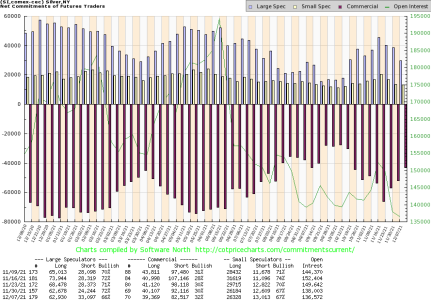

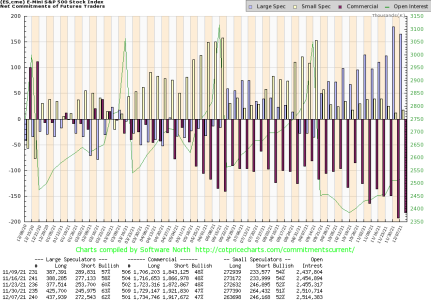

Sorry, but my Magic Ball is Broken. However, this data provided by Jeff is a good ST warning indicator for sure. We shall see how it plays out.

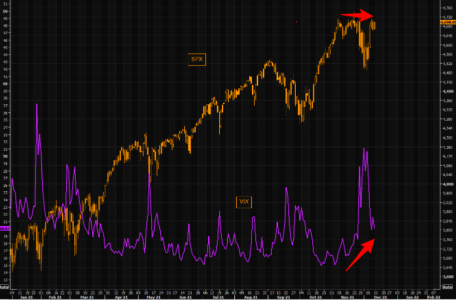

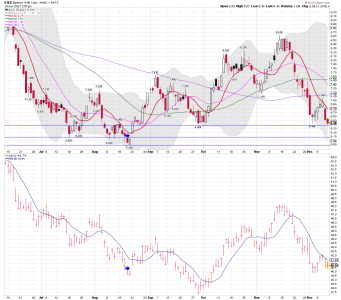

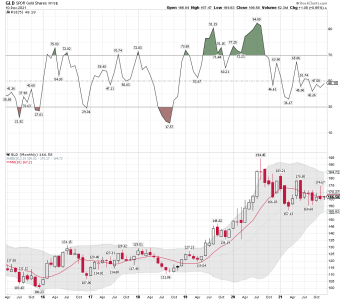

VIX daily chart: VXX filling the gap

The Crystal Ball Is Flashing a Warning

Jeff Clark | Dec 13, 2021 | Market Minute | 3 min read

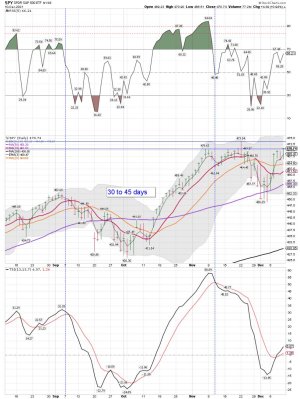

The “easy money” from the recent buy is done.

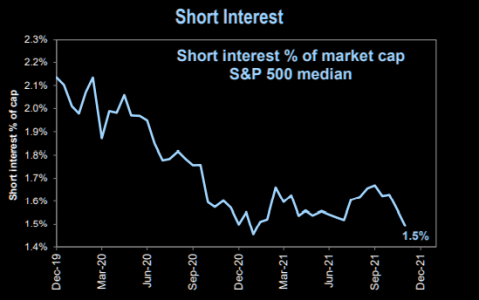

Any further gains from here are going to be hard fought. And, if our crystal ball has anything to say about it, the stock market is more likely to be lower two weeks from now rather than higher.

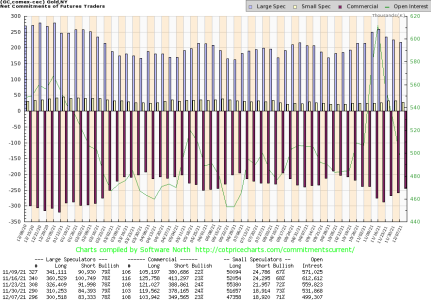

the VIX calls are more than double the price of the VIX puts. When we’ve seen this condition before it often leads to a higher VIX in the days ahead. And a higher VIX usually goes along with a falling stock market.

Traders who bought into last week’s buy signal might consider trimming some profits today.

And, folks who might be looking to put more money to work in the current environment might have a better chance to do so in the days ahead.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/the-crystal-ball-is-flashing-a-warning/