robo

TSP Legend

- Reaction score

- 471

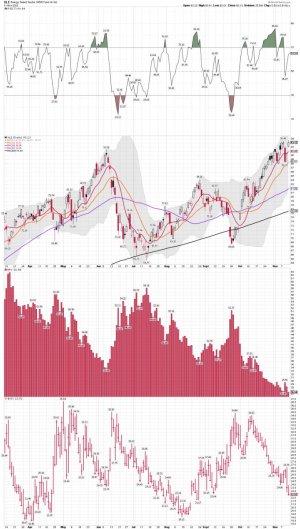

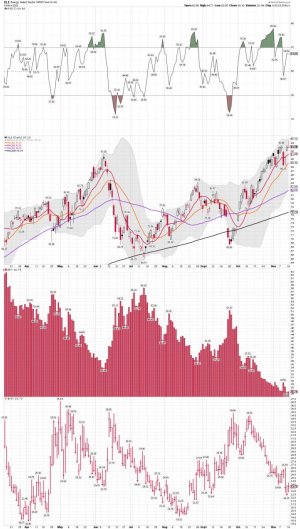

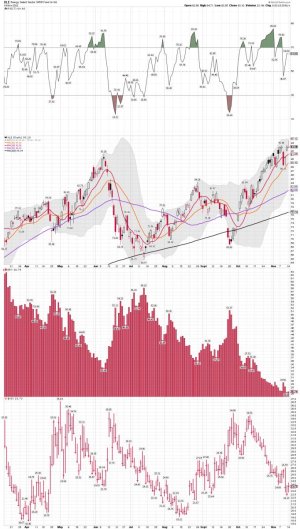

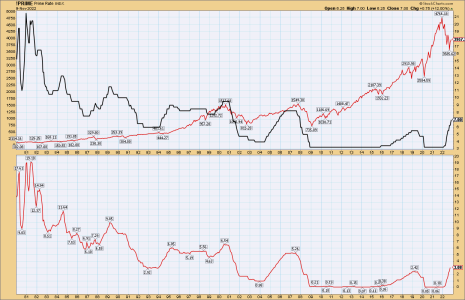

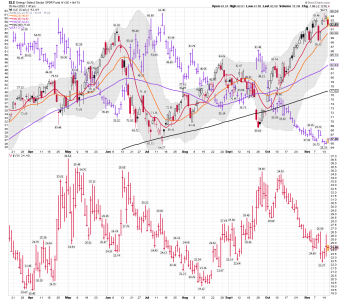

GOLD/SLV daily: The DCL looks to be in, but now gold is a tad stretched above the 10 dma. I'm expecting a pullback, but that's just a guess...

We shall see how it plays out, and what the dollar does next with the data coming out tomorrow. The move above the 50dma this early in the daily cycle is Bullish!

We shall see how it plays out, and what the dollar does next with the data coming out tomorrow. The move above the 50dma this early in the daily cycle is Bullish!

Attachments

Last edited: