robo

TSP Legend

- Reaction score

- 471

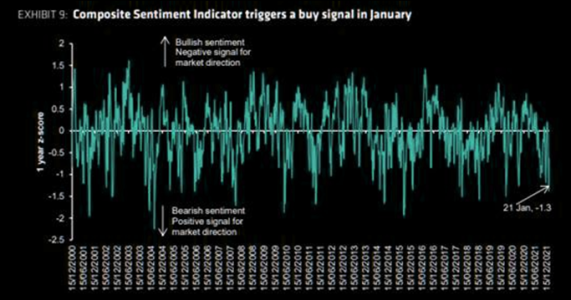

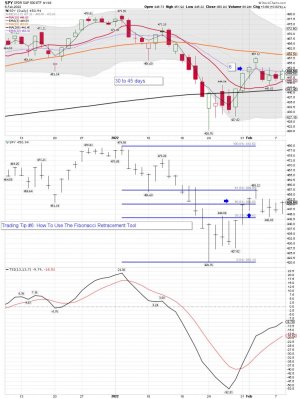

That Bernstein Buy signal...

"Investor sentiment dropped sharply in January with our short-term composite sentiment indicator hitting lows of -1.38 in the third week of January, the most bearish short-term sentiment reading since the worst of the pandemic volatility and a buy signal over the following 4-6 weeks. Our longer term, Cross border flow indicator has eased to a neutral level having flagged moderately bullish sentiment in the middle of last year. In the past, global equity returns have been around long-term average levels over the following 12 months when the indicator has been

https://themarketear.com/

"Investor sentiment dropped sharply in January with our short-term composite sentiment indicator hitting lows of -1.38 in the third week of January, the most bearish short-term sentiment reading since the worst of the pandemic volatility and a buy signal over the following 4-6 weeks. Our longer term, Cross border flow indicator has eased to a neutral level having flagged moderately bullish sentiment in the middle of last year. In the past, global equity returns have been around long-term average levels over the following 12 months when the indicator has been

https://themarketear.com/