robo

TSP Legend

- Reaction score

- 471

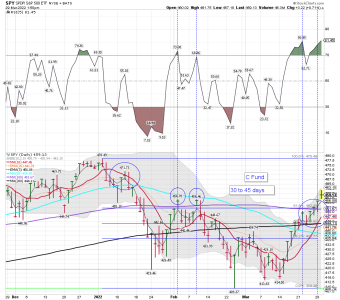

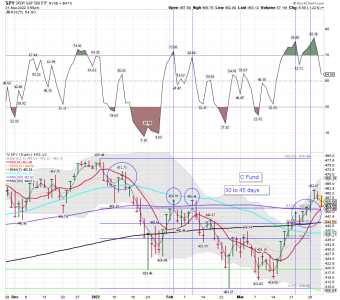

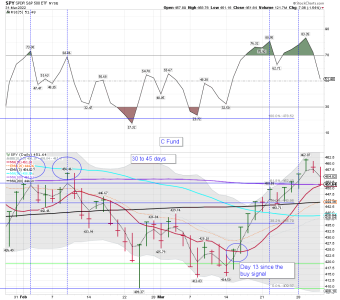

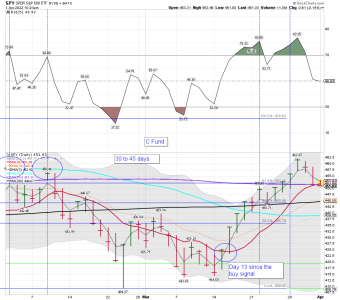

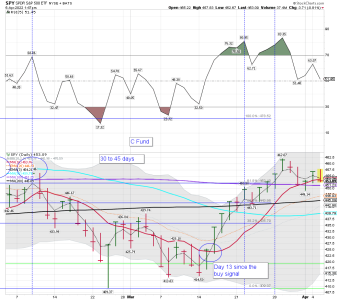

SPY daily: The move up continues...

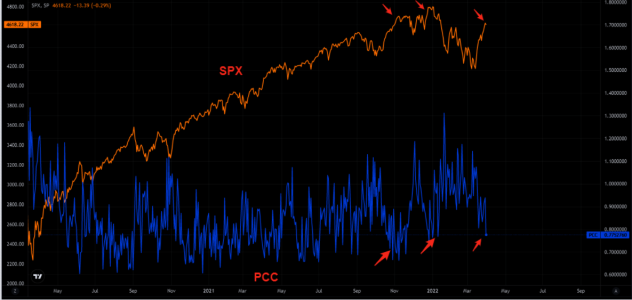

SPX - say hello to 4600

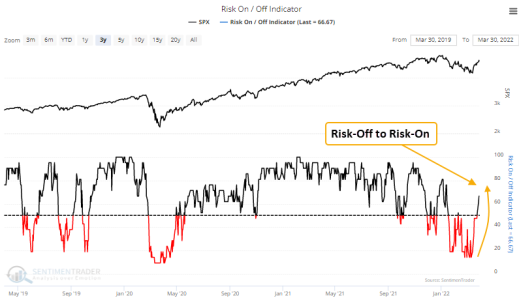

Most have been surprised by the squeeze continuing to push higher. Here we are with the SPX futs trading at the big 4600 level. We jumped above the 100 day moving average yesterday, but this is getting slightly overbought. Our main take remains intact: SPX lacks a trend, so trade it with a mean reversion mind. Next resistance above the 4600 is the 4640 level. First bigger support is down at the 4500/4480 area.

https://themarketear.com/

SPX - say hello to 4600

Most have been surprised by the squeeze continuing to push higher. Here we are with the SPX futs trading at the big 4600 level. We jumped above the 100 day moving average yesterday, but this is getting slightly overbought. Our main take remains intact: SPX lacks a trend, so trade it with a mean reversion mind. Next resistance above the 4600 is the 4640 level. First bigger support is down at the 4500/4480 area.

https://themarketear.com/