robo

TSP Legend

- Reaction score

- 471

Miner Volatility

Posted on January 15, 2022

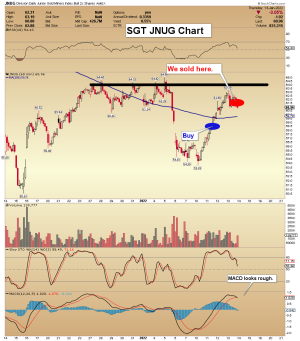

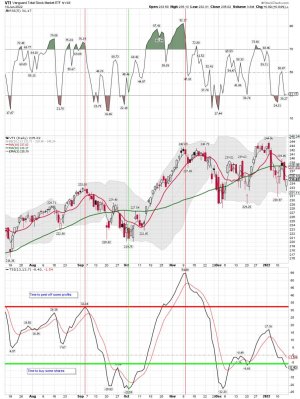

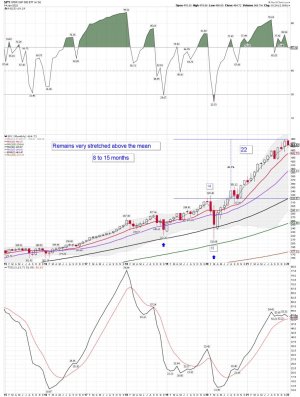

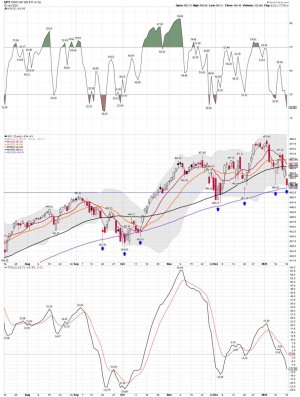

The status of the daily Miners cycle is not clear. Closing above the 50 day MA and the upper daily cycle band on Wednesday indicates the day 16 hosted an early DCL. But then the Miners lost the 50 day MA on Thursday and formed a swing high on Friday.

A close below the 10 day MA will signal a continuation of the daily cycle decline. However, the Miners formed a bullish reversal off the 10 day MA on Friday. The Miners are currently in daily uptrend. If they form a swing low and close back above the 50 day MA then they will remain in their daily uptrend and trigger a cycle band buy signal. If this occurs then we will label day 16 as an early DCL.

https://likesmoneycycletrading.wordpress.com/author/likesmoneystudies/

Morris took profits. Me too, buy I'm buying back my position. We shall see how this next DCL plays out. We closed above the 10 sma on Friday, but will we see a smack down next week.

Posted on January 15, 2022

The status of the daily Miners cycle is not clear. Closing above the 50 day MA and the upper daily cycle band on Wednesday indicates the day 16 hosted an early DCL. But then the Miners lost the 50 day MA on Thursday and formed a swing high on Friday.

A close below the 10 day MA will signal a continuation of the daily cycle decline. However, the Miners formed a bullish reversal off the 10 day MA on Friday. The Miners are currently in daily uptrend. If they form a swing low and close back above the 50 day MA then they will remain in their daily uptrend and trigger a cycle band buy signal. If this occurs then we will label day 16 as an early DCL.

https://likesmoneycycletrading.wordpress.com/author/likesmoneystudies/

Morris took profits. Me too, buy I'm buying back my position. We shall see how this next DCL plays out. We closed above the 10 sma on Friday, but will we see a smack down next week.

Attachments

Last edited: