robo

TSP Legend

- Reaction score

- 471

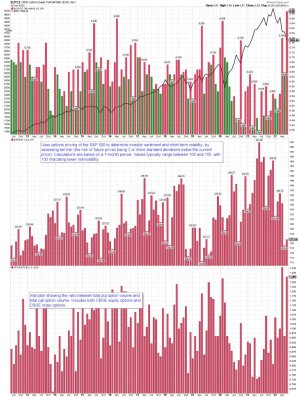

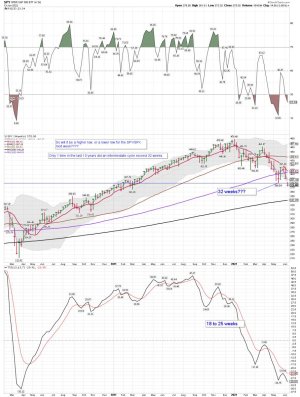

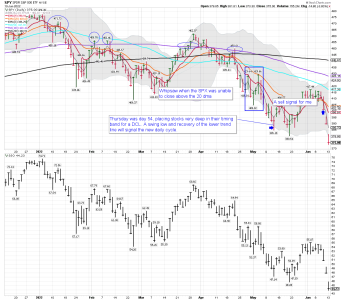

$CPCE monthly: We shall see how all of this plays out the rest of June. A gap down for the SPY futures at the open, as was expected.

SevenSentinels

@SevenSentinels

·

5h

Panic Comes at the BOTTOM Of Each Intermediate Term Cycle.

We are barely BEGINNING that stage with

Friday's One Day

CPC of 1.28 &

CPCE of 0.89

The Real PANIC Emerges This Week

See this week's article on Sludin?jumi - SS.COM

Sleeping Giant Awakens & His Name Is PANIC

Quote Tweet

Daniel

@exposurerisk

· 18h

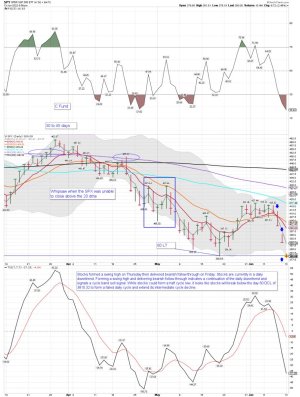

6) One can understand a lack of fear in a sharp rally but a lack of fear in today's drop? The same thing happened in July 2008 before the plunge. And there you go, it doesn't matter the extremes reached but the response to a move especially when it is bizarre. Never boring.

SevenSentinels

@SevenSentinels

·

8h

...2/2

This week's article entitled "A Sleeping Giant Awakens, and His Name Is PANIC.."

Is ready and will be available when we come back online.

Serious Traders Take Note- This is the stuff of which trading careers are made when you "get it right."

Good Trading, All! D

SevenSentinels

@SevenSentinels

·

8h

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^authorSince we were down for maintenance Friday, we had our tech team take the opportunity to do a complete upgrade to speed up response times and beef up security.

They did so, and we are just waiting for Blue Host to reactivate website within 24 hours.

Meantime... 1/2

SevenSentinels

@SevenSentinels

·

5h

Panic Comes at the BOTTOM Of Each Intermediate Term Cycle.

We are barely BEGINNING that stage with

Friday's One Day

CPC of 1.28 &

CPCE of 0.89

The Real PANIC Emerges This Week

See this week's article on Sludin?jumi - SS.COM

Sleeping Giant Awakens & His Name Is PANIC

Quote Tweet

Daniel

@exposurerisk

· 18h

6) One can understand a lack of fear in a sharp rally but a lack of fear in today's drop? The same thing happened in July 2008 before the plunge. And there you go, it doesn't matter the extremes reached but the response to a move especially when it is bizarre. Never boring.

SevenSentinels

@SevenSentinels

·

8h

...2/2

This week's article entitled "A Sleeping Giant Awakens, and His Name Is PANIC.."

Is ready and will be available when we come back online.

Serious Traders Take Note- This is the stuff of which trading careers are made when you "get it right."

Good Trading, All! D

SevenSentinels

@SevenSentinels

·

8h

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^authorSince we were down for maintenance Friday, we had our tech team take the opportunity to do a complete upgrade to speed up response times and beef up security.

They did so, and we are just waiting for Blue Host to reactivate website within 24 hours.

Meantime... 1/2

Attachments

Last edited: