robo

TSP Legend

- Reaction score

- 471

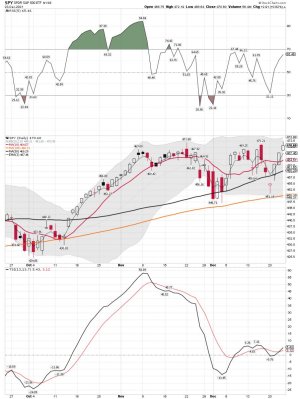

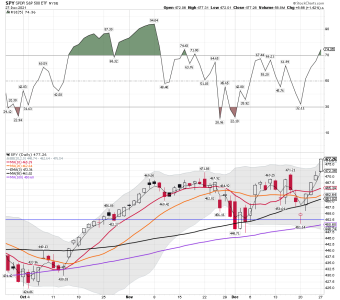

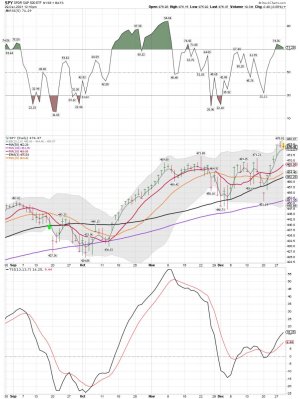

SPY daily: A nice bounce after moving down very close to tagging the 100 sma on the daily chart. Another new ATH be coming next week? I use the daily closing price for my signals and the SPY remains long. However, I currently have NO position in the SPY index. The futures look like many are placing bets for the next trading day after xmas which is usually up. We will see how it plays out, but last week was a nice start. The buy signal, if you use the monthly chart ( a move above the 10 month sma) was 20 months ago and a very nice run indeed.....

The 12/24/21 Weekend Report Preview

Stocks rallied to close above the 4715 resistance level on Thursday.

Closing above the 4715 resistance level was our signal to add to positions. Stops can now be raised to the rising 10 day MA. RSI 05 formed a quick bullish reversal on Monday. We are now watching to see if RSI 05 will embed in overbought to indicate a continuation of the intermediate cycle advance. A quick bearish reversal will be a signal that stocks are shifting into the declining phase of their intermediate cycle.

https://likesmoneycycletrading.wordpress.com/2021/12/24/the-12-24-21-weekend-report-preview/

The 12/24/21 Weekend Report Preview

Stocks rallied to close above the 4715 resistance level on Thursday.

Closing above the 4715 resistance level was our signal to add to positions. Stops can now be raised to the rising 10 day MA. RSI 05 formed a quick bullish reversal on Monday. We are now watching to see if RSI 05 will embed in overbought to indicate a continuation of the intermediate cycle advance. A quick bearish reversal will be a signal that stocks are shifting into the declining phase of their intermediate cycle.

https://likesmoneycycletrading.wordpress.com/2021/12/24/the-12-24-21-weekend-report-preview/

Attachments

Last edited: