-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

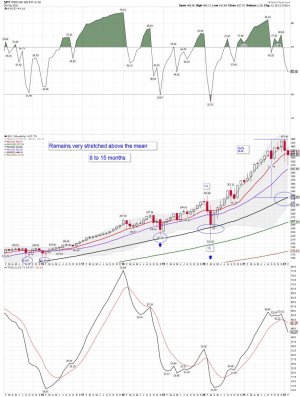

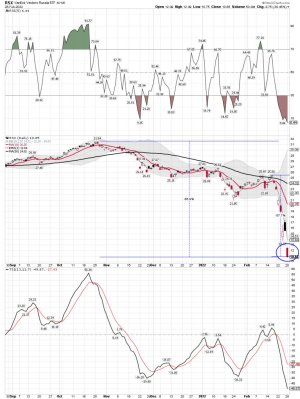

We shall see how this daily cycle low plays out. Getting back above the 10 dma might not be so easy right now. Watching!

Daily Cycle Low

Stocks formed a bullish reversal on Thursday.

Thursday was only day 22 for the daily equity cycle, placing stocks about 2 weeks shy of its normal timing band for a daily cycle low. However, stocks formed a convincing bullish reversal on Thursday that regained its breakdown level. If stocks form a swing low, that will signal an early DCL. A break above 4294.73 will form a daily swing low. Then a close above the 10 day MA will have us label day 22 as the DCL. Stocks will still need to break above both the 200 day MA and the 50 day MA before a trending move can develop.

https://likesmoneycycletrading.wordpress.com/2022/02/24/daily-cycle-low-5/

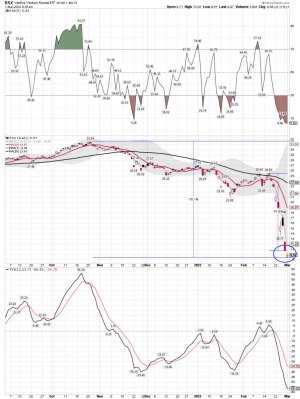

Daily Cycle Low

Stocks formed a bullish reversal on Thursday.

Thursday was only day 22 for the daily equity cycle, placing stocks about 2 weeks shy of its normal timing band for a daily cycle low. However, stocks formed a convincing bullish reversal on Thursday that regained its breakdown level. If stocks form a swing low, that will signal an early DCL. A break above 4294.73 will form a daily swing low. Then a close above the 10 day MA will have us label day 22 as the DCL. Stocks will still need to break above both the 200 day MA and the 50 day MA before a trending move can develop.

https://likesmoneycycletrading.wordpress.com/2022/02/24/daily-cycle-low-5/

Attachments

robo

TSP Legend

- Reaction score

- 471

robo

TSP Legend

- Reaction score

- 471

Attachments

robo

TSP Legend

- Reaction score

- 471

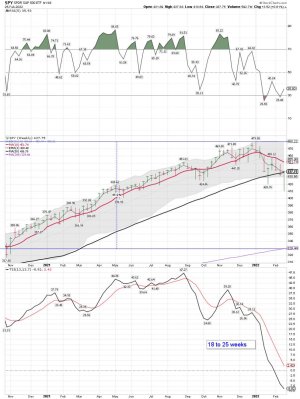

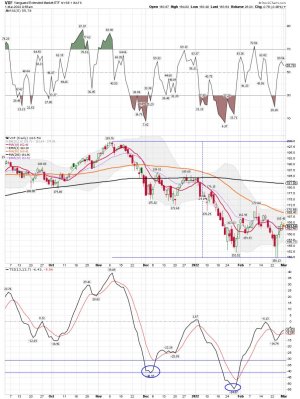

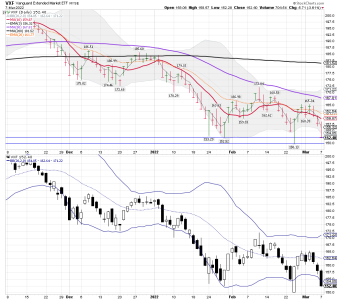

SPY weekly: A huge move up after moving way below the lower BB. A close back above the 50 week SMA was a huge win for the Bulls. Not much you can do in your TSP account in a market like this one with only two moves a month. For those that timed the move down and bought when there was blood in the streets - Nice Trade! I will continue to keep it small trading in the current market. Waiting to see if this turns out to be a nice trend trading move. We shall see if the SPY can move back above the 10 week SMA in the days ahead. Red line around 451ish.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

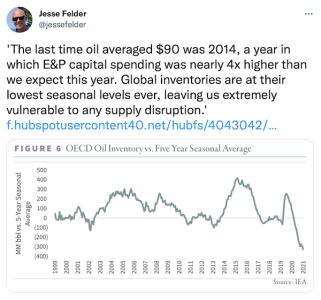

The Wall of Worry is getting higher.

https://twitter.com/jessefelder

Tweet

See new Tweets

Conversation

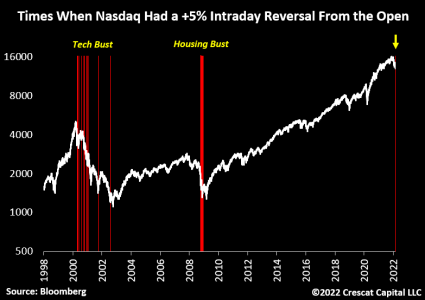

Otavio (Tavi) Costa

@TaviCosta

The last 21 times Nasdaq had an intraday reversal of +5% happened during brutal bear markets.

David Rosenberg

@EconguyRosie

19h

The S&P 500 has soared 150 pts from the nearby lows and yet Treasury yields haven't budged from where they were at Wednesday's close. Both asset classes can't be right. Or at least bondies are looking at the sharp equity rally as being part of an Elliott Wave bear market bounce.

Mohamed A. El-Erian Retweeted

Financial Times

@FinancialTimes

·

3h

Russia’s invasion of Ukraine has thrown policymakers, companies and markets into an inherently uncertain and unsettling world.

If you're an investor, here's what you should be watching out for, writes https://twitter.com/elerianm

https://twitter.com/jessefelder

Tweet

See new Tweets

Conversation

Otavio (Tavi) Costa

@TaviCosta

The last 21 times Nasdaq had an intraday reversal of +5% happened during brutal bear markets.

David Rosenberg

@EconguyRosie

19h

The S&P 500 has soared 150 pts from the nearby lows and yet Treasury yields haven't budged from where they were at Wednesday's close. Both asset classes can't be right. Or at least bondies are looking at the sharp equity rally as being part of an Elliott Wave bear market bounce.

Mohamed A. El-Erian Retweeted

Financial Times

@FinancialTimes

·

3h

Russia’s invasion of Ukraine has thrown policymakers, companies and markets into an inherently uncertain and unsettling world.

If you're an investor, here's what you should be watching out for, writes https://twitter.com/elerianm

Attachments

robo

TSP Legend

- Reaction score

- 471

"Still in a downtrend so the bears are still in control."

I agree the trend remains down.

Still, I'm a short-term trader so I placed a counter-trend trade using SSO after tagging the lower BB..... I will be keeping these trades small....

03/07/2022 17:53:58 Bought SSO @ 56.12

I agree the trend remains down.

Still, I'm a short-term trader so I placed a counter-trend trade using SSO after tagging the lower BB..... I will be keeping these trades small....

03/07/2022 17:53:58 Bought SSO @ 56.12

Attachments

robo

TSP Legend

- Reaction score

- 471

The damage has been done. Recession later this year

https://www.youtube.com/watch?v=oLGV12Ol7aA

https://www.youtube.com/watch?v=oLGV12Ol7aA

robo

TSP Legend

- Reaction score

- 471

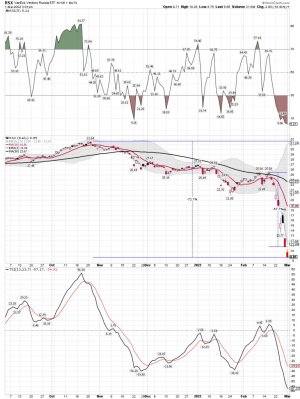

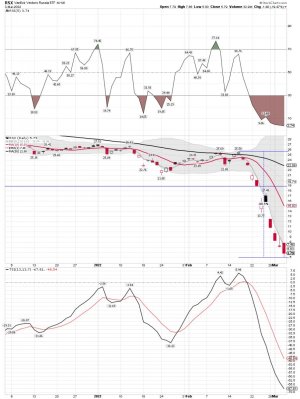

SPY/VXF daily: ( C and S funds) The trend remains down, so all newly placed long trades are counter-trend. Catching the falling knife is more about luck, but I do use odds based on my tools when making a grab at it.

As long as we grab the handle, it's all good...

robo

TSP Legend

- Reaction score

- 471

SPY daily: Selling 1/2 of my SSO position. I will continue to only ST trade and stay very nimble in a market like this one. What kind of turn will the War take next? The 10 day sma is up next and I have NO IDEA what will happen. I traded the lower BB tag and we shall see if it has legs.... Made a few bucks on this trade.

Filled Sell 150 SSO Market 58.25

Filled Sell 150 SSO Market 58.25