robo

TSP Legend

- Reaction score

- 471

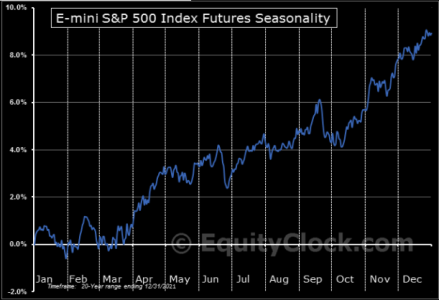

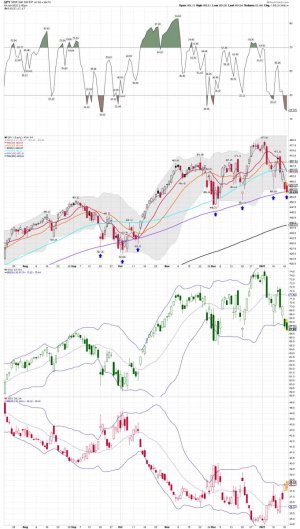

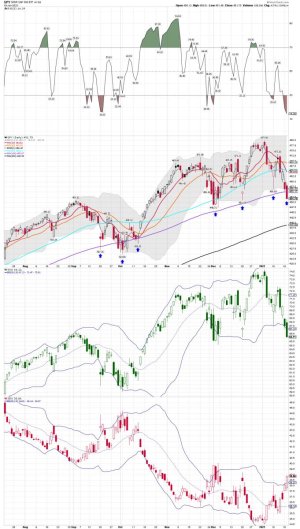

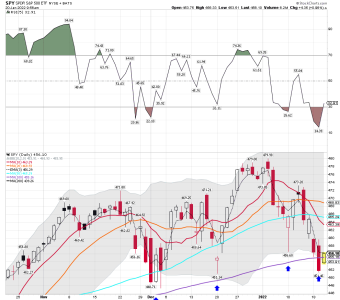

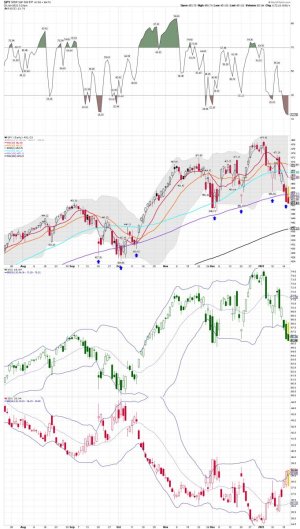

Remember seasonality?

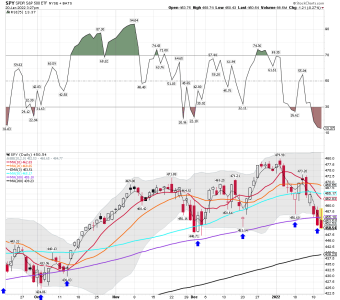

It wasn't long ago everybody was busy front running the January effect. Sentiment has definitely changed and January isn't actually as good as people think, especially not the second part of it. Let's see how this plays out, but the bullish seasonality should kick in later, or is this time different?

https://themarketear.com/

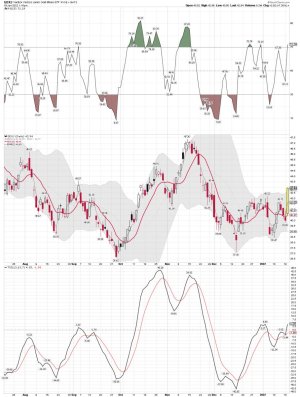

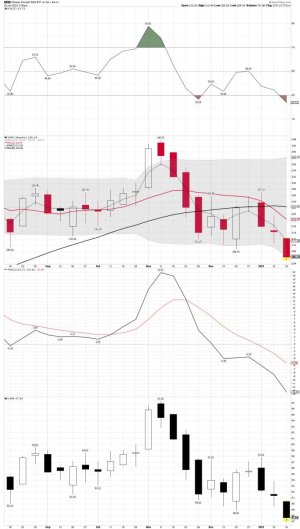

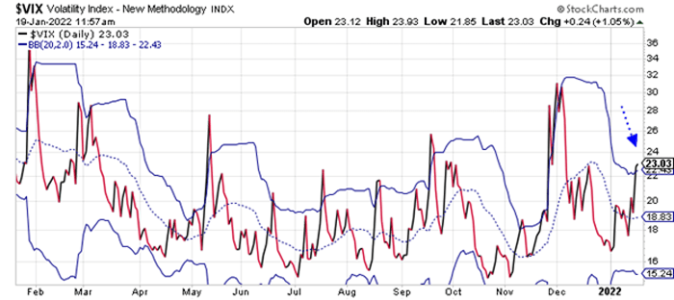

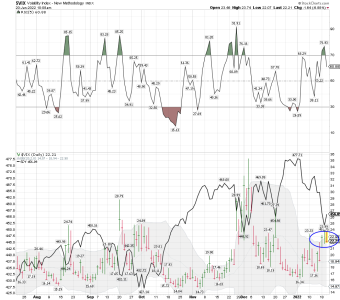

What about VIX seasonality?

VIX seasonality looks "strong"...but don't forget volatility is mean reverting.

It wasn't long ago everybody was busy front running the January effect. Sentiment has definitely changed and January isn't actually as good as people think, especially not the second part of it. Let's see how this plays out, but the bullish seasonality should kick in later, or is this time different?

https://themarketear.com/

What about VIX seasonality?

VIX seasonality looks "strong"...but don't forget volatility is mean reverting.