Do not forget these (upcoming) risks

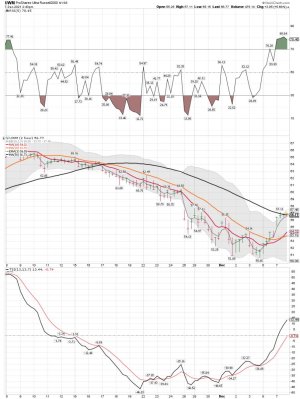

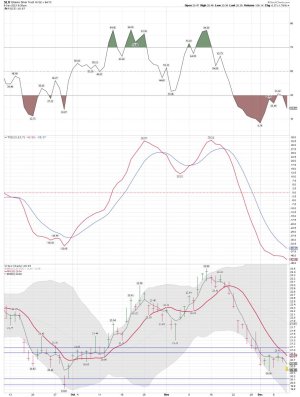

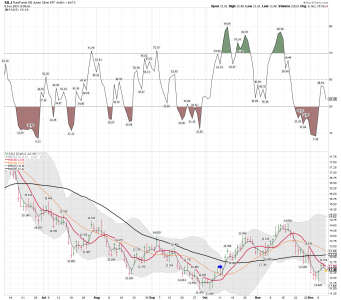

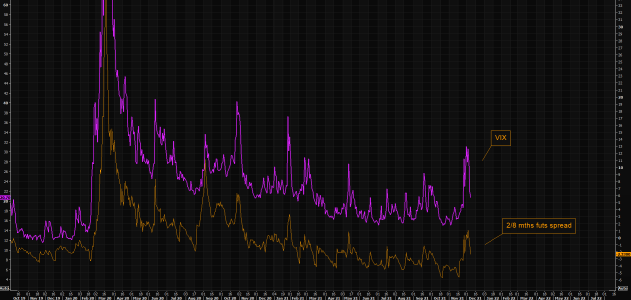

Despite the brutal short squeeze, there are risks to consider going forward. Volatility remains huge, both ways. Few risks to focus on according to Nomura:

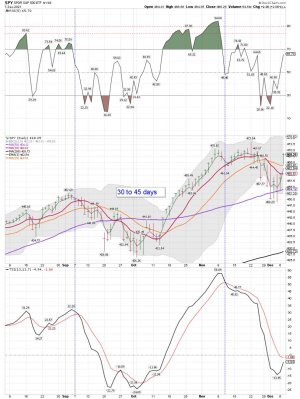

1. Op-Ex and Fed next week

2. CTA deleveraging “sell triggers” will remain “proximate enough” to spot after this imminent covering squeeze tuckers-out

3. Skew stays completely “jacked up” and stress-y

4. US inflation prints are not expected to peak until 1Q21, it is highly probable that “Fed Put” strike is now much lower

The crowd has been shocked, both ways. Maybe this market needs to thread water and sober up before any new meaningful direction can take place...

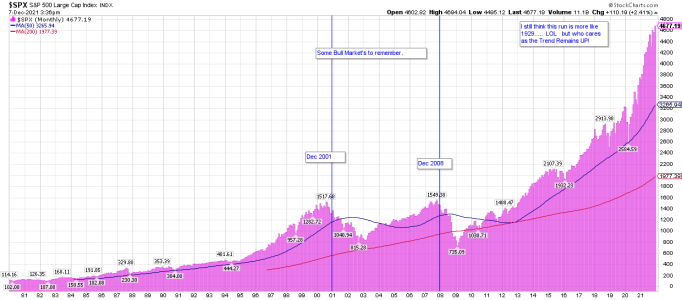

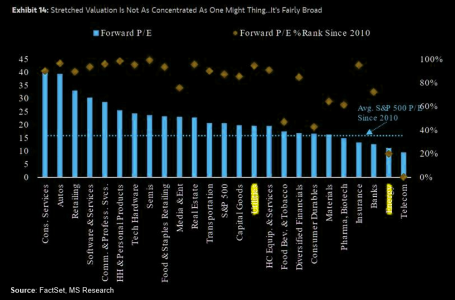

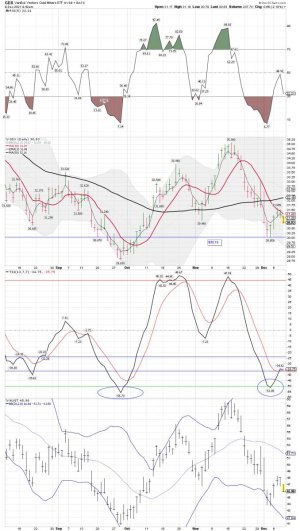

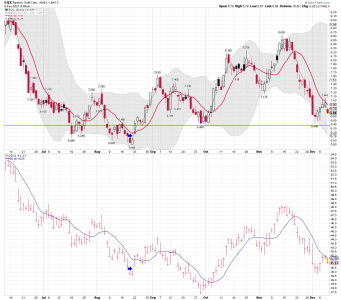

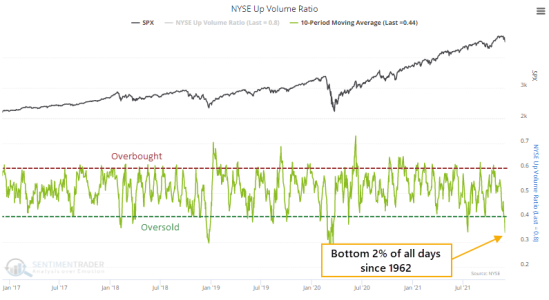

Stretched valuation is more broad-based

Morgan Stanley believes the Fed pivoting to a faster taper (not Omicron) is the primary driver of the market’s de-rating over the past two weeks. However, P/Es are still higher than they were two months ago at nearly 20x… with 70% of S&P 500 industry groups currently trading in the top 25% of historical forward P/E levels going back to ’10, and all but five groups (out of 24) trading above the SPX’s average multiple since ‘10 (15.9x). Bottom line: Elevated valuation is pervasive despite a lot of focus on a concentrated market, which strengthens the case for a market multiple de-rate, and the importance of stock selection.

https://themarketear.com/