-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

Fund Flows.....

https://www.etf.com/etfanalytics/etf-fund-flows-tool

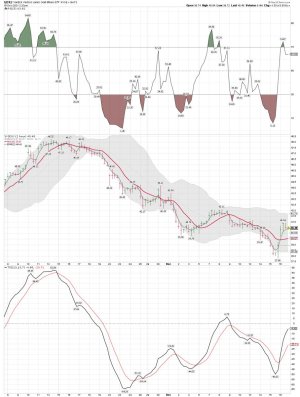

The miners look to be having trouble getting above the 10 sma...... Maybe a gap and crap..... We shall see how we close.

Well, My morning trading be over......

https://www.etf.com/etfanalytics/etf-fund-flows-tool

The miners look to be having trouble getting above the 10 sma...... Maybe a gap and crap..... We shall see how we close.

Well, My morning trading be over......

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Miners holding up well. So I’m talking profits from my Jnug, and Nugt trade and buying more GDXJ, and SILJ. If we close above the 10 sma on the daily chart we could see more buyers come in. For how long and how much is STBD. I will be using the 3 dma and 10 sma on the daily charts. We shall see if this is the start of a new multi-day trend. I will be waiting to see what the cycle dudes and the Gold Bulls have to say about this move up the next few days. I will just trade what I see, and not what they say. We could be seeing the start of a trend change.

robo

TSP Legend

- Reaction score

- 471

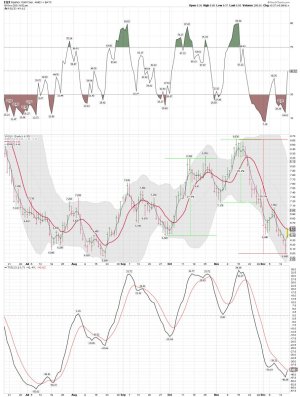

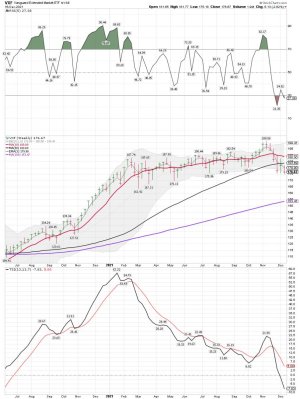

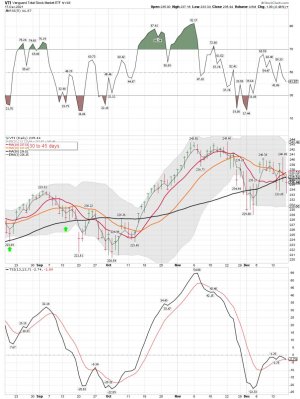

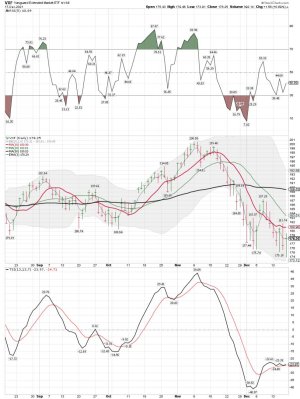

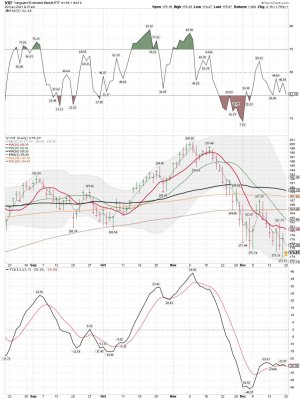

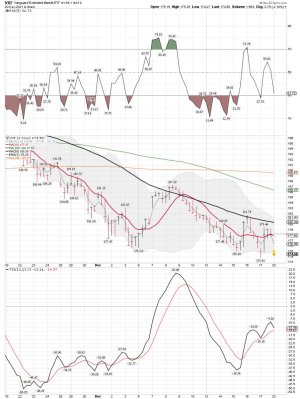

VXF weekly: Remains in a downtrend below the 10, 20 and 50 week sma...... Not what you want to see......

VXF daily: Remains ugly......

Bottom Line: I remain flat VXF and wait for the next buy signal. As you can see the last move above the 3 ema and the 10 sma was a nasty whipsaw, and using TSP funds makes it hard to stay ahead of a market like this one.

VXF daily: Remains ugly......

Bottom Line: I remain flat VXF and wait for the next buy signal. As you can see the last move above the 3 ema and the 10 sma was a nasty whipsaw, and using TSP funds makes it hard to stay ahead of a market like this one.

Attachments

robo

TSP Legend

- Reaction score

- 471

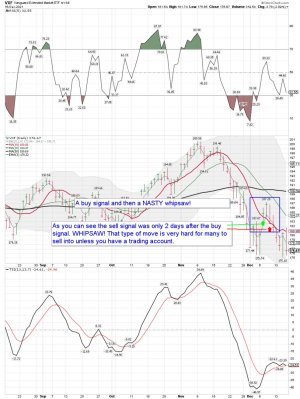

VXF daily after the close: Comments about the whipsaw on my daily chart. As a general rule I NEVER place a trade using over 10% of my account balance on a single trade, and MOST of the time it is much smaller. I marked the buy and sell points for VXF if one was trying to trade it.

For the record: I'm using the 3 ema and the 10 sma for trading just because. Others us different ema's and sma's, but that is what I use. Back test other values and see how it works for you. Some investors like to use the 20 and 50 sma's. However, I'm not an investor..... I'm a trader.....

For the record: I'm using the 3 ema and the 10 sma for trading just because. Others us different ema's and sma's, but that is what I use. Back test other values and see how it works for you. Some investors like to use the 20 and 50 sma's. However, I'm not an investor..... I'm a trader.....

Attachments

robo

TSP Legend

- Reaction score

- 471

Cycle data for the miners: It looks good so far....BUT!

The Miners formed a swing low on Thursday.

The Miners broke below the day 46 low on Tuesday then delivered bearish follow through on Wednesday. Wednesday was day 54, placing them very deep in their timing band for a DCL. The Miners formed a bullish reversal on Wednesday which eased the parameters for forming a swing low. The Miners then formed a swing low on Thursday that closed above the declining trend line and turned the 10 day MA higher so we will label day 54 as the DCL. The Miners are currently in a daily downtrend. But a close above the upper daily cycle band will end the daily downtrend and begin a new daily uptrend.

https://likesmoneycycletrading.wordpress.com/author/likesmoneystudies/

The Miners formed a swing low on Thursday.

The Miners broke below the day 46 low on Tuesday then delivered bearish follow through on Wednesday. Wednesday was day 54, placing them very deep in their timing band for a DCL. The Miners formed a bullish reversal on Wednesday which eased the parameters for forming a swing low. The Miners then formed a swing low on Thursday that closed above the declining trend line and turned the 10 day MA higher so we will label day 54 as the DCL. The Miners are currently in a daily downtrend. But a close above the upper daily cycle band will end the daily downtrend and begin a new daily uptrend.

https://likesmoneycycletrading.wordpress.com/author/likesmoneystudies/

Attachments

robo

TSP Legend

- Reaction score

- 471

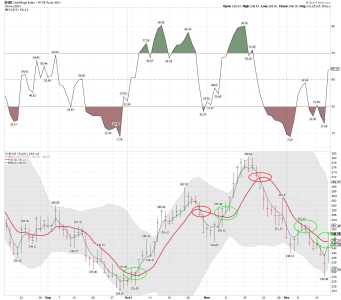

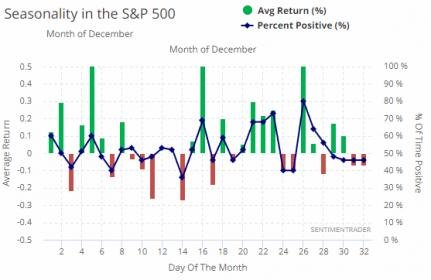

Where is the Santa Rally for Small and Mid caps? Watching VXF......

VXF daily: Remains in a downtrend! Lots of investors bought into the best six months......

SPX - much ado about nothing?

SPX is down some 30 handles from the all time highs close and VIX is around 21, which is elevated and stressed given where we are trading. Tomorrow's expiration is the main event and 4700 remains the pin strike to watch. Resistance is all time high close, support levels are: 4640 and 4600 (lower part of the channel). Let's see what expiration brings...

https://themarketear.com/

Click on the YTD icon.....

https://www.etf.com/etfanalytics/etf-fund-flows-tool

VXF daily: Remains in a downtrend! Lots of investors bought into the best six months......

SPX - much ado about nothing?

SPX is down some 30 handles from the all time highs close and VIX is around 21, which is elevated and stressed given where we are trading. Tomorrow's expiration is the main event and 4700 remains the pin strike to watch. Resistance is all time high close, support levels are: 4640 and 4600 (lower part of the channel). Let's see what expiration brings...

https://themarketear.com/

Click on the YTD icon.....

https://www.etf.com/etfanalytics/etf-fund-flows-tool

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Well, another gap down for VXF as the selling continues..... Tom mentioned maybe next week we "MIGHT" start seeing some improvement. I'm going to buy a few shares today with this gap down.

I'm now long a small position of VXF with this gap down at the open. This will be for a trade ONLY and I will be using stops. This is a counter-trend trade since I still DO NOT have a buy signal. You can see why I like a Roth IRA at Vanguard. Easy to move in or out of positions during the trading day. We shall see if VXF can move back above the 3 ema in the next few trading days and give me a buy signal. Marked with a green circle on the last VXF daily chart posted.

https://stockcharts.com/h-sc/ui?s=VXF&p=D&yr=0&mn=4&dy=0&id=p42311185585&a=1082009543

The following order executed on 12/17/2021 at 9:42 AM, Eastern time:

Account:

Transaction type: Buy

Order type: Market

Security: VANGUARD EXTENDED MARKET ETF (VXF)

Quantity:

Price:* $174.28

https://stockcharts.com/h-sc/ui?s=VXF&p=D&yr=0&mn=4&dy=0&id=p42311185585&a=1082009543

From Tom Yesterday - "Again, it's quadruple witching Friday in front of the start of the typical Santa Claus Rally two week period. Barring any crashes or major events over the next two weeks, trading volume should lighten up which tends to favor the bulls as traders take time off, and investors continue to make their automatic payroll contributions into the stock market, and that combination gives the market a bullish bias.

Today is the 17th, so history suggests next week could get better. Not always, but..."

https://www.tsptalk.com/comments.php

Update: Long, GDXJ, SILJ, EQX, and VXF

I'm now long a small position of VXF with this gap down at the open. This will be for a trade ONLY and I will be using stops. This is a counter-trend trade since I still DO NOT have a buy signal. You can see why I like a Roth IRA at Vanguard. Easy to move in or out of positions during the trading day. We shall see if VXF can move back above the 3 ema in the next few trading days and give me a buy signal. Marked with a green circle on the last VXF daily chart posted.

https://stockcharts.com/h-sc/ui?s=VXF&p=D&yr=0&mn=4&dy=0&id=p42311185585&a=1082009543

The following order executed on 12/17/2021 at 9:42 AM, Eastern time:

Account:

Transaction type: Buy

Order type: Market

Security: VANGUARD EXTENDED MARKET ETF (VXF)

Quantity:

Price:* $174.28

https://stockcharts.com/h-sc/ui?s=VXF&p=D&yr=0&mn=4&dy=0&id=p42311185585&a=1082009543

From Tom Yesterday - "Again, it's quadruple witching Friday in front of the start of the typical Santa Claus Rally two week period. Barring any crashes or major events over the next two weeks, trading volume should lighten up which tends to favor the bulls as traders take time off, and investors continue to make their automatic payroll contributions into the stock market, and that combination gives the market a bullish bias.

Today is the 17th, so history suggests next week could get better. Not always, but..."

https://www.tsptalk.com/comments.php

Update: Long, GDXJ, SILJ, EQX, and VXF

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

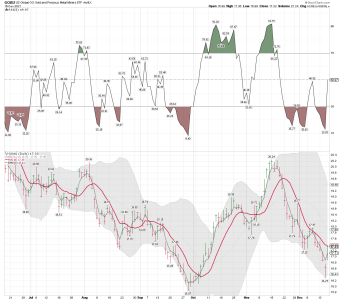

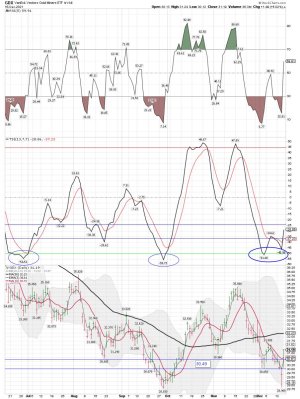

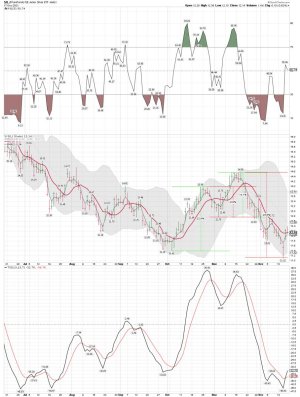

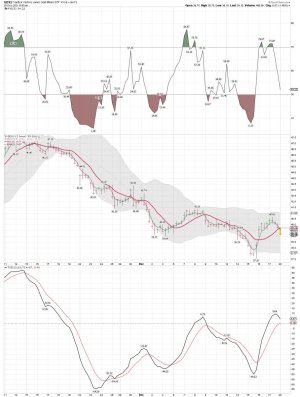

GDXJ daily: I remain long some gold miners, and for now I remain on a buy signal. Keep in mind this is a very hard sector to trade and keep it small if you are trading the gold miners. I NEVER go over 10% on any single trade, and take gains as the position moves up. I mainly trade "extremes" and I am NOT an INVESTOR in this sector. I only trade it......

Long: GDXJ, SILJ, EQX and VXF.

Long: GDXJ, SILJ, EQX and VXF.

Attachments

robo

TSP Legend

- Reaction score

- 471

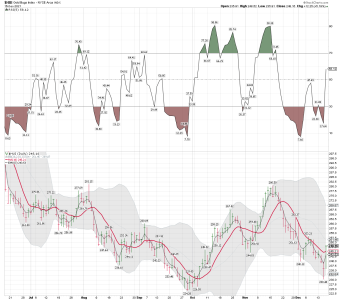

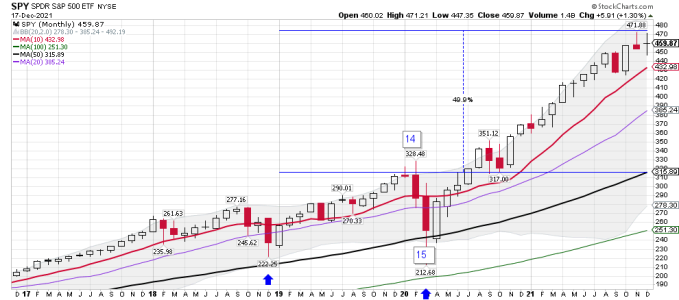

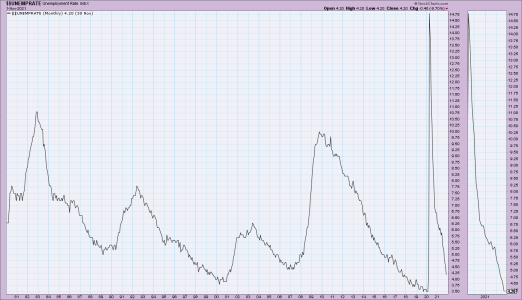

It is concerning that since forming its DCL, stocks have been unable to deliver any bullish follow through.

We need to keep in mind that stocks are on month 21 for the yearly cycle. Which means that stocks are way overdue for a yearly cycle decline. Stocks formed a swing high on Friday. A close below the 50 day MA will trigger our stop. Then a close below the lower daily cycle band will end the daily uptrend and begin a daily downtrend, potentially beginning the yearly cycle decline.

We need to keep in mind that stocks are on month 21 for the yearly cycle. Which means that stocks are way overdue for a yearly cycle decline. Stocks formed a swing high on Friday. A close below the 50 day MA will trigger our stop. Then a close below the lower daily cycle band will end the daily uptrend and begin a daily downtrend, potentially beginning the yearly cycle decline.

Attachments

robo

TSP Legend

- Reaction score

- 471

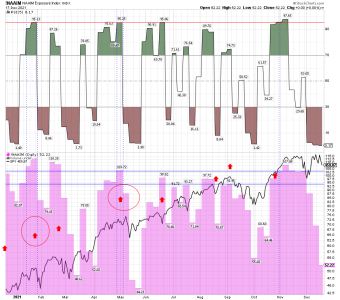

The NAAIM data around 55ish or lower normally gets us a bounce based on the pattern. We shall see how next week plays out. Still no buy signal for my system for VTI or VXF. I trade both of these indexes at Vanguard.

Long VXF: I have a small position after the gap down Friday morning

Long VXF: I have a small position after the gap down Friday morning

Attachments

robo

TSP Legend

- Reaction score

- 471

GDXJ daily: Lots of buy signals went out for the gold miners last week. Still, GDXJ unable to close above the 10 sma.

Long: GDXJ, SILJ, and EQX. I currently have some positions, but in this sector you can get whipsawed quickly. Waiting on a confirmed trend before I get even close to a full 10% position. I will be ST trading NUGT if we keep moving higher ans stay above the 10 sma on the daily.

Morris is sure Bullish!

Dec 17, 2021 Gold Stocks: Are Space Helmets Required? Morris Hubbartt 321gold ...inc ...s

Gold Stocks: Are Space Helmets Required?

Long: GDXJ, SILJ, and EQX. I currently have some positions, but in this sector you can get whipsawed quickly. Waiting on a confirmed trend before I get even close to a full 10% position. I will be ST trading NUGT if we keep moving higher ans stay above the 10 sma on the daily.

Morris is sure Bullish!

Dec 17, 2021 Gold Stocks: Are Space Helmets Required? Morris Hubbartt 321gold ...inc ...s

Gold Stocks: Are Space Helmets Required?

Attachments

robo

TSP Legend

- Reaction score

- 471

NUGT: I will be ST trading this index if GDX continues higher. I DO NOT position trade using 2X. I place NUGT trades based on the GDX chart not the NUGT chart. GDX did close above the 10 sma, but I have NO NUGT positions going into next week. I will buy them again soon if the current setup continues.

Attachments

robo

TSP Legend

- Reaction score

- 471

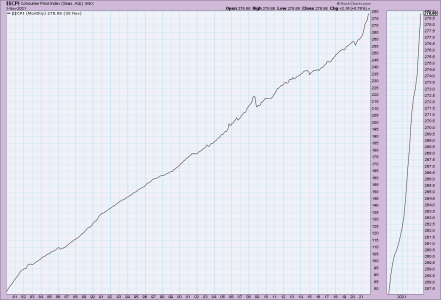

Inflation by the Numbers

John Mauldin John Mauldin

|

Thoughts from the Frontline

|

December 17, 2021

Milton Friedman famously said inflation is “always and everywhere a monetary phenomenon.” He was right but that short statement doesn’t fully explain how inflation works. It has other causes, too. The period in which he did his most famous research showed inflation was clearly a monetary phenomenon, but I’m not sure he would make the same assertion today.

Last week’s What Really Caused Inflation letter generated an unusual number of questions and comments. That tells me I need to go a little deeper. We know inflation by the higher prices it generates, but exactly how it flows through the economy isn’t always obvious.

Policy Error

The current episode of inflation we have is unlike anything we’ve seen in modern history. It has three component causes, all equally culpable.

First, there is the Federal Reserve’s easy monetary policy. Quantitative Easing caused asset price inflation in both financial assets and home prices. Low interest rates have spurred increases in home prices, rental property prices, new/used cars, and have clearly contributed to the financialization of the economy.

Low interest rates encouraged investors, both small and large, to reach for yield and take more portfolio risk. Small investors in particular have moved into riskier stocks. If we have a bear market in an inflationary cycle, it will devastate the retirement portfolios of many retirees and those who are close to retirement.

Pretty much no one (except frustrated buyers) is upset when their home or stocks go up in price. Clearly, the Federal Reserve has made that a feature of their policy. They think of it as financial stability.

The problem is that there are many aspects of inflation monetary policy can’t control. We will continue seeing headline CPI and PCE inflation numbers well above their 2% target (which is in and of itself destructive) which means that if the Federal Reserve wants to maintain its inflation-fighting credibility, it will have to go further than anyone thinks now, or lose that credibility. And that risks (gasp!) a recession.

https://www.mauldineconomics.com/frontlinethoughts/inflation-by-the-numbers

John Mauldin John Mauldin

|

Thoughts from the Frontline

|

December 17, 2021

Milton Friedman famously said inflation is “always and everywhere a monetary phenomenon.” He was right but that short statement doesn’t fully explain how inflation works. It has other causes, too. The period in which he did his most famous research showed inflation was clearly a monetary phenomenon, but I’m not sure he would make the same assertion today.

Last week’s What Really Caused Inflation letter generated an unusual number of questions and comments. That tells me I need to go a little deeper. We know inflation by the higher prices it generates, but exactly how it flows through the economy isn’t always obvious.

Policy Error

The current episode of inflation we have is unlike anything we’ve seen in modern history. It has three component causes, all equally culpable.

First, there is the Federal Reserve’s easy monetary policy. Quantitative Easing caused asset price inflation in both financial assets and home prices. Low interest rates have spurred increases in home prices, rental property prices, new/used cars, and have clearly contributed to the financialization of the economy.

Low interest rates encouraged investors, both small and large, to reach for yield and take more portfolio risk. Small investors in particular have moved into riskier stocks. If we have a bear market in an inflationary cycle, it will devastate the retirement portfolios of many retirees and those who are close to retirement.

Pretty much no one (except frustrated buyers) is upset when their home or stocks go up in price. Clearly, the Federal Reserve has made that a feature of their policy. They think of it as financial stability.

The problem is that there are many aspects of inflation monetary policy can’t control. We will continue seeing headline CPI and PCE inflation numbers well above their 2% target (which is in and of itself destructive) which means that if the Federal Reserve wants to maintain its inflation-fighting credibility, it will have to go further than anyone thinks now, or lose that credibility. And that risks (gasp!) a recession.

https://www.mauldineconomics.com/frontlinethoughts/inflation-by-the-numbers

robo

TSP Legend

- Reaction score

- 471

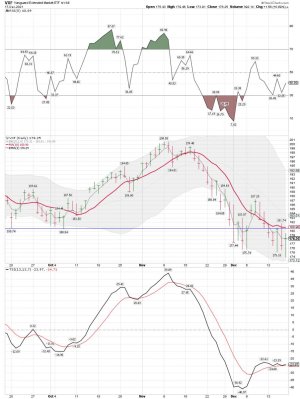

VXF daily chart: (S Fund) - Small and Mid caps remains Ugly.... Another gap down this morning.......

SPX - and the 50 day is gone

SPX is "well" below the 50 day, currently trading around the big 4550 level. Note there is a short term trend line coming in here. Next big support to watch is the 4500/4520 area. Note the 100 day around these levels. We are still above the post Thanksgiving lows, but momentum isn't the greatest and liquidity from now on will be very poor.

SPX - and the 50 day is gone

SPX is "well" below the 50 day, currently trading around the big 4550 level. Note there is a short term trend line coming in here. Next big support to watch is the 4500/4520 area. Note the 100 day around these levels. We are still above the post Thanksgiving lows, but momentum isn't the greatest and liquidity from now on will be very poor.

Attachments

robo

TSP Legend

- Reaction score

- 471

VXF daily: Another gap down and the VXF index remains below the 10,20,50, 100, and 200 sma on the daily chart. UGLY! Time to buy or run for the hills?

VXF 2 hour chart:

https://stockcharts.com/h-sc/ui?s=VXF&p=120&yr=0&mn=1&dy=0&id=p51628993042&a=1083460128

VXF 2 hour chart:

https://stockcharts.com/h-sc/ui?s=VXF&p=120&yr=0&mn=1&dy=0&id=p51628993042&a=1083460128

Attachments

robo

TSP Legend

- Reaction score

- 471