robo

TSP Legend

- Reaction score

- 471

This Ultimate Market Barometer Signals a Rally

Jeff Clark | Mar 14, 2022 | Market Minute | 2 min read

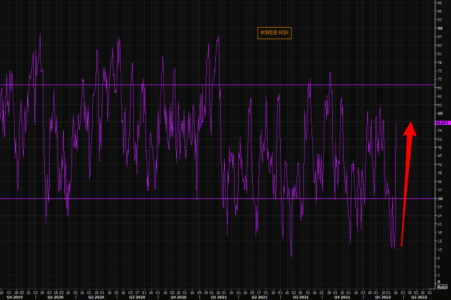

If you’re looking for signs of a stock market bottom, then pay attention to junk.

High-yield bonds (a.k.a. junk bonds) are the ultimate barometer of investors’ willingness to take on risk.

If the stock market is going to rally, then junk bonds will likely rally first. And, when the market is set to fall, weakness in high-yield bonds is often the “canary in the coal mine.”

We’ve written about this relationship between junk bonds and stocks many times here in Market Minute.

The action in high-yield bonds tends to lead the action in the broad stock market by anywhere from two days to two weeks.

That relationship should inspire some hope among the stock market bulls. It looks like high-yield bonds are setting up for a rally.

Take a look at this chart of the iShares iBoxx High Yield Corporate Bond Fund (HYG)…

https://www.jeffclarktrader.com/market-minute/this-ultimate-market-barometer-signals-a-rally/

Jeff Clark | Mar 14, 2022 | Market Minute | 2 min read

If you’re looking for signs of a stock market bottom, then pay attention to junk.

High-yield bonds (a.k.a. junk bonds) are the ultimate barometer of investors’ willingness to take on risk.

If the stock market is going to rally, then junk bonds will likely rally first. And, when the market is set to fall, weakness in high-yield bonds is often the “canary in the coal mine.”

We’ve written about this relationship between junk bonds and stocks many times here in Market Minute.

The action in high-yield bonds tends to lead the action in the broad stock market by anywhere from two days to two weeks.

That relationship should inspire some hope among the stock market bulls. It looks like high-yield bonds are setting up for a rally.

Take a look at this chart of the iShares iBoxx High Yield Corporate Bond Fund (HYG)…

https://www.jeffclarktrader.com/market-minute/this-ultimate-market-barometer-signals-a-rally/