robo

TSP Legend

- Reaction score

- 471

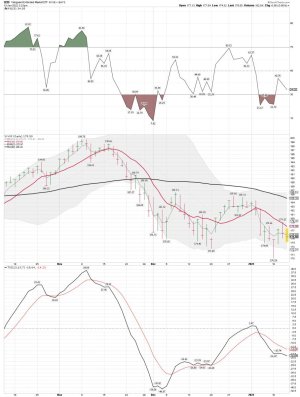

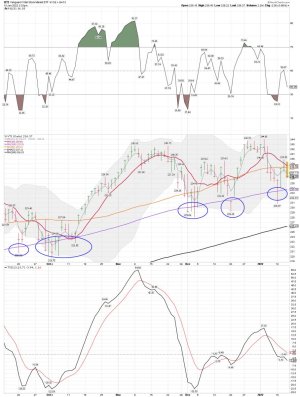

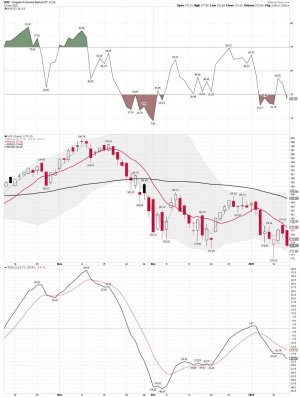

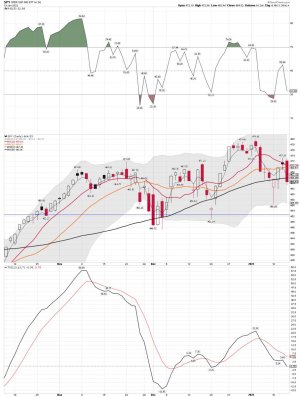

Breaking down or getting ready to bounce? We shall see if UUP bounces off the 100 sma on the daily soon or something bigger is in play. Is the flight to safety run now over? The dollar is getting a tad oversold in the ST, and we now have a lower BB crash in play. If the dollar bounces it will put pressure on the metals.

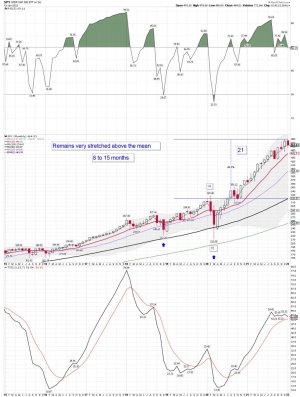

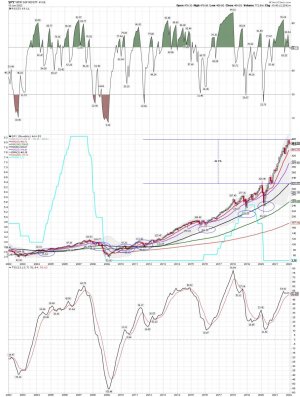

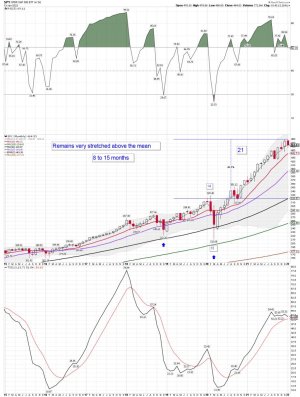

King dollar breaking down

The DXY is breaking below the huge trend channel that has been in place since May last year. Note it has not traded this much below the 50 day in a very long time. The relative long EEM, FXI, copper etc trades are all extending gains. For a deeper read on the USD dynamics see here.

https://themarketear.com/

King dollar breaking down

The DXY is breaking below the huge trend channel that has been in place since May last year. Note it has not traded this much below the 50 day in a very long time. The relative long EEM, FXI, copper etc trades are all extending gains. For a deeper read on the USD dynamics see here.

https://themarketear.com/

Attachments

Last edited: