Top Dollar For Top Dollar

John P. Hussman, Ph.D.

President, Hussman Investment Trust

February 2022

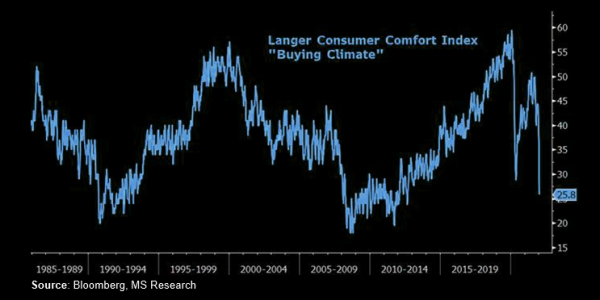

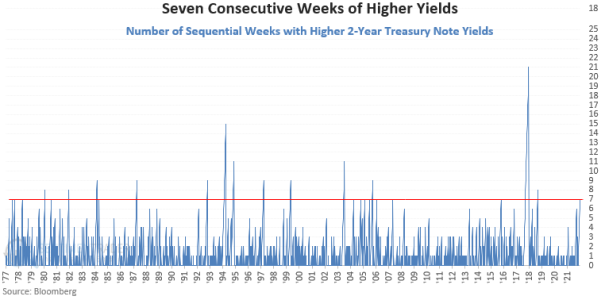

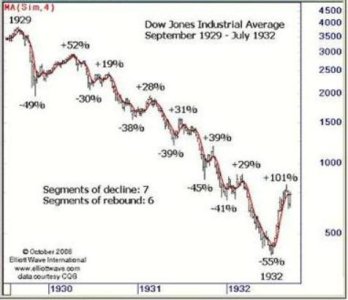

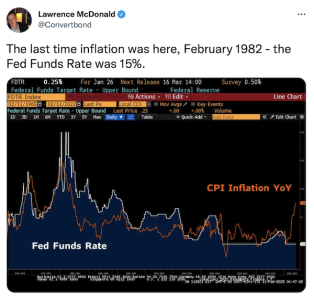

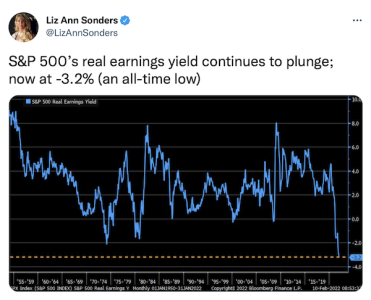

Why is it so hard to accept that speculative bubbles can burst? Interest rates were driven to zero for a decade. Yield-starved investors chased stocks to valuations beyond the 1929 and 2000 extremes. That speculation front-loaded more than a decade of future market gains into the present. Those gains are now behind us, embedded in breathtaking multiples. If history is any guide, a collapse in valuations is likely to return those gains to the future.

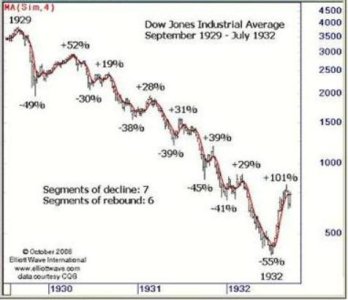

The process of losing speculative gains and recovering them over time is what I’ve often called a “long, interesting trip to nowhere.” It bears repeating that the S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period. When the investment horizon begins at extreme valuations, and doesn’t end at the same extremes, the retreat in valuations acts as a headwind that consumes the return that would otherwise be provided by dividends and growth in fundamentals.

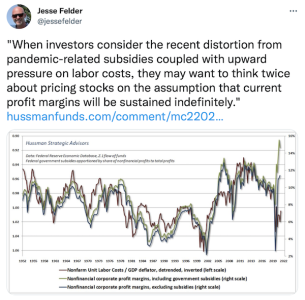

There is no birthright to ever-rising valuations, particularly given that market internals, fiscal subsidies, and the Federal Reserve’s latitude for recklessness have all turned against this speculative bubble. The record stock prices that investors observe here are the product of a) record valuation multiples that have been inflated by a decade of zero interest rate policy and resulting speculation by yield-starved investors, times; b) record earnings that embed distorted profit margins inflated by trillions of dollars of temporary deficit spending.

Investors are paying top dollar for top dollar.

https://www.hussmanfunds.com/comment/mc220210/