robo

TSP Legend

- Reaction score

- 471

SevenSentinels

@SevenSentinels

·

15m

2:15

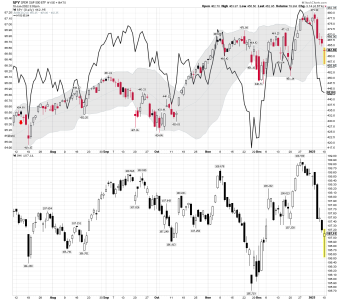

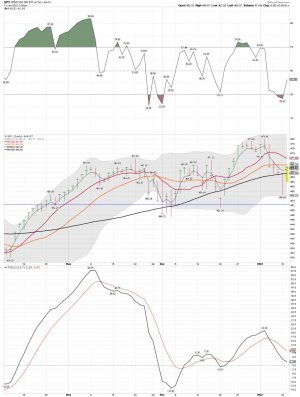

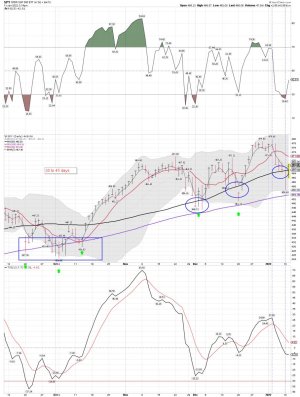

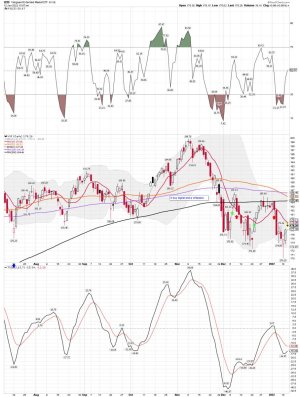

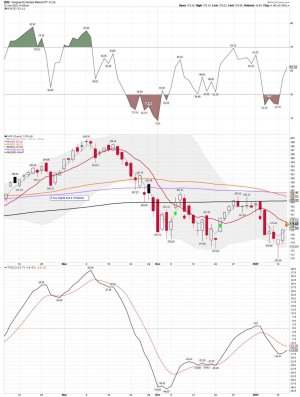

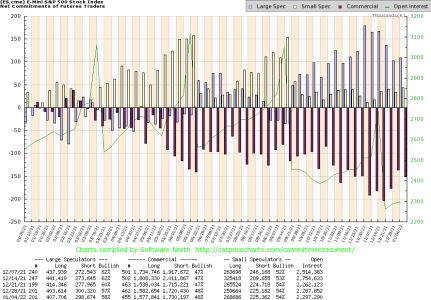

One chart below is Feb 28, 2020 (during the crash)

The other is today

Can You Tell Which Is Which?

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

thomas

@VolumeDynamics

So if you don't think the economy is crashing... can you explain to me this flight load from NY to LA today, Monday, busiest day of the week. Click on seat map

https://united.com/en/us/flightstatus/details/752/2022-01-10/EWR/LAX/UA

10:41 AM · Jan 10, 2022·Twitter Web App

https://twitter.com/VolumeDynamics/status/1480595651851272192

David Rosenberg

@EconguyRosie

·

Jan 7

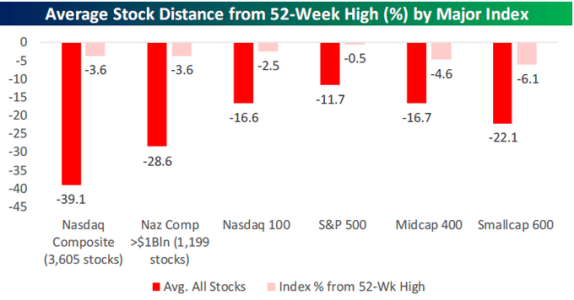

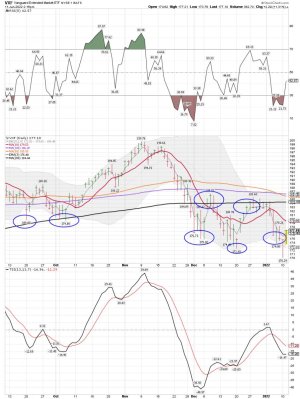

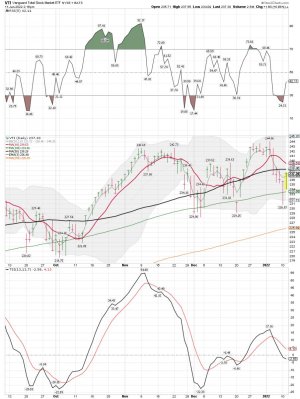

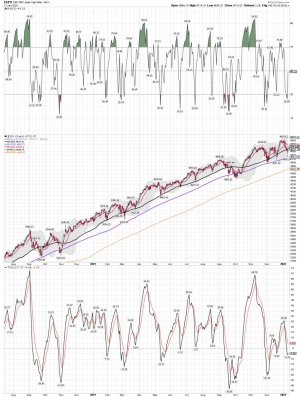

Strip out oil (thank you, Libya!) and banks (thank you, Fed!), and the S&P 500 is down 2.5% for the year -- and no higher now than at the beginning of November. A two-sector story.

https://twitter.com/EconguyRosie?lang=en

@SevenSentinels

·

15m

2:15

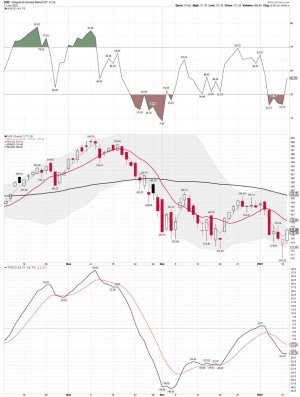

One chart below is Feb 28, 2020 (during the crash)

The other is today

Can You Tell Which Is Which?

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

thomas

@VolumeDynamics

So if you don't think the economy is crashing... can you explain to me this flight load from NY to LA today, Monday, busiest day of the week. Click on seat map

https://united.com/en/us/flightstatus/details/752/2022-01-10/EWR/LAX/UA

10:41 AM · Jan 10, 2022·Twitter Web App

https://twitter.com/VolumeDynamics/status/1480595651851272192

David Rosenberg

@EconguyRosie

·

Jan 7

Strip out oil (thank you, Libya!) and banks (thank you, Fed!), and the S&P 500 is down 2.5% for the year -- and no higher now than at the beginning of November. A two-sector story.

https://twitter.com/EconguyRosie?lang=en