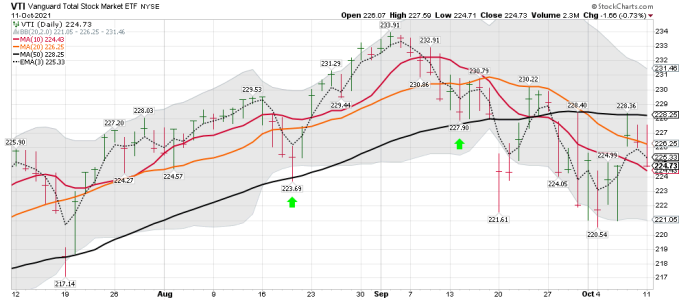

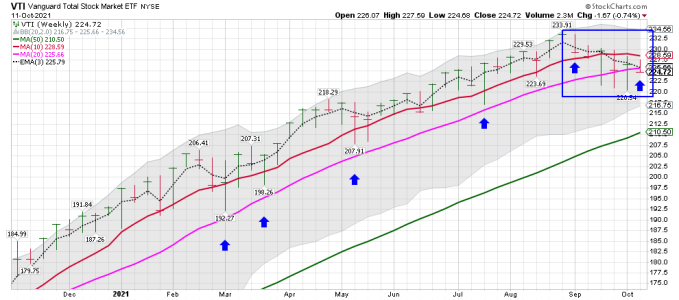

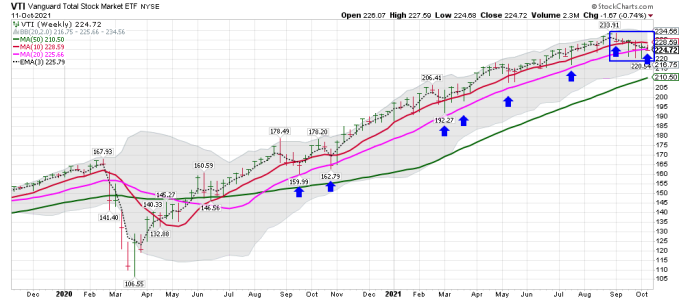

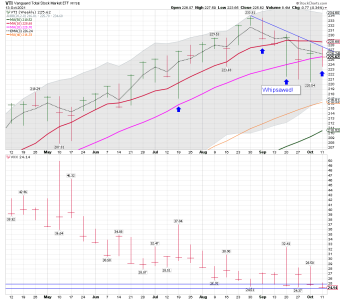

LOL....... I'm just going too trade what is happening in real-time....... However, investors probably have lots of things to look over in the months ahead. I also think taxes are going up next year. So are we going to see some tax selling? I think we are already seeing some....

The top 10 questions for Goldman right now

Here's a smattering of 10 questions Goldman are monitoring:

1. Will the recent rise in inflation prove to be temporary or more sustained?

2. Will the Fed raise rates sooner than markets expect?

3. Will the labor shortage resolve itself or has something structurally changed in how people work?

4. Will China's issues spillover to global growth?

5. Will the latest wave of the virus remain contained?

6. Will the spike in commodities suppress earnings growth across a range of sectors?

7. Can corporate earnings overcome the headwinds of supply chain bottlenecks?

8. Will Washington DC reach a longer dated agreement on raising the US debt limit?

9. Will Congress be able to pass an infrastructure bill or have we already seen the last fiscal stimulus of this cycle?

10. Can the S&P 500 Index go up if the FAAMG complex underperforms? (Goldman Sachs).

Could higher energy prices trigger a recession?

With energy costs as a % of GDP up to 7% this month, Sanford Bernstein notes that history shows that the probability of a recession increases when energy costs exceed this level for a prolonged period of time (>1 year). Bernstein: "We aren’t there yet, but coal and natural gas have been responsible for much of the inflation in energy costs. While the recent spike in energy costs may prove transient, a protracted period of energy costs (>1 year) or further rise in oil to over US$100/bbl could trigger a slowdown in global economic growth as disposable income gets squeezed. On an annual basis, the cost of oil as a percent of GDP is unremarkable at ~3% and well below the 5% peak. A rise in oil prices above $100 per barrel alongside high coal and gas prices could push energy prices to levels which damage economic growth" (Sanford Bernstein)

https://themarketear.com/