-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

Cycles: Still not confirmed....

Opportunity Knocking

Stocks broke below the February low this week.

If February was the yearly cycle low, then the first intermediate cycle should right translate. Instead, stocks peaked on what would have been week 5 then went on to break below the February low this week.

And – if February was the intermediate cycle low, then the first daily cycle should right translate. Instead, stocks printed consecutive failed daily cycles, beginning a pattern of lower lows.

Opportunity Knocking

Stocks broke below the February low this week.

If February was the yearly cycle low, then the first intermediate cycle should right translate. Instead, stocks peaked on what would have been week 5 then went on to break below the February low this week.

And – if February was the intermediate cycle low, then the first daily cycle should right translate. Instead, stocks printed consecutive failed daily cycles, beginning a pattern of lower lows.

Attachments

robo

TSP Legend

- Reaction score

- 471

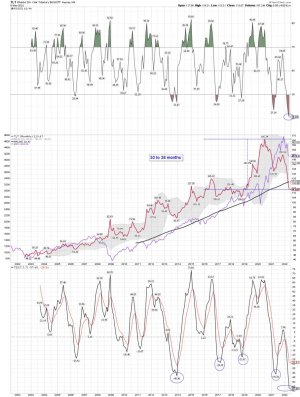

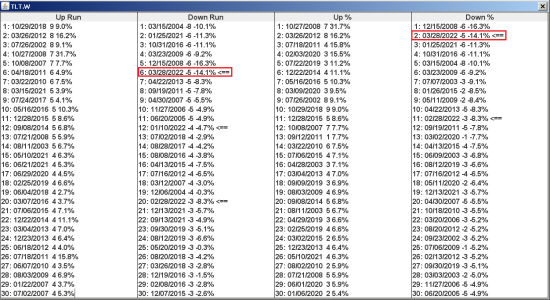

TLT Monthly, Weekly and Daily charts: The patterns continue to get more extreme as the monthly moves below the 100 month ma, and the weekly moves way below the 200 week ma. Rare extremes indeed. How much longer before we see an ICL and a possible 3 YCL.

Bottom Line: The move down continues, and we are currently seeing some rare extreme oversold levels for TLT.Repricing a Market Priced for Zero

A comment below about TLT and some thoughts about some possible swing trading coming our way

John P. Hussman, Ph.D.

President, Hussman Investment Trust

April 2022

Market crashes

One of the interesting features of long, interesting trips to nowhere is that much of the repricing can occur within a compressed period of time. For example, while the total return of the S&P 500 lagged Treasury bills between 2000-2013, a great deal of the damage was compressed into the 2000-2002 collapse, after which the market enjoyed a 5-year bull market before the global financial crisis emerged. So even though I frankly expect the S&P 500 to lag Treasury bills for a period between 10 and 20 years, I also expect very frequent periods of investment opportunity along the way. I would expect the best opportunities to emerge in periods when a material retreat in market valuations is joined by an improvement what I often describe as the “uniformity” of market internals.

A market crash is nothing but risk-aversion meeting a low risk-premium; upward yield pressure meeting an inadequate yield. Both features are necessary. Extreme valuations may set investors up for dismal long-term returns, and they may imply profound market losses over the complete market cycle – but so long as investors have the speculative bit in their teeth, extreme valuations can persist for a very long time before collapsing.

https://www.hussmanfunds.com/comment/mc220429/

Bottom Line: The move down continues, and we are currently seeing some rare extreme oversold levels for TLT.Repricing a Market Priced for Zero

A comment below about TLT and some thoughts about some possible swing trading coming our way

John P. Hussman, Ph.D.

President, Hussman Investment Trust

April 2022

Market crashes

One of the interesting features of long, interesting trips to nowhere is that much of the repricing can occur within a compressed period of time. For example, while the total return of the S&P 500 lagged Treasury bills between 2000-2013, a great deal of the damage was compressed into the 2000-2002 collapse, after which the market enjoyed a 5-year bull market before the global financial crisis emerged. So even though I frankly expect the S&P 500 to lag Treasury bills for a period between 10 and 20 years, I also expect very frequent periods of investment opportunity along the way. I would expect the best opportunities to emerge in periods when a material retreat in market valuations is joined by an improvement what I often describe as the “uniformity” of market internals.

A market crash is nothing but risk-aversion meeting a low risk-premium; upward yield pressure meeting an inadequate yield. Both features are necessary. Extreme valuations may set investors up for dismal long-term returns, and they may imply profound market losses over the complete market cycle – but so long as investors have the speculative bit in their teeth, extreme valuations can persist for a very long time before collapsing.

https://www.hussmanfunds.com/comment/mc220429/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Re: TLT

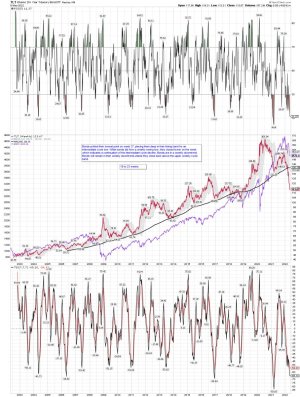

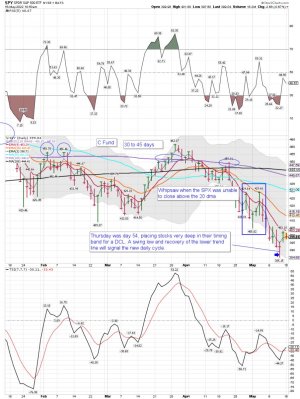

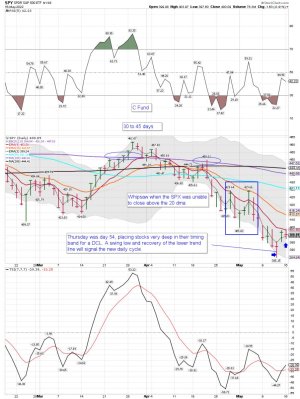

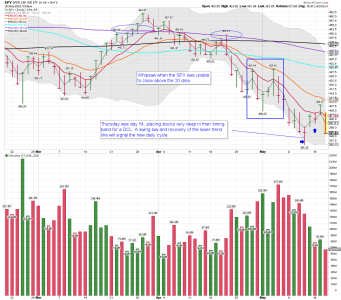

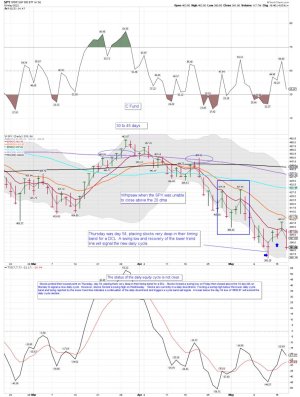

SPX daily: I got whipsawed the last time I thought the DCL was in. Stocks were unable to close back above the 20 dma after a close above the 10 dma. That move was a buy signal for me based on my indicators, but I got whipsawed. We shall see how next week plays out. My focus remains on trading the gold miners right now.

This is a very tough market to try and trade!

Long - GDXJ, EQX, SLV, TLT - (TSP C and S funds) In a trading account I would have sold with any move back below the 10 dma. However, there is only two moves a month in TSP, we were late in the cycle, and since I'm performing a test I held. TSP is great in Bull Markets. If you buy early in a Bull Market the Bull will save you. But in Bear Markets, trying to catch the falling knife can be rough. I use data for my buy signals that give me better odds for a winner, but there is NO SUCH thing as a perfect system. I use very few indicators and keep it simple.

Good Luck to all next week.

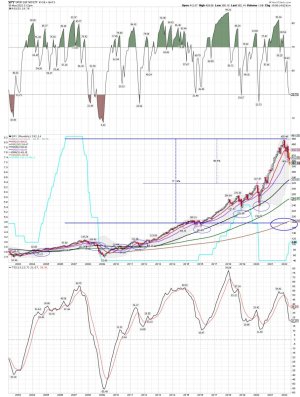

I don't post much when I'm doing lots of short-term trading. Since TSP is a MT type trading system or a long-term investment account it shouldn't be used much during a Bear market. How could it be anything else with only two moves a month. Great for dollar cost averaging when we are in a Bull Market, and going to cash in a Bear Market. We are current in a Bear Market, so it's hard to trade the rips and dips. Please note the weekly 2000 bear market chart below. Tradeable, but very tough to do using a TSP account. Note that the weekly overall trend was down for years. (The last chart -2000 Weekly Bear Market Chart) Some new investors/traders and never traded in a Bear Market. They will learn some lessons the hard way.

SPX daily: I got whipsawed the last time I thought the DCL was in. Stocks were unable to close back above the 20 dma after a close above the 10 dma. That move was a buy signal for me based on my indicators, but I got whipsawed. We shall see how next week plays out. My focus remains on trading the gold miners right now.

This is a very tough market to try and trade!

Long - GDXJ, EQX, SLV, TLT - (TSP C and S funds) In a trading account I would have sold with any move back below the 10 dma. However, there is only two moves a month in TSP, we were late in the cycle, and since I'm performing a test I held. TSP is great in Bull Markets. If you buy early in a Bull Market the Bull will save you. But in Bear Markets, trying to catch the falling knife can be rough. I use data for my buy signals that give me better odds for a winner, but there is NO SUCH thing as a perfect system. I use very few indicators and keep it simple.

Good Luck to all next week.

I don't post much when I'm doing lots of short-term trading. Since TSP is a MT type trading system or a long-term investment account it shouldn't be used much during a Bear market. How could it be anything else with only two moves a month. Great for dollar cost averaging when we are in a Bull Market, and going to cash in a Bear Market. We are current in a Bear Market, so it's hard to trade the rips and dips. Please note the weekly 2000 bear market chart below. Tradeable, but very tough to do using a TSP account. Note that the weekly overall trend was down for years. (The last chart -2000 Weekly Bear Market Chart) Some new investors/traders and never traded in a Bear Market. They will learn some lessons the hard way.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Re: TLT

Last week was rough: We shall see how this indicator plays out this time.

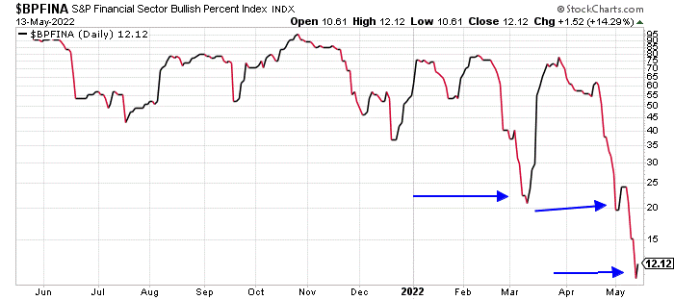

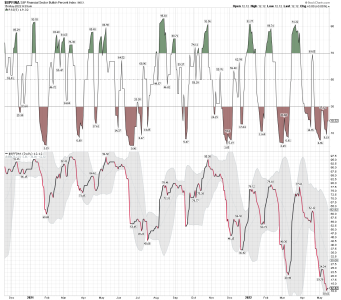

This Critical Indicator Looks Hopeful

Amid last week’s chaos, a little bit of hope showed up in a critical chart.

The Bullish Percent Index for the financial sector (BPFINA) just turned higher from oversold conditions.

Meaning that we now have a buy signal for the banking stocks.

And, since the action in the banks tends to lead the action in the broad stock market, a BPFINA buy signal could mean we’ve seen the worst of the recent stock market decline…

Take a look at this chart of the BPFINA…

However, last week, the BPFINA dropped to its lowest level of the year (right blue arrow) – meaning the financial sector was more oversold than at any time in the past twelve months.

It turned higher on Friday… so, we have another buy signal.

Of course, there’s no guarantee this one will play out. But it’s rare to get two failed signals in a row. So, I like the odds.

The BPFINA buy signal back in March led to a 10% rally in the KBW Bank Index (BKX) in just two weeks. And that move went along with a 10% rally in the S&P 500 during the same time frame.

The BPFINA is more oversold today than it was in March.

So, I suspect whatever rally or bounce we get from this setup will be even stronger than what we saw in March.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/this-critical-indicator-looks-hopeful/

Last week was rough: We shall see how this indicator plays out this time.

This Critical Indicator Looks Hopeful

Amid last week’s chaos, a little bit of hope showed up in a critical chart.

The Bullish Percent Index for the financial sector (BPFINA) just turned higher from oversold conditions.

Meaning that we now have a buy signal for the banking stocks.

And, since the action in the banks tends to lead the action in the broad stock market, a BPFINA buy signal could mean we’ve seen the worst of the recent stock market decline…

Take a look at this chart of the BPFINA…

However, last week, the BPFINA dropped to its lowest level of the year (right blue arrow) – meaning the financial sector was more oversold than at any time in the past twelve months.

It turned higher on Friday… so, we have another buy signal.

Of course, there’s no guarantee this one will play out. But it’s rare to get two failed signals in a row. So, I like the odds.

The BPFINA buy signal back in March led to a 10% rally in the KBW Bank Index (BKX) in just two weeks. And that move went along with a 10% rally in the S&P 500 during the same time frame.

The BPFINA is more oversold today than it was in March.

So, I suspect whatever rally or bounce we get from this setup will be even stronger than what we saw in March.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/this-critical-indicator-looks-hopeful/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Re: TLT

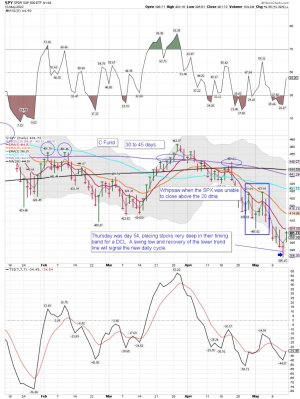

SPY daily: The SPY was unable to close above the 9 ema today, but closing above the 3 ema again was a small positive. We shall see what tomorrow brings. Still capped under the 10 dma as the Bears have the edge, and buyers are worried about another move lower.

SPY daily: The SPY was unable to close above the 9 ema today, but closing above the 3 ema again was a small positive. We shall see what tomorrow brings. Still capped under the 10 dma as the Bears have the edge, and buyers are worried about another move lower.

Attachments

robo

TSP Legend

- Reaction score

- 471

Re: TLT

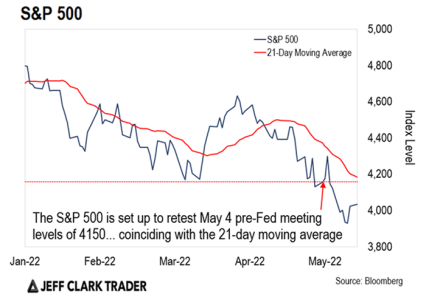

Opportunity in a Capitulating Market

Eric Shamilov | May 17, 2022 |

The VIX started heading lower on May 9…

Yet, stocks continued to drop for another three days before finally bouncing.

When stocks fall, volatility rises. But in this case, stocks and volatility were falling in unison.

You can’t have it both ways for any material stretch of time.

This tends to happen when momentum feeds on itself and capitulates – with margin selling toward the end of the move, as we’re seeing now.

My favorite example of divergence between volatility and stock prices occurred in January 2018… where the reverse happened.

Stocks kept rising with tiny intraday ranges, and the VIX started rising as well toward the end of the month.

This was a prelude to what has become known as “Volmageddon” – when the market crashed 10% in 9 days.

We’re not going to see a complete mirror image of those events now, just a small relief bounce.

But for traders, a smooth 2-3% move can generate big profits.

One area to target is 4150 – the price level on the S&P 500 right before the most recent Fed meeting on May 4.

The chart below shows how there’s quite a bit of room for the market to run before it retests those levels…

https://www.jeffclarktrader.com/market-minute/opportunity-in-a-capitulating-market/

Opportunity in a Capitulating Market

Eric Shamilov | May 17, 2022 |

The VIX started heading lower on May 9…

Yet, stocks continued to drop for another three days before finally bouncing.

When stocks fall, volatility rises. But in this case, stocks and volatility were falling in unison.

You can’t have it both ways for any material stretch of time.

This tends to happen when momentum feeds on itself and capitulates – with margin selling toward the end of the move, as we’re seeing now.

My favorite example of divergence between volatility and stock prices occurred in January 2018… where the reverse happened.

Stocks kept rising with tiny intraday ranges, and the VIX started rising as well toward the end of the month.

This was a prelude to what has become known as “Volmageddon” – when the market crashed 10% in 9 days.

We’re not going to see a complete mirror image of those events now, just a small relief bounce.

But for traders, a smooth 2-3% move can generate big profits.

One area to target is 4150 – the price level on the S&P 500 right before the most recent Fed meeting on May 4.

The chart below shows how there’s quite a bit of room for the market to run before it retests those levels…

https://www.jeffclarktrader.com/market-minute/opportunity-in-a-capitulating-market/

Attachments

robo

TSP Legend

- Reaction score

- 471

Re: TLT

SPY daily: The gap is filled..... Now what be up next? A move above the 9 ema that was a buy signal and now a smash-down and a whipsaw. Get use to it for the next few years......

So far a low volume sell-off...... We shall see how the rest of the week plays out.....

SPY daily: The gap is filled..... Now what be up next? A move above the 9 ema that was a buy signal and now a smash-down and a whipsaw. Get use to it for the next few years......

So far a low volume sell-off...... We shall see how the rest of the week plays out.....

Attachments

robo

TSP Legend

- Reaction score

- 471

SPY monthly...... If it's a Bear Market it has a long ways to go before it bottoms. The monthly will move much lower during a Bear Market before it finds a true bottom. That doesn't mean it will be straight down, but trying to use TSP funds in Bear Market is more about luck then good trading.

Attachments

robo

TSP Legend

- Reaction score

- 471

SPY daily: I just sold my SDS in the premarket. I'm now looking to buy some SSO. This is a very tough market to be trading in.... We shall see what happens as we closer the 385.15 low marker.

Still in play - A back test, a higher low, an undercut, or the next leg down.

The status of the daily equity cycle is not clear.

Still in play - A back test, a higher low, an undercut, or the next leg down.

The status of the daily equity cycle is not clear.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

SPY daily and the fear gauge: It remains under 10 and for good reason. - https://www.cnn.com/markets/fear-and-greed

Waiting to see if we undercut the low or make a lower high.

Waiting to see if we undercut the low or make a lower high.

Attachments

robo

TSP Legend

- Reaction score

- 471

Dipping a Cautious Toe Into the Water

By Jeff Clark, editor, Market Minute

The S&P 500 has fallen for seven weeks straight. The index was above 4600 near the end of April.

It closed on Friday at 3900 – a drop of more than 15%. And it registers as one of the worst seven-week performances for the stock market… ever.

During this entire period, as the broad stock market was falling many of the technical indicators we follow were dropping right along with it.

The S&P 500 would fall to a lower low, and all the momentum indicators fell to lower lows as well.

That changed last week…

It’s subtle. But if you look closely at the following chart of the S&P 500, you can see some positive divergence on the technical indicators at the bottom (MACD, RSI, and CCI)

https://www.jeffclarktrader.com/market-minute/dipping-a-cautious-toe-into-the-water/

By Jeff Clark, editor, Market Minute

The S&P 500 has fallen for seven weeks straight. The index was above 4600 near the end of April.

It closed on Friday at 3900 – a drop of more than 15%. And it registers as one of the worst seven-week performances for the stock market… ever.

During this entire period, as the broad stock market was falling many of the technical indicators we follow were dropping right along with it.

The S&P 500 would fall to a lower low, and all the momentum indicators fell to lower lows as well.

That changed last week…

It’s subtle. But if you look closely at the following chart of the S&P 500, you can see some positive divergence on the technical indicators at the bottom (MACD, RSI, and CCI)

https://www.jeffclarktrader.com/market-minute/dipping-a-cautious-toe-into-the-water/