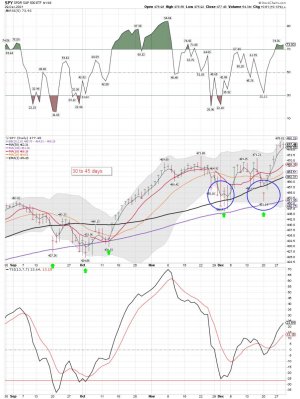

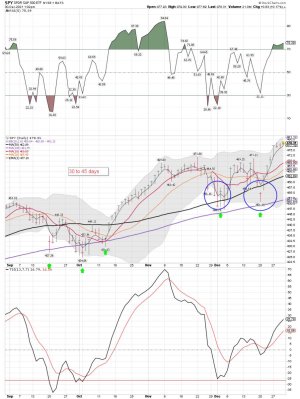

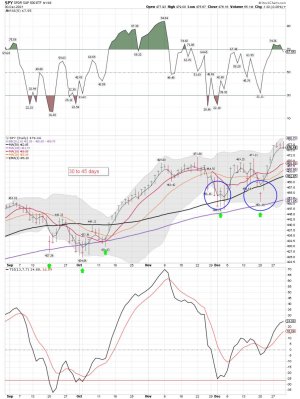

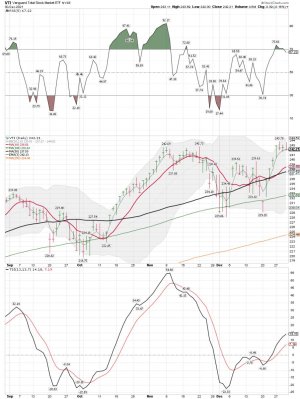

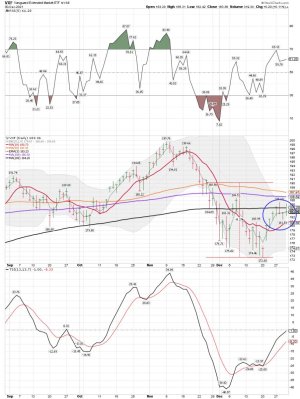

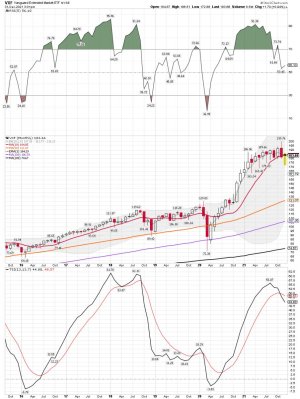

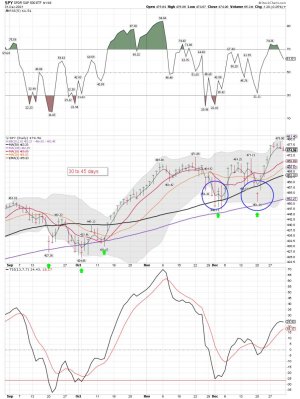

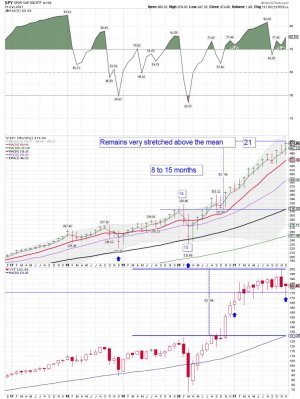

At some point we WILL move into a yearly cycle low. How far it will move below the 10 month sma is STBD, but we remain very stretched above the mean. I use the 50 sma on the month chart for the mean. As you can see this will snap back some at some point, and we are deep into the current cycle.

I will post a few monthly charts below to look over and note how deep we are into this cycle, and how stretched we are above the mean's for these indexes.

I still think the easy money has been made, and in my opinion one "SHOULD NOT be making all in moves one taking early positions in 2022.... Time to see how things place out this deep into a yearly cycle and this stretched above the mean.

A comment from Kaplan:

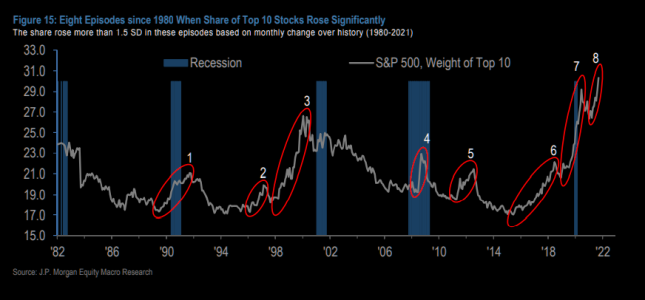

The primary significance of recent all-time highs for large-cap U.S. indices is its message about when the U.S. equity bear market is most likely to end with a crushing bottoming pattern and frequent downward spikes.

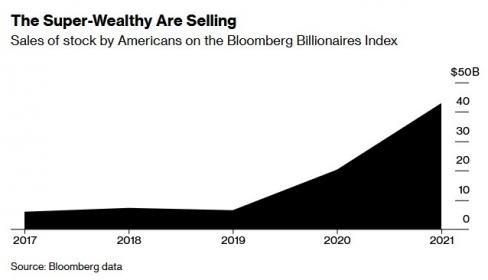

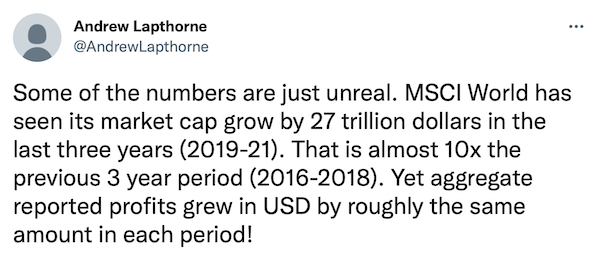

Nearly all bear markets end with repeated downward spikes as panic waves sweep among Bogleheads and others who classically sell near the exact nadirs of bottoming patterns. With all-time highs near the end of December and/or perhaps in early January 2022, the end of the bear market will likely occur near the end of 2023 for some assets and in 2024 for many others. Securities which typically bottom early in the cycle, such as gold mining and silver mining shares and many emerging-market securities, have probably already completed their lowest points of the decade. These undervalued assets will keep experiencing corrections, some of them sharp, but they will likely make mostly higher lows for the next decade or so rather than the lower highs which large-cap U.S. shares will mostly do until around 2024. The biggest percentage losses going forward will tend to be concentrated in those assets which have the highest multiples to their respective fair-value levels. This includes the most-hyped and most-loved stocks, high-yield corporate bonds, real estate, and especially cryptocurrencies. I would be surprised if any cryptocurrencies can avoid dropping less than 95% from top to bottom.

https://truecontrarian-sjk.blogspot.com/