robo

TSP Legend

- Reaction score

- 471

ANALYSIS, PERSPECTIVE, TRADING STRATEGY

AT THE EDGE OF CHAOS: BACK TO THE FUTURE - WHAT IF THE COVID LOCKDOWNS SURGE JUST AS THE FED STARTS TO TAPER?

Editor Joe Duarte in the Money Options

November 21, 2021

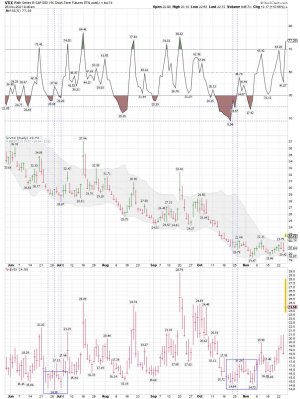

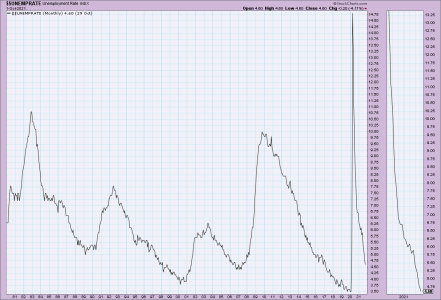

Does it make sense for the Fed to taper as a “fourth wave of COVID” begins to develop?

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

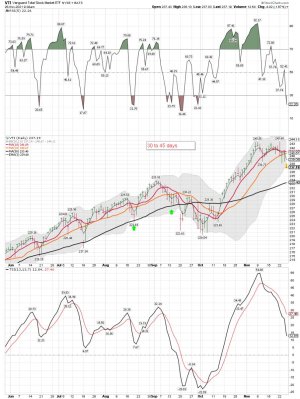

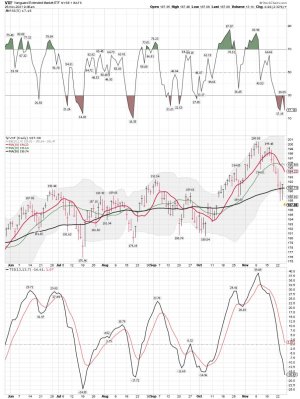

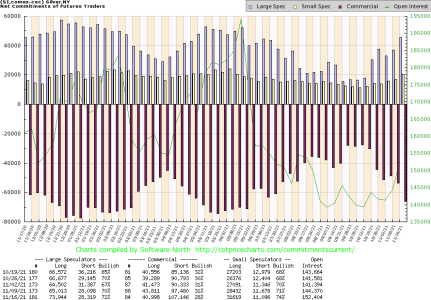

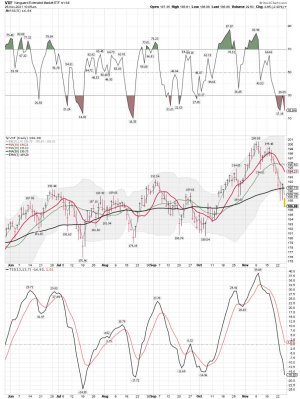

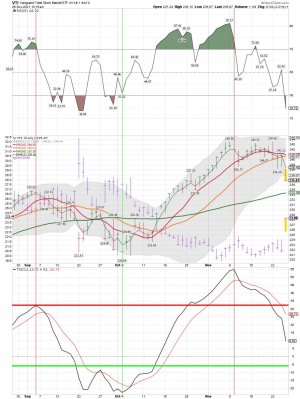

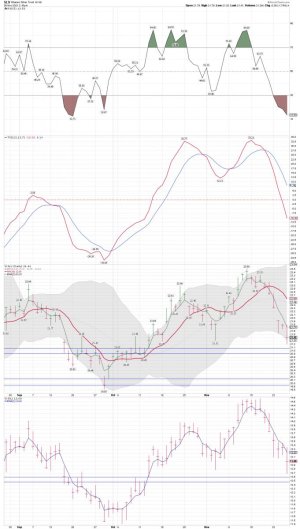

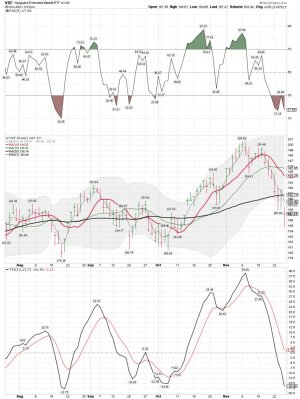

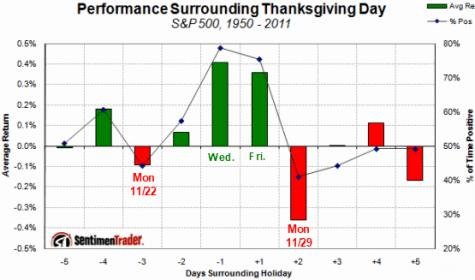

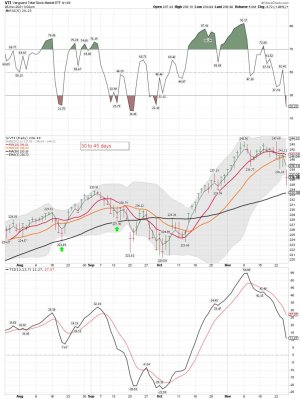

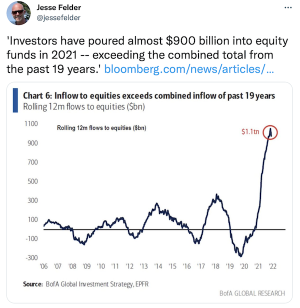

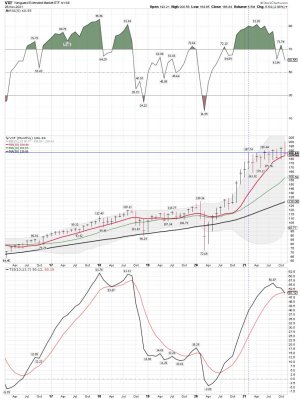

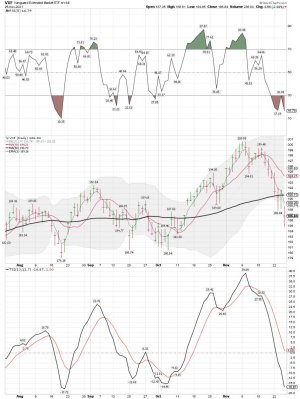

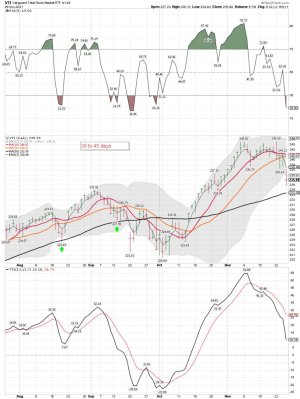

Talk about that butterfly flapping its wings, eh? Sure enough, recent events suggest that the combination of a pandemic surge occurring simultaneously with the start of the Fed’s QE tapering may be too much for the stock market to handle, despite its heading into what is usually a very positive season.

Not another Perfect Storm Please

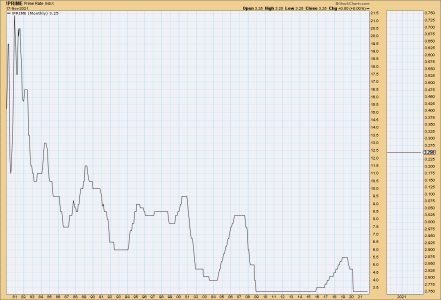

Let the games begin. The Federal Reserve will be reducing its bond purchases by $10 billion per month starting in December, formalizing the beginning of the tapering of its COVID-19 pandemic record setting QE. And while the stock market initially took the news in stride it seems as if traders are suddenly running for the exits.

https://www.joeduarteinthemoneyoptions.com/reports/TA.asp

AT THE EDGE OF CHAOS: BACK TO THE FUTURE - WHAT IF THE COVID LOCKDOWNS SURGE JUST AS THE FED STARTS TO TAPER?

Editor Joe Duarte in the Money Options

November 21, 2021

Does it make sense for the Fed to taper as a “fourth wave of COVID” begins to develop?

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

Talk about that butterfly flapping its wings, eh? Sure enough, recent events suggest that the combination of a pandemic surge occurring simultaneously with the start of the Fed’s QE tapering may be too much for the stock market to handle, despite its heading into what is usually a very positive season.

Not another Perfect Storm Please

Let the games begin. The Federal Reserve will be reducing its bond purchases by $10 billion per month starting in December, formalizing the beginning of the tapering of its COVID-19 pandemic record setting QE. And while the stock market initially took the news in stride it seems as if traders are suddenly running for the exits.

https://www.joeduarteinthemoneyoptions.com/reports/TA.asp