robo

TSP Legend

- Reaction score

- 471

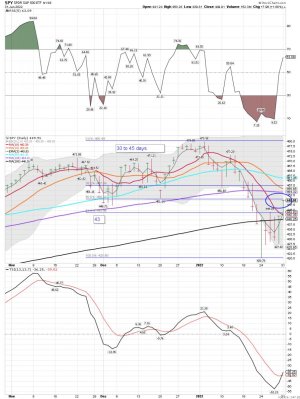

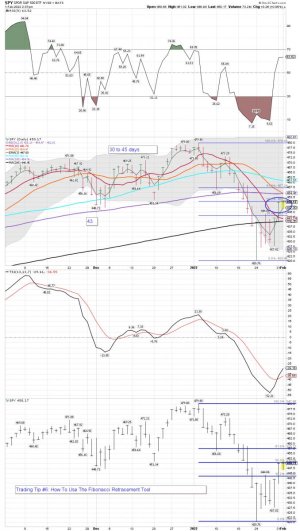

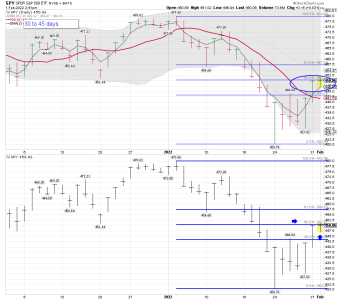

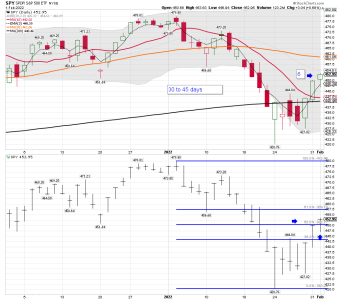

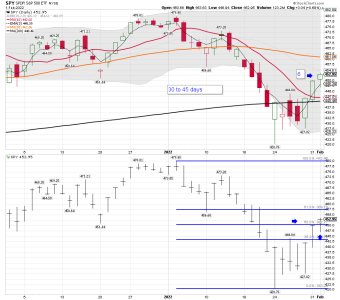

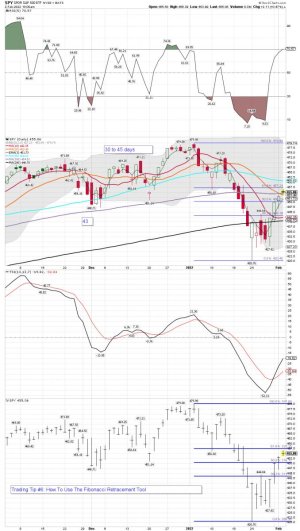

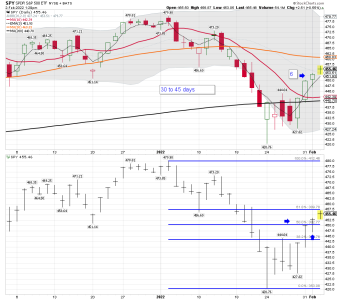

SPY daily: Well, we hit a 50% retracement on this bounce off the lows. Will it bring in more shorts or buyers or maybe just some sideways action. It depends on who you ask!

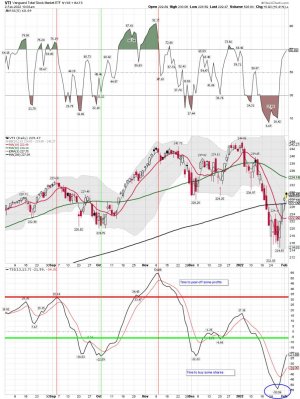

Bottom Line: The new daily cycle puts me back on a buy signal, but will it fail? We shall see how today plays out.

Long GDXJ, EQX and VXF

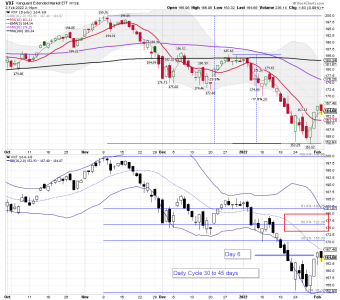

Bottom Line: The new daily cycle puts me back on a buy signal, but will it fail? We shall see how today plays out.

Long GDXJ, EQX and VXF