So, if one rolled over nearly all of his TSP into a Vanguard account, then one could make free trades, right? But, is there a dollar limit on how big a trade can be? In the TSP, I very often move my entire balance with an IFT. Also, if someone wants to make numerous trades in a day without worrying about settled funds, then you'd need a day-trading account, no? If this January has shown me anything, it's that I'm much too limited very often.

Tom has that correct Brother. However, as a trader I would NEVER move all of my funds at once on a single trade. I have a Roth broker account at Vanguard.

Example You have 100k in your account:

This is how your balance would look.

Funds available to trade 100k:

Funds available to withdraw 100k: These funds have cleared.

You move 100k to VXF on 1-20-22 and sell the same day. You now have funds that you must wait two days to clear. However, you can still buy one more time.

You can buy VXF back again on the 23rd, but if you sell before the funds clear on the 24th from the first trade it's a free ride and you get your first warning.

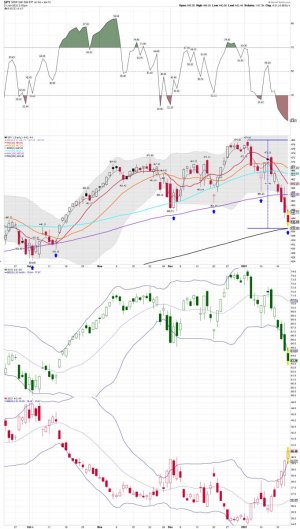

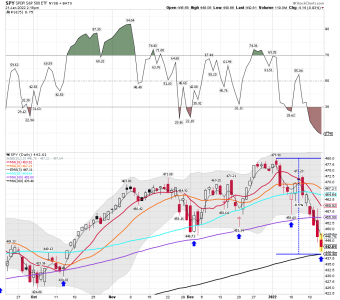

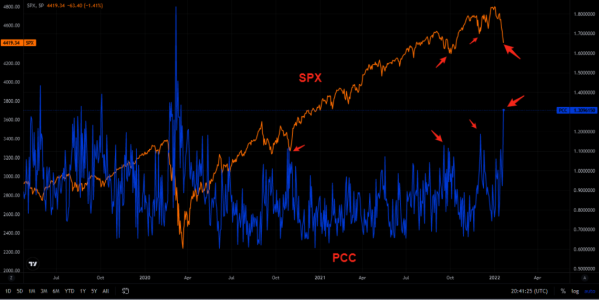

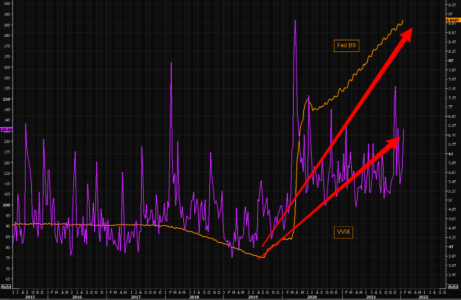

So, you can BUY, SELL and BUY again all in the same day if you "STARTED" the day and all your funds were settled funds, but now you must wait 2 days for the first trade to settle before selling again or you get a warning. There is a move to change it to one day, and it might pass soon. Brother moving 100% of you money on a single move is a good thing in a Bull Market, but during a deeper correction or a Bear Market those types of moves can be an account killer. There are folks right now here on the tracker that are down around (-10%). Sure they will get their money back if we are still in a Bull market and the market bounces back. But what if it doesn't or folks sell just before a huge bounce.

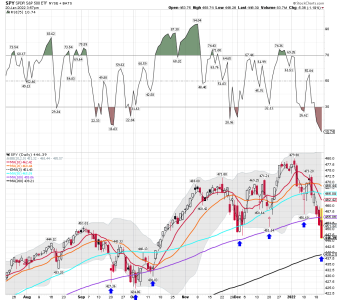

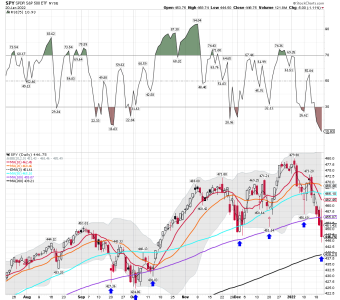

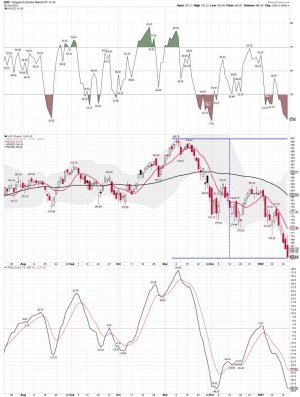

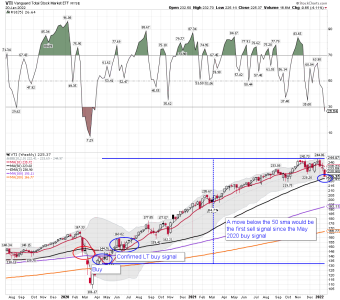

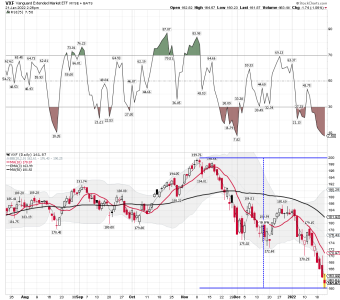

VXF is now down close to (-19%) since its high in November. I posted what happened to me the first few years I went to Vanguard on an another post. The result was I lost a shitload of money from over trading, but learned fairly quick about over trading and risk management.

I have a Roth Brokerage account at Vanguard. So I don't have to worry about RMD's or paying taxes on money I withdraw. I use TSP mainly for the G Fund.

Bottom line: Unlimited moves are very good thing in a Bull Market, but one has to be careful over trading in a market like this one.

Call Vanguard Brother and they will answer all your questions. You will need a broker type account to trade anytime during the trading day.

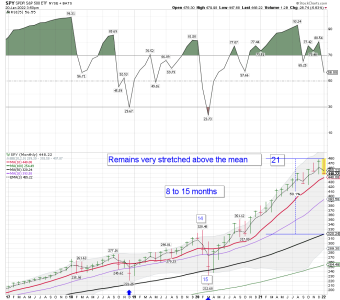

So look at the chart below of VXF and tell me when you would have made these 100% moves Brother.

I like Vanguard and unlimited moves, but I have a trading system and indicators I use for buy and sell signals. I also use Risk Management..... I told you when I first got unlimited moves I went from the frying pan right into the fire. Sometimes having only two moves will save you money.

Maybe you could move say 10k to Vanguard and see how it works out. That is what I did when I started out, and lost money with unlimited moves. My point is what type of system will you use at Vanguard to make these trades. If you have one that is working well then you should do ok Brother.

Take Care and call Vanguard.

I also have two account at TD Ameritrade for trading. One is a Roth IRA and the other is just a normal account. Lots of headaches with that account when it comes tax time.