robo

TSP Legend

- Reaction score

- 471

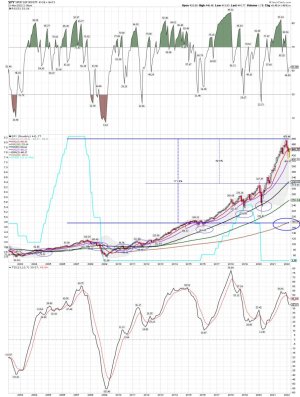

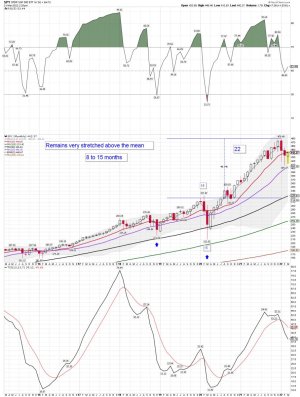

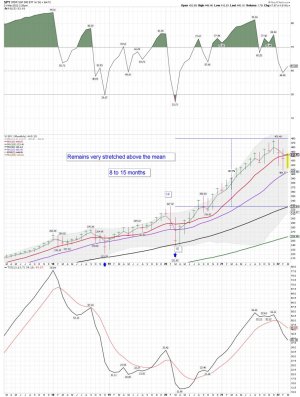

SPY monthly: Getting closer - To moving back above the 10 month moving average... For now it remains resistance and is still very stretched above the mean. We shall see how it plays out as the Fed pulls back from its balance sheet and increases rates..... Like many have pointed out.... The easy money has been made. The Bulls will want to see a close back above the 10 month ma. ( Last chart - a closer look) It's normal for the monthly to trend much closer to the 50 month ma. However, we haven't seen much we can call normal for a few years now.