robo

TSP Legend

- Reaction score

- 471

Some tweets

SevenSentinels

@SevenSentinels

·

1h

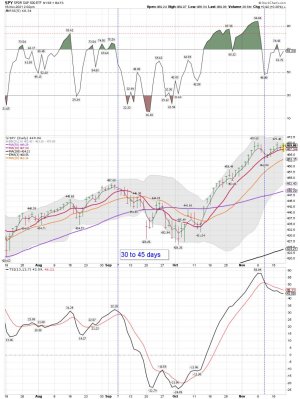

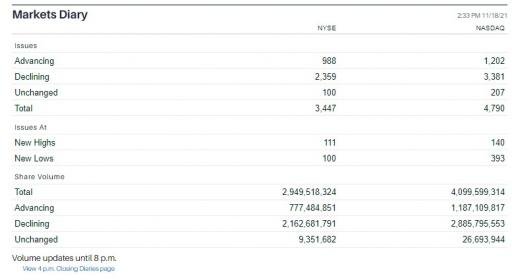

Wednesday 1:40

SS LOLR STS

Up Down Down

1/6 1/6 0/7

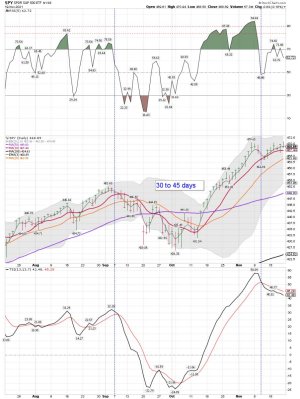

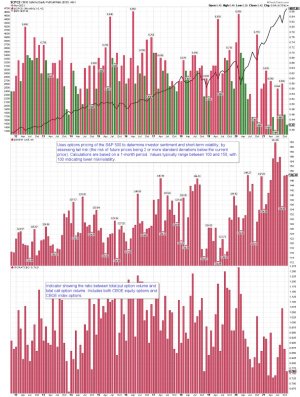

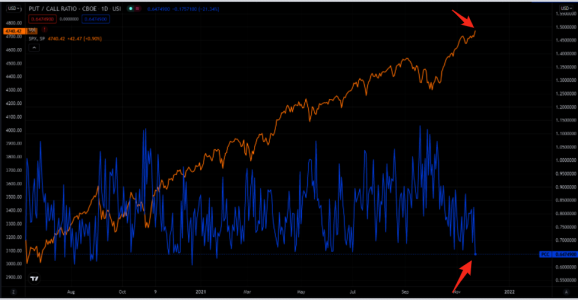

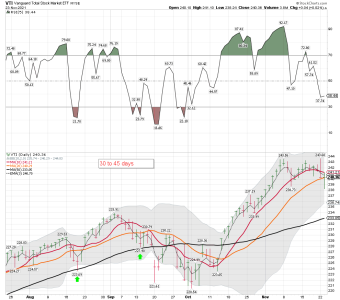

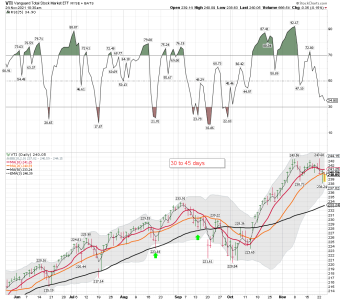

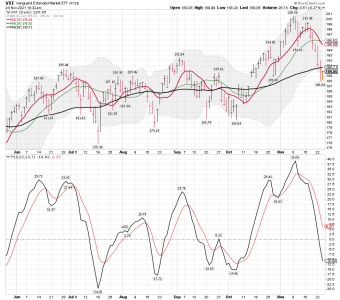

Breadth: -1500/-1800 ( First Chart)

NYSE McO: -38

NASDAQ McO: -25

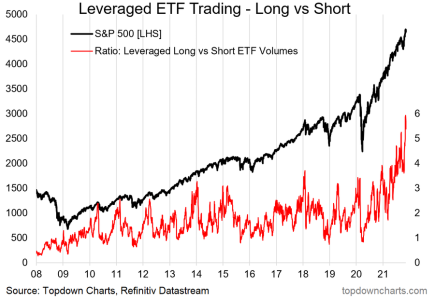

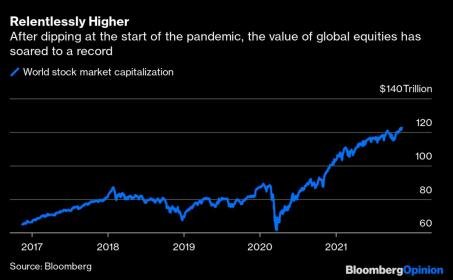

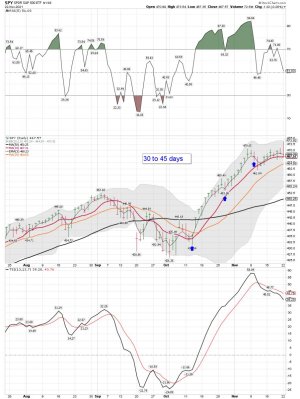

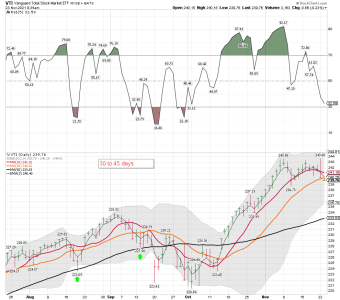

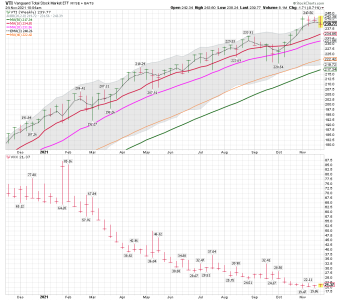

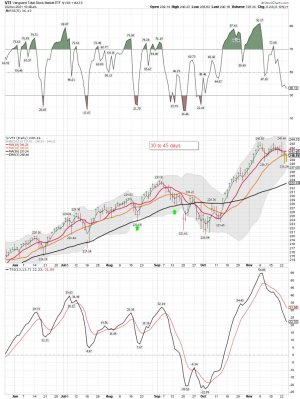

SentimenTrader (Second Chart)

@sentimentrader

·

21h

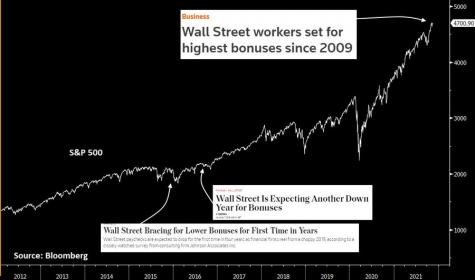

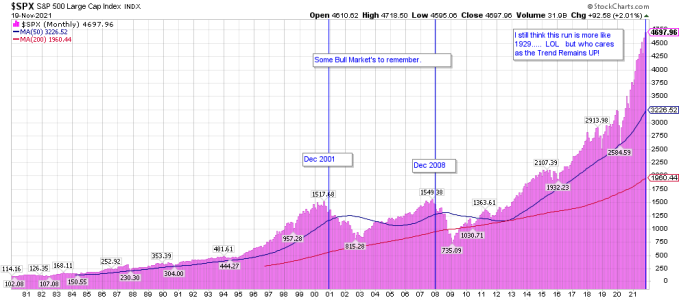

Just your friendly neighborhood reminder that Wall Street is cyclical.

True Contrarian

@TrueContrarian

·

Nov 11

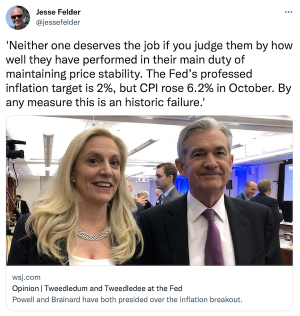

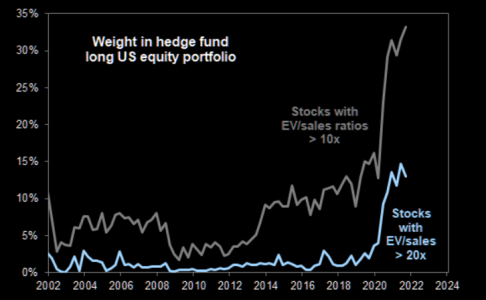

#ElonMusk has been doing in 2021 exactly what most other top corporate insiders have. This is consistent with how the world's most-experienced investors have behaved in 2021 and which is the exact opposite of what the vast majority of asset-chasing amateurs have been doing.

Elon has been selling shares as many insiders have been doing.

Ok, another easy money week!

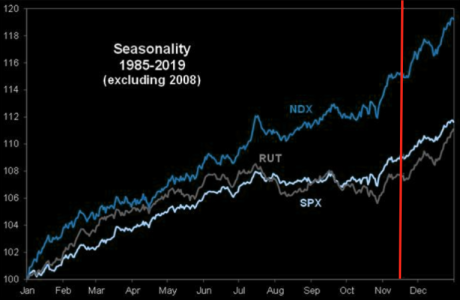

StockTrader'sAlmanac

@AlmanacTrader

·

21h

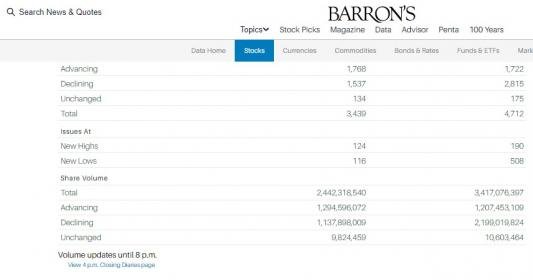

November Monthly Option Expiration Week: DJIA Best - DJIA has been up 14 of the last 19 years on November’s monthly option expiration Friday with an average gain of 0.49%. By the way, it is not a mistake that November Op-Ex day has the same...

https://twitter.com/almanactrader?lang=en

https://twitter.com/elerianm

SevenSentinels

@SevenSentinels

·

1h

Wednesday 1:40

SS LOLR STS

Up Down Down

1/6 1/6 0/7

Breadth: -1500/-1800 ( First Chart)

NYSE McO: -38

NASDAQ McO: -25

SentimenTrader (Second Chart)

@sentimentrader

·

21h

Just your friendly neighborhood reminder that Wall Street is cyclical.

True Contrarian

@TrueContrarian

·

Nov 11

#ElonMusk has been doing in 2021 exactly what most other top corporate insiders have. This is consistent with how the world's most-experienced investors have behaved in 2021 and which is the exact opposite of what the vast majority of asset-chasing amateurs have been doing.

Elon has been selling shares as many insiders have been doing.

Ok, another easy money week!

StockTrader'sAlmanac

@AlmanacTrader

·

21h

November Monthly Option Expiration Week: DJIA Best - DJIA has been up 14 of the last 19 years on November’s monthly option expiration Friday with an average gain of 0.49%. By the way, it is not a mistake that November Op-Ex day has the same...

https://twitter.com/almanactrader?lang=en

https://twitter.com/elerianm