robo

TSP Legend

- Reaction score

- 471

Fed Caves On Tightenings

Jan. 29, 2022 1:43 AM

Summary

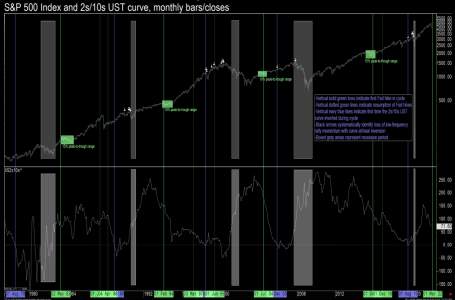

The Fed caved on its last quantitative-tightening attempt, abandoning it years early. Once that tightening forced stock markets to the verge of a new bear, the FOMC lost all courage.

The Fed reversed course abruptly to aggressive new easings. Fed officials talk a big game when stock markets are high, hawkishly jawboning away. But their threatened actions never live up.

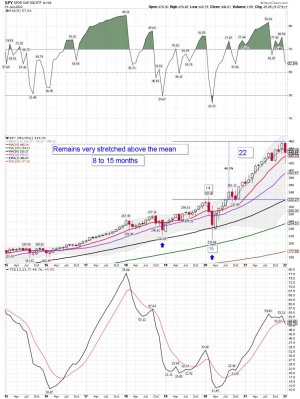

With the SPX near records recently, Fed officials are proclaiming an imminent rate-hike cycle and new QT. While those tightenings will start, they will only last while stock markets cooperate.

With the SPX near record highs in recent months, Fed officials are boldly proclaiming an imminent rate-hike cycle and new QT. While the FOMC will start those tightenings, they will only last while stock markets cooperate. That likely won’t be long with valuations forced deep into dangerous bubble territory by the Fed’s epic QE4 money printing. These coming tightenings will be quickly abandoned when stocks plunge.

https://seekingalpha.com/article/44...m_source=seeking_alpha&utm_term=26528882.2325

Jan. 29, 2022 1:43 AM

Summary

The Fed caved on its last quantitative-tightening attempt, abandoning it years early. Once that tightening forced stock markets to the verge of a new bear, the FOMC lost all courage.

The Fed reversed course abruptly to aggressive new easings. Fed officials talk a big game when stock markets are high, hawkishly jawboning away. But their threatened actions never live up.

With the SPX near records recently, Fed officials are proclaiming an imminent rate-hike cycle and new QT. While those tightenings will start, they will only last while stock markets cooperate.

With the SPX near record highs in recent months, Fed officials are boldly proclaiming an imminent rate-hike cycle and new QT. While the FOMC will start those tightenings, they will only last while stock markets cooperate. That likely won’t be long with valuations forced deep into dangerous bubble territory by the Fed’s epic QE4 money printing. These coming tightenings will be quickly abandoned when stocks plunge.

https://seekingalpha.com/article/44...m_source=seeking_alpha&utm_term=26528882.2325