robo

TSP Legend

- Reaction score

- 471

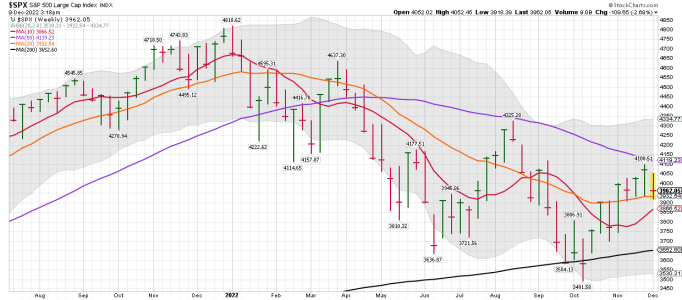

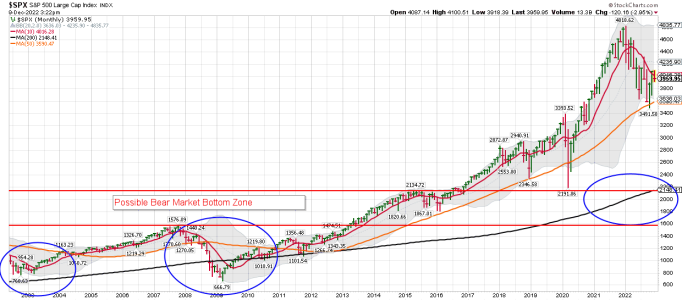

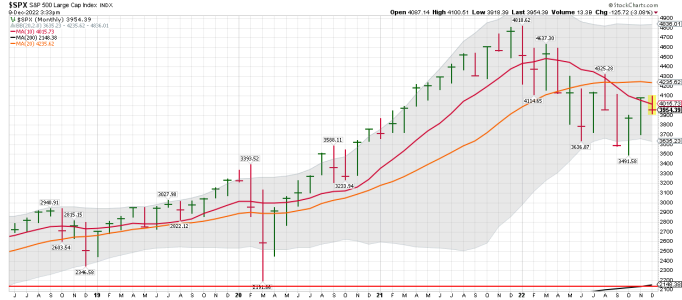

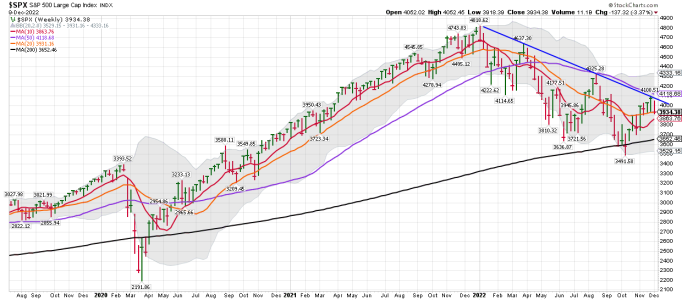

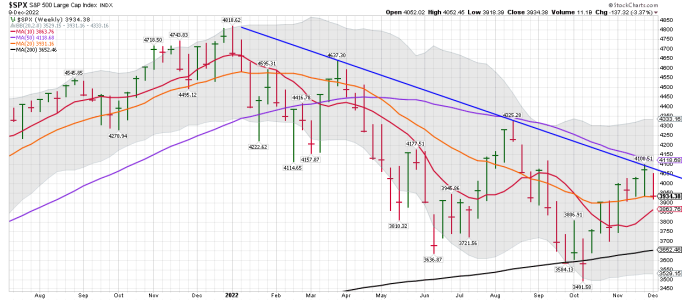

SPX daily: The SPX has now moved back below the 10 and 20 day MA's.... We shall see how this pattern plays out. The 50 day MA be up next.... The 200 day MA remains resistance as one would think if you are trading using Bear Market rules....

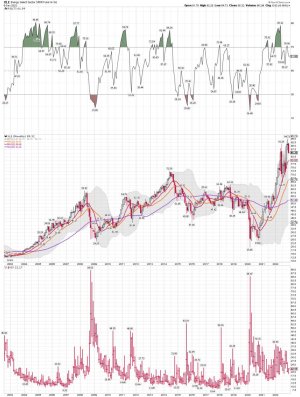

I remain flat SPX/SPY and I'm shorting XLE and long VXX.... ( For a ST trade only)

(Beer Money Trades)

12/02/2022 15:57:53 Bought 300 VXX @ 14.375

12/06/2022 12:46:02 Sold 300 VXX @ 15.055

Selling my VXX and XLE short position as I wait for the next move..... Crazy market right now....

I remain flat SPX/SPY and I'm shorting XLE and long VXX.... ( For a ST trade only)

(Beer Money Trades)

12/02/2022 15:57:53 Bought 300 VXX @ 14.375

12/06/2022 12:46:02 Sold 300 VXX @ 15.055

Selling my VXX and XLE short position as I wait for the next move..... Crazy market right now....

Attachments

Last edited: