robo

TSP Legend

- Reaction score

- 471

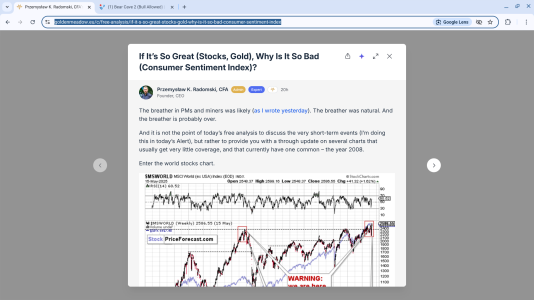

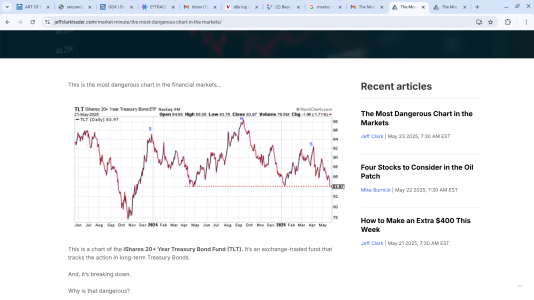

This will cause some problems for those living pay-check to pay-check...

Personal Finance

Personal Finance

Trump administration to garnish wages of 5.3 million defaulted student loan borrowers this summer

Key Points- The Trump administration is set to garnish the wages of the 5.3 million federal student loan borrowers in default in just a few months.

- Meanwhile, it began this week alerting around 195,000 defaulted borrowers that their federal benefits will be subject to garnishment in 30 days.