robo

TSP Legend

- Reaction score

- 471

At a rapid pace

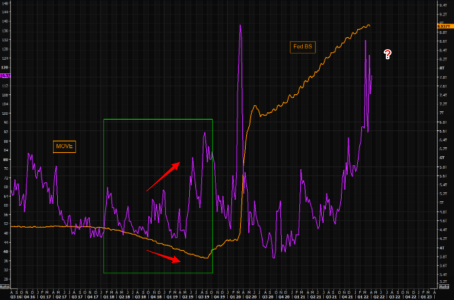

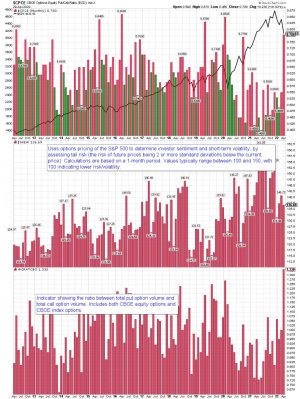

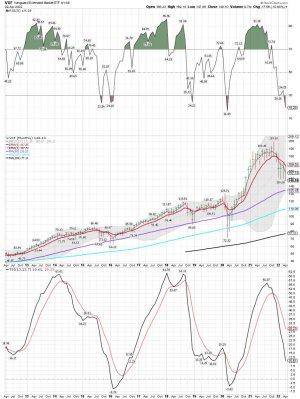

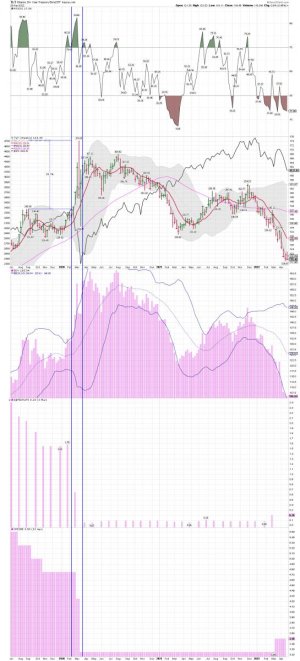

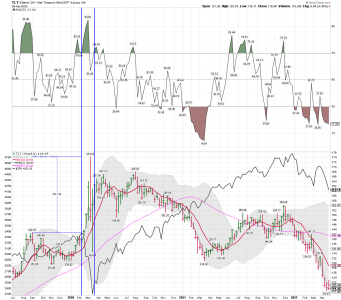

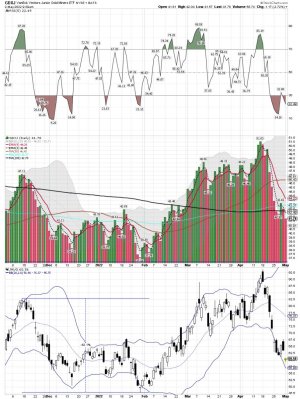

Guess Brainard didn't check this chart before talking about reducing the BS at a rapid pace. Last time Fed reduced the BS, MOVE index moved sharply higher and was a huge problem for markets. This time around things are obviously much more extreme. Regular readers of TME know our general take on volatility and Fed: Fed has distorted volatility markets. The steep rise in bond volatility, MOVE index, shows just that Fed can't manage "everything". How will this MOVE when they start shrinking it?

https://themarketear.com/

Guess Brainard didn't check this chart before talking about reducing the BS at a rapid pace. Last time Fed reduced the BS, MOVE index moved sharply higher and was a huge problem for markets. This time around things are obviously much more extreme. Regular readers of TME know our general take on volatility and Fed: Fed has distorted volatility markets. The steep rise in bond volatility, MOVE index, shows just that Fed can't manage "everything". How will this MOVE when they start shrinking it?

https://themarketear.com/