed DCL. The last move up that closed above the 10 dma was another fake out and a whipsaw. Well, for those of us that use a move above the 10 dma as a buy signal. Yes I do use that data along with other indicators as that is part of my trading system....

Still doing ok trading SDS and SSO..... Impossible to trade TSP in a market like this one with only 2 moves a month. Not a market I want to buy and hold. Still long some C and S fund for my test, but I have those positions hedge using SDS and flip to SSO when I like the setups. We shall see it the SPY can close back above the 3 ema today. That would be a plus. Bought some SSO during the dip this morning for a daytrade.

Tough trading for sure!

Still doing ok trading SDS and SSO..... Impossible to trade TSP in a market like this one with only 2 moves a month. Not a market I want to buy and hold. Still long some C and S fund for my test, but I have those positions hedge using SDS and flip to SSO when I like the setups. We shall see it the SPY can close back above the 3 ema today. That would be a plus. Bought some SSO during the dip this morning for a daytrade.

Tough trading for sure!

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

For any 22 LR plinkers out there. Finally got my Vudoo..... Shoots well, but probably over priced for most plinkers. Hard to get a good look at it from the picture below, but close to the one in this video.

THE MOST ACCURATE 22LR BOLT ACTION I HAVE EVER SHOT - VUDOO RAVAGE

https://www.youtube.com/watch?v=O8BnGrvnrww

THE MOST ACCURATE 22LR BOLT ACTION I HAVE EVER SHOT - VUDOO RAVAGE

https://www.youtube.com/watch?v=O8BnGrvnrww

Attachments

robo

TSP Legend

- Reaction score

- 471

robo

TSP Legend

- Reaction score

- 471

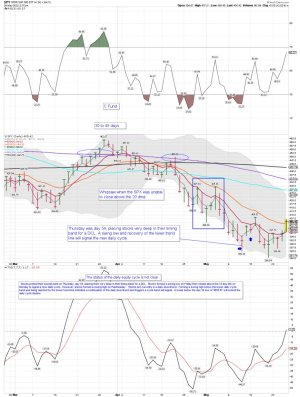

Has BTFD's turned into STFR's?

Very possibe! We shall see how this daily cycle low plays out. I'm still trying to catch the next ICL, but continue to get whipsawed. Bear Markets are tough to trade. Watching the weekly for a possible ICL..... It looks like the 7 weeks down will hold. It was above average odds just to go long using that data point.

"The S&P 500 is down for seven consecutive weeks, its worst stretch since the bursting of the dot-com bubble in 2001."

Stocks Confirm New Daily Cycle

Stocks formed a swing low on Monday then delivered bullish follow through Wednesday and Thursday.

The next task at hand is to break above the lower stem of the megaphone topping pattern. Stocks will need to do so in order for any bullish trending move to develop. Rejection here would extend the intermediate cycle decline.

https://likesmoneycycletrading.wordpress.com/2022/05/26/stocks-confirm-new-daily-cycle-3/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Hmmmm....

The Red Cycle Approximates Where We are Currently in this Bear Market Cycle

1:18 PM · May 27, 2022·TweetDeck

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

We won't say that most investors are clueless about the past, but we'll call them historically challenged.

In recent years it has become politically correct to say that people with defects are physically or mentally challenged. 99% of today's investors have put close to zero effort into understanding the market's patterns through the decades and are certain that it's completely different this time. We won't even call them dimwits. Instead, we'll be nice and say that they're historically challenged. Today's investors don't respect previous episodes not just because they have no concept of past behavior, but because they're sure that it can't be of any use to their current portfolios or the most likely future behavior.

Kaplan

https://truecontrarian-sjk.blogspot.com/

David Rosenberg

@EconguyRosie

·

May 25

As Bill Ackman tees off on the Fed, do you think he knows that both M1 & M2 contracted in April, taking their YoY growth trends back to where they were pre-COVID? Tack on the fiscal contraction & we have the makings of demand-led deflation ahead, regardless of supply-chain issues

https://twitter.com/EconguyRosie?lang=en

The Red Cycle Approximates Where We are Currently in this Bear Market Cycle

1:18 PM · May 27, 2022·TweetDeck

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

We won't say that most investors are clueless about the past, but we'll call them historically challenged.

In recent years it has become politically correct to say that people with defects are physically or mentally challenged. 99% of today's investors have put close to zero effort into understanding the market's patterns through the decades and are certain that it's completely different this time. We won't even call them dimwits. Instead, we'll be nice and say that they're historically challenged. Today's investors don't respect previous episodes not just because they have no concept of past behavior, but because they're sure that it can't be of any use to their current portfolios or the most likely future behavior.

Kaplan

https://truecontrarian-sjk.blogspot.com/

David Rosenberg

@EconguyRosie

·

May 25

As Bill Ackman tees off on the Fed, do you think he knows that both M1 & M2 contracted in April, taking their YoY growth trends back to where they were pre-COVID? Tack on the fiscal contraction & we have the makings of demand-led deflation ahead, regardless of supply-chain issues

https://twitter.com/EconguyRosie?lang=en

Attachments

robo

TSP Legend

- Reaction score

- 471

Cycles:

Stocks Crossed The Line

Stocks closed back above the lower stem of the megaphone topping pattern on Friday.

When stocks broke bearishly out of the megaphone topping pattern – it looked like the Worse Case Scenario, which we discussed here. However, this may be the best buying opportunity of the year. In the Weekend Report I take a look at the bigger picture for stocks. I discuss where stocks are in their daily weekly and yearly cycles. And why I believe that the best opportunity for gains for the year is still in front of us.

Stocks Crossed The Line

Stocks closed back above the lower stem of the megaphone topping pattern on Friday.

When stocks broke bearishly out of the megaphone topping pattern – it looked like the Worse Case Scenario, which we discussed here. However, this may be the best buying opportunity of the year. In the Weekend Report I take a look at the bigger picture for stocks. I discuss where stocks are in their daily weekly and yearly cycles. And why I believe that the best opportunity for gains for the year is still in front of us.

Attachments

robo

TSP Legend

- Reaction score

- 471

Attachments

robo

TSP Legend

- Reaction score

- 471

Making Friends with Bears Through Math

John P. Hussman, Ph.D.

President, Hussman Investment Trust

June 2022

Waiting for “the” capitulation

Aside from ignoring valuations and market internals, one of the behaviors that will get you eaten in a bear market is placing too much confidence in any single “capitulation.” Speculative episodes typically unwind in waves. The steeper the starting valuations, the more waves one typically observes.

S&P 500 2000-2002:

https://www.hussmanfunds.com/comment/mc220601/

John P. Hussman, Ph.D.

President, Hussman Investment Trust

June 2022

Waiting for “the” capitulation

Aside from ignoring valuations and market internals, one of the behaviors that will get you eaten in a bear market is placing too much confidence in any single “capitulation.” Speculative episodes typically unwind in waves. The steeper the starting valuations, the more waves one typically observes.

S&P 500 2000-2002:

https://www.hussmanfunds.com/comment/mc220601/

Attachments

robo

TSP Legend

- Reaction score

- 471

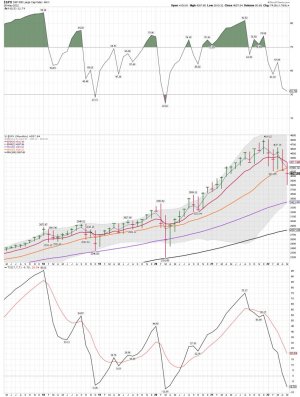

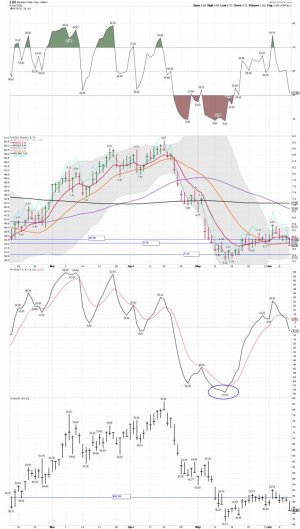

VXF daily (S Fund) : Unable to move above the 50 dma. Is VXF going to make a higher low, tag the lower BB or maybe make a lower low. LOL..... We shall see! I still have one move left, but would have to see some kind of extreme to buy some TSP shares again. I'm doing very well in accounts with unlimited moves.

Attachments

robo

TSP Legend

- Reaction score

- 471

VXF weekly: ( S Fund) Still unable to start a new trend above the 10 week MA. The index remains in a bearish setup..... If you use the 20 week MA VXF moved below it 29 weeks ago which is a confirmed sell signal on my weekly chart and never recovered. The trend remains down using the weekly data as it continues to make lower highs..... This is classic Bear Market action.

The moves in the dollar is adding to the current stock market pressure and causing some of these crazy swings.

The moves in the dollar is adding to the current stock market pressure and causing some of these crazy swings.

Attachments

robo

TSP Legend

- Reaction score

- 471

Strong markets can stay overbought, weak ones can stay oversold. I'm ready for SPX 3,500 and don't see the lows holding. If it goes lower, that's just more tax loss selling I can do in the taxable account.

I have been done lots of ST trading both ways. Up for the year so far, but I'm playing small ball and keeping it that way for now. As I pointed out earlier, are we about to see a lower low or a higher low? We shall see!

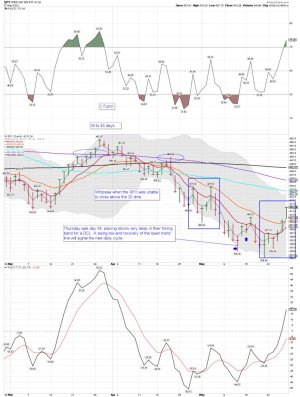

Stocks Deliver Sell Signal

With stocks in their timing band for both an intermediate and yearly cycle low, the odds were good that the late May cycle low would mark a new weekly and yearly cycle low. So if day 60 was the intermediate/yearly cycle low then the first daily cycle out of that low should right translate. However stocks formed a swing high on Thursday. And with a potential peak on day 8 — that would indicate a left translated daily cycle formation.

Stocks are currently in a daily downtrend. Forming a swing high below the upper daily cycle band indicates a continuation of the daily downtrend and signals a cycle band sell signal.

https://likesmoneycycletrading.wordpress.com/2022/06/09/stocks-deliver-sell-signal-3/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

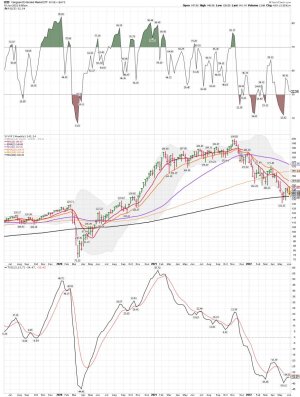

VXF weekly: (S fund) I will be trying to catch a bounce off the 200 week MA. LOL.... If we get one...... This is catching the falling knife trade, but it will be hedged. A high risk trade, but I like the odds for a ST trade. Not recommended for most! We shall see if we undercut the 200 wma, make a higher low, or just keep moving lower and make a lower low. My "GUESS and BET" is we will bounce somewhere around the 200 wma. Yes, this is gambling and is a High Risk Trade. I was long SDS going into today's move lower. Also long some other short indexes.

Typical Bear Market action.... We shall see how we close..... I will sell most short positions and take profits before we close today. Those gains is how I offset my long positions, and I'm still only ST trading.

Typical Bear Market action.... We shall see how we close..... I will sell most short positions and take profits before we close today. Those gains is how I offset my long positions, and I'm still only ST trading.

Attachments

Last edited: