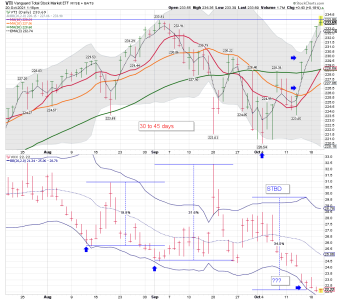

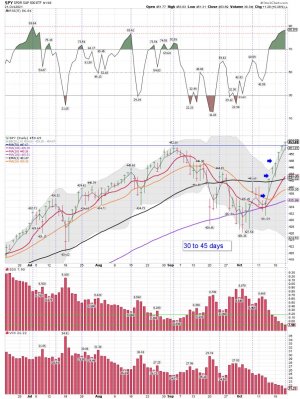

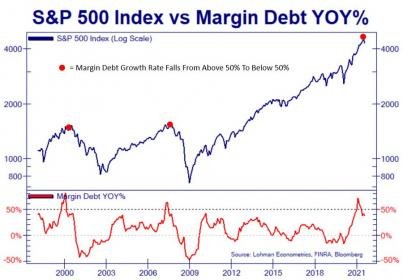

Hmmmmm... You don't say! BUY BUY BUY and NO FEAR..... Back to the melt-up comments for sure and this really has been a very nice rip up..... Probably not many shorts left standing.... The bears better throw in the towel... Today will be day 10 since my buy signal.... We shall see how the next DCL low plays out as most are calling this a NEW intermediate term cycle.

https://www.youtube.com/watch?v=TfAYz6p-mlw

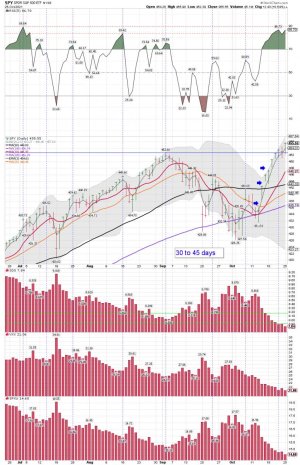

SPY daily: Bottom Line The trend remains up!

The chances for an imminent correction just cratered

Jason Goepfert

Jason Goepfert

Published: 2021-10-26 at 07:35:00 CDT

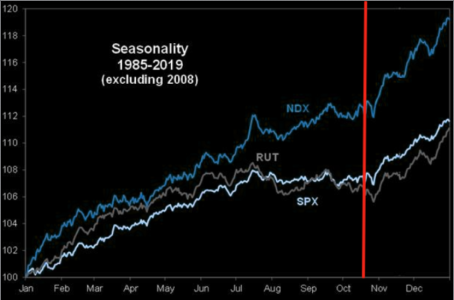

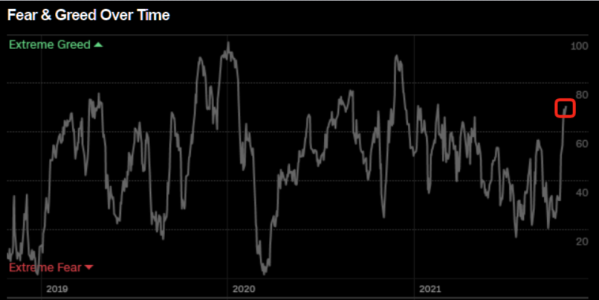

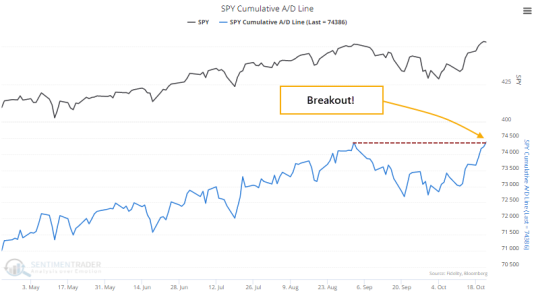

The most benchmarked index in the world is trying to hold a breakout to record highs. Supporting its case is the fact that most of its stocks have been rising, and breadth within the index confirms its good performance.

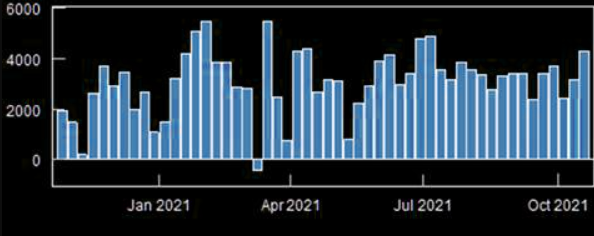

Even though the S&P 500 settled back a bit on Friday, most of the stocks in the index gained ground. That was enough to push the S&P's Cumulative Advance/Decline Line to a new high, the first in more than 30 sessions.

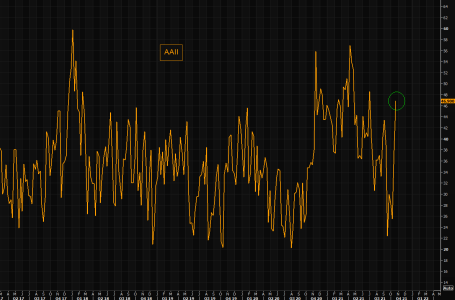

Among other major indexes, the Nasdaq 100 has also seen a breakout in its Advance/Decline Line but other indexes have not.

Many times over the past couple of decades, we've discussed the idea that stocks are less likely to suffer a large drawdown in the following months when the advance/decline line breaks out to a new high.

Since 1928, the S&P 500 was three times more likely to suffer a 10% decline at some point within the next three months if the S&P's Advance/Decline Line was not at a multi-year high. When it did break out to a new high, there was only a 4.6% probability of a 10% or greater decline within the next few months.