robo

TSP Legend

- Reaction score

- 471

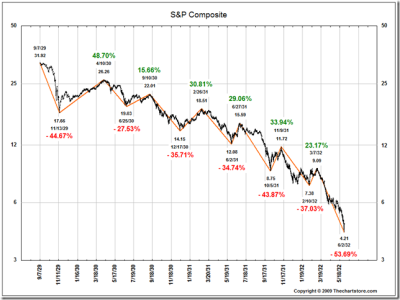

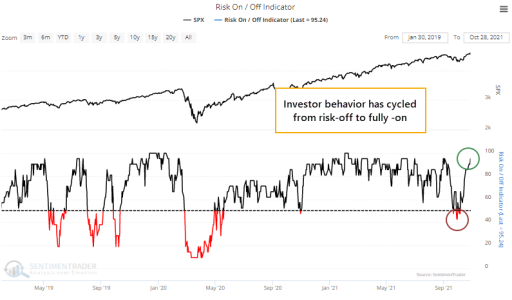

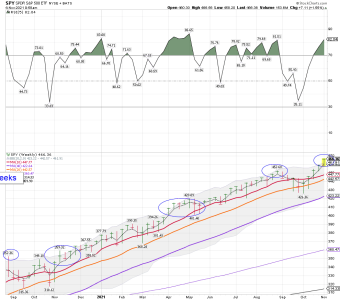

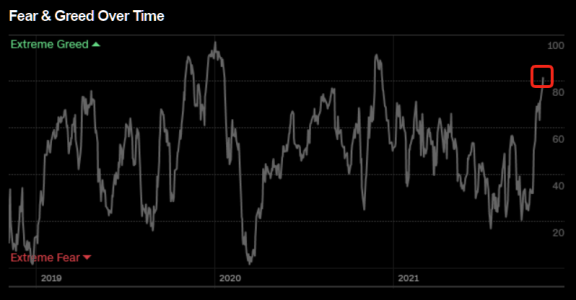

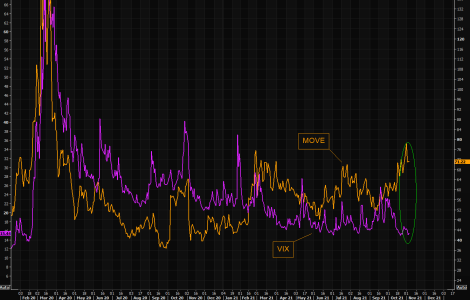

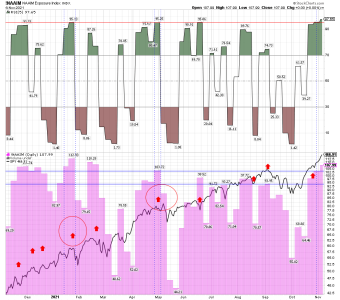

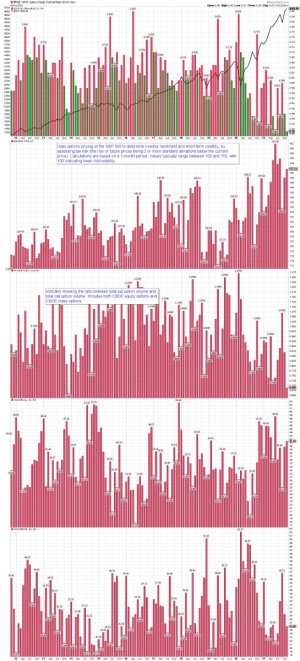

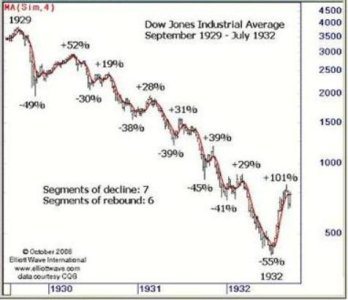

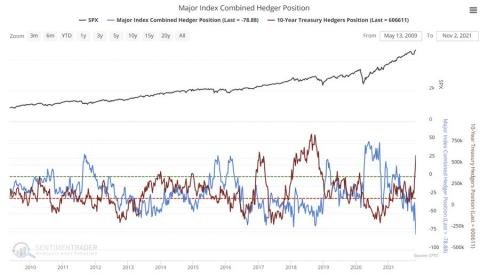

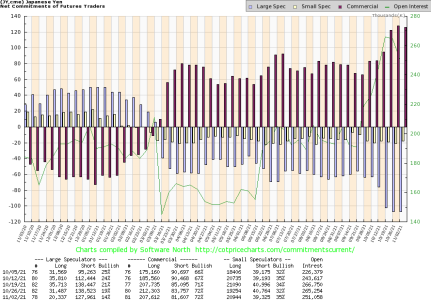

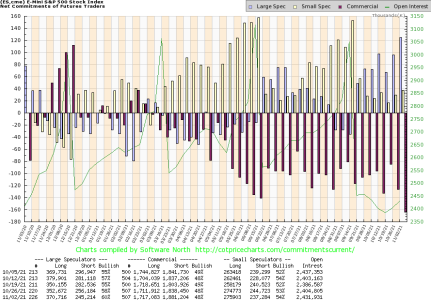

More on November Buyers! So for all of the years looked at how many were at an extreme like we are currently in. NONE.... Not that it matters to me since I trade the trend and it remains UP! You know, apples to apples type comparing of data. I wonder how the SPX did in November of 1929. That is about where we are now, but I still think the current market might be a tad more overbought. I know, this is nothing like 1929...... It's different this time. Still, my point was apples to apples should be used when comparing historical data. At least that is how I try to do it.

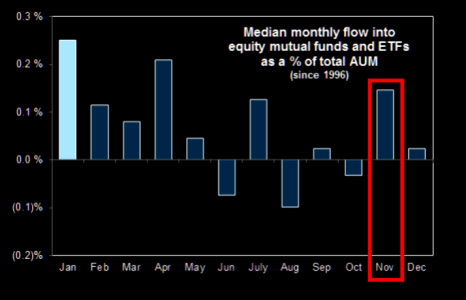

Remember November?

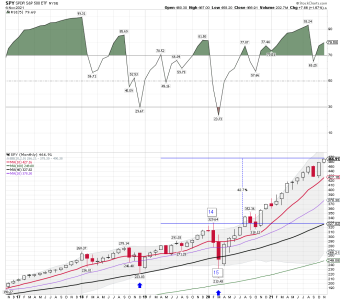

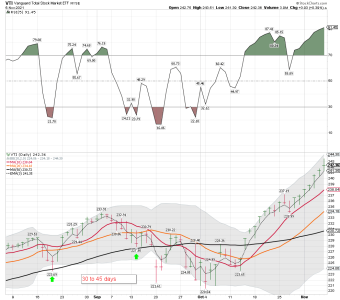

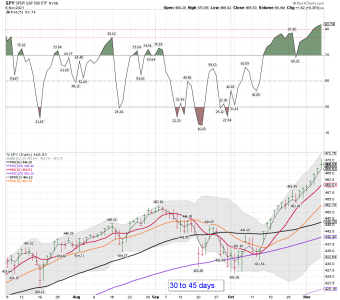

November is the 3rd largest inflow month. And it kicks-off the absolutely strongest stretch on inflow months of the season...some big months coming up.

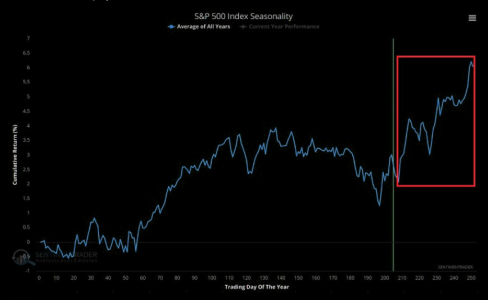

Seasonality Bonanza

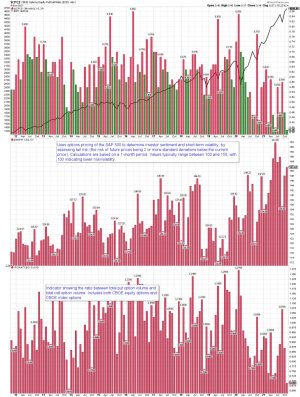

Just sit back and enjoy as seasonality kicks in? The problem we could be facing is that even the bears are referring to the positive seasonality pattern. Sentimentrader writes:

41.8% of all years saw a drawdown of LESS THAN -1% (a dip).

85.1% of all years saw a drawdown of LESS THAN -5% (a pullback).

95.5% of all years saw a drawdown of LESS THAN -10% (a correction).

(chart since 1953).

Remember November?

November is the 3rd largest inflow month. And it kicks-off the absolutely strongest stretch on inflow months of the season...some big months coming up.

Seasonality Bonanza

Just sit back and enjoy as seasonality kicks in? The problem we could be facing is that even the bears are referring to the positive seasonality pattern. Sentimentrader writes:

41.8% of all years saw a drawdown of LESS THAN -1% (a dip).

85.1% of all years saw a drawdown of LESS THAN -5% (a pullback).

95.5% of all years saw a drawdown of LESS THAN -10% (a correction).

(chart since 1953).

Attachments

Last edited: