robo

TSP Legend

- Reaction score

- 471

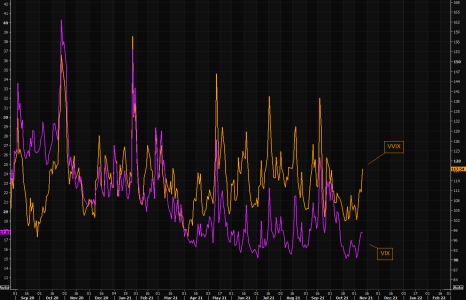

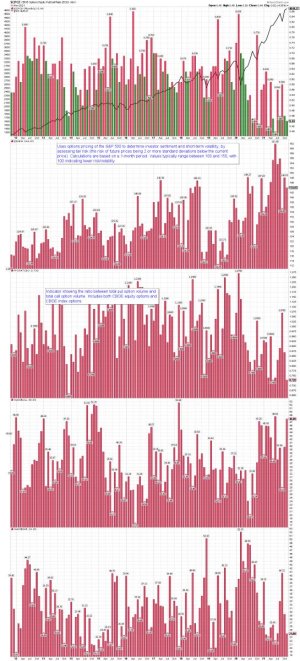

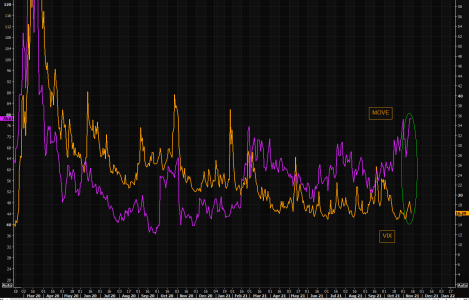

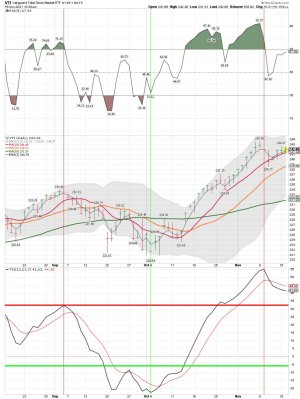

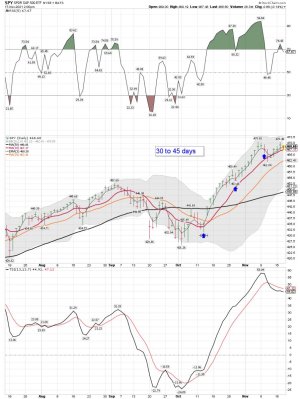

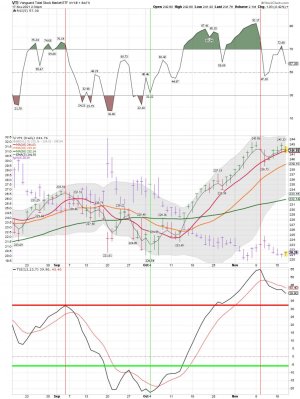

VIX daily: Moving back down at the open.....

VIX has squeezed...but have you seen VVIX?

VVIX is back to late Sep levels.

Back then VIX was somewhat higher...around 23!

We are not saying VIX should hit 23, but the constant bid in VVIX remains very much alive.

VIX has squeezed...but have you seen VVIX?

VVIX is back to late Sep levels.

Back then VIX was somewhat higher...around 23!

We are not saying VIX should hit 23, but the constant bid in VVIX remains very much alive.