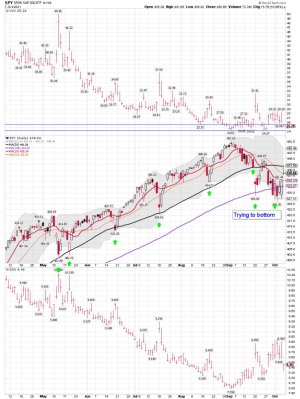

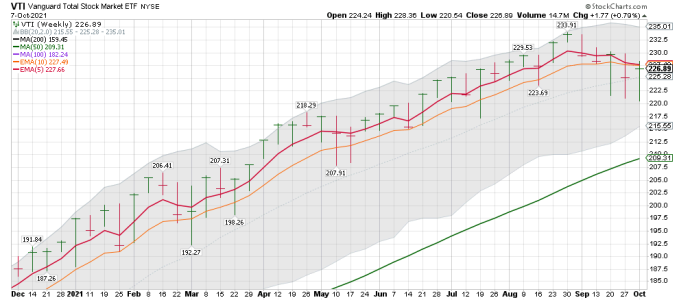

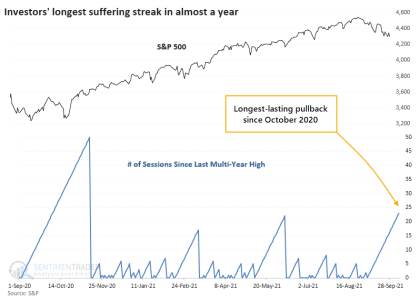

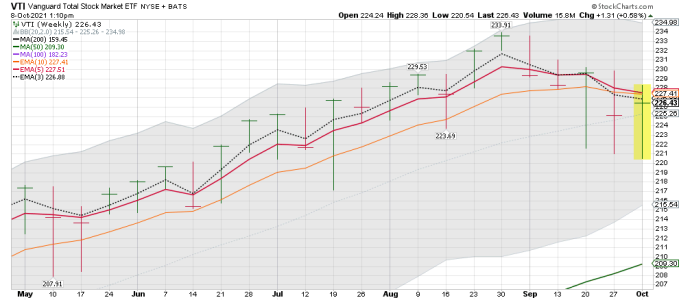

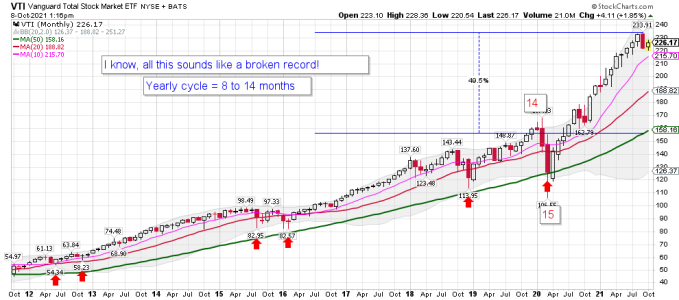

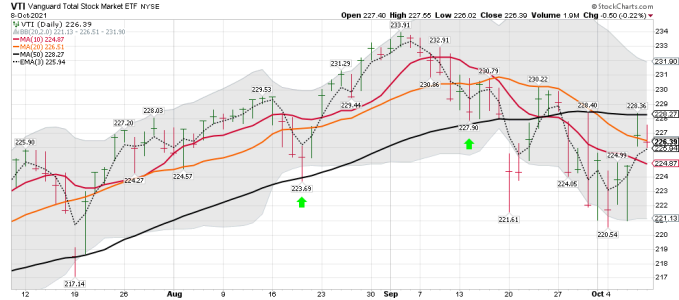

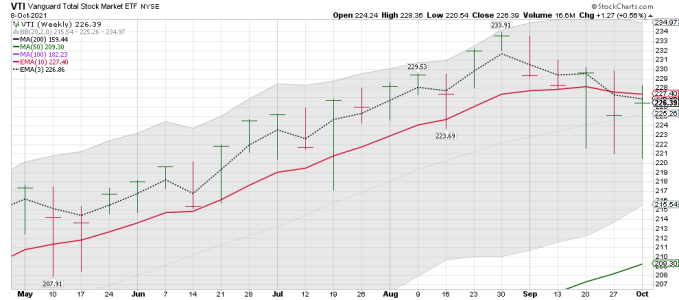

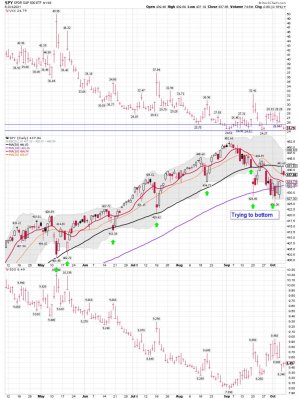

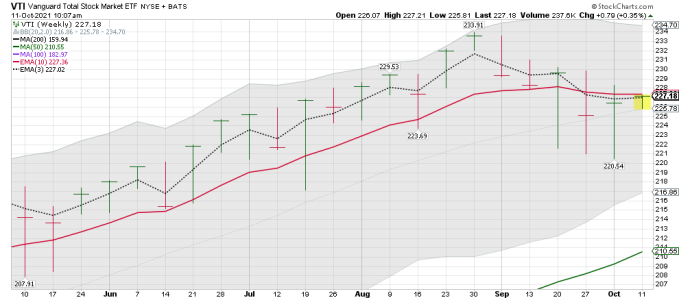

VTI weekly: As I pointed out in a post above, I will be watching the weekly data more. VTI has trended below the 5 EMA four out of the last five weeks. Not what you want to see. We shall if the Bulls can turn this back up and we can get an ICL. The video above seems to think we have already started the move. I want to see a close back above the 5 ema on the weekly chart below before I get to excited about an ICL being in. I also want to see a close back above the 50 sma on the daily chart. The 50 sma is watched by many traders. Yes, I'm a trader not an investor.

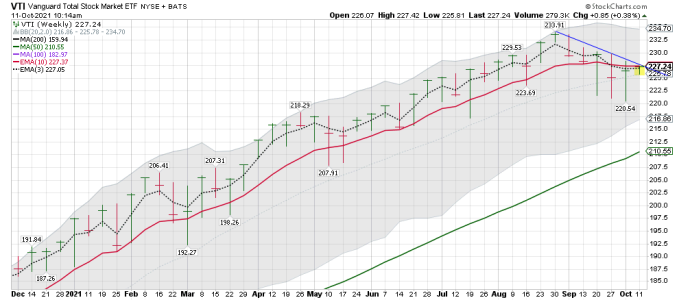

VTI weekly using the 5 and 10 week ema on the chart below: Read about EMA's and SMA's at the link below. There is also a video, but you really don't need to watch it. I use the EMA's sometimes when I'm looking for turns. I will sometimes use the 3 ema on the daily. The point is - we do not want to see the index trending below the 5 ema like it is right now on the weekly. However, some better news on the shorter time frame as the 3 ema is turning up. Day 3 that VTI has closed above the 3 ema. The Bulls should be able to push the indexes higher the next two days.....

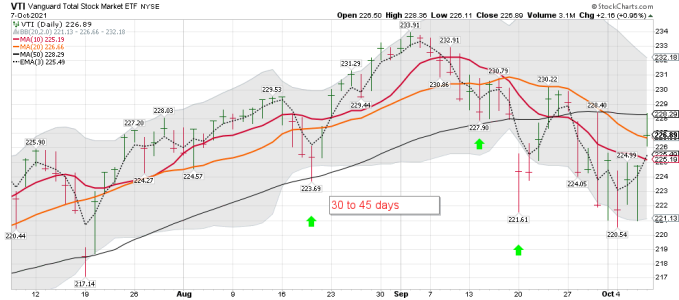

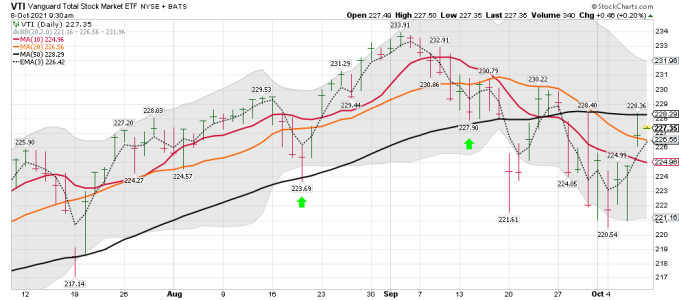

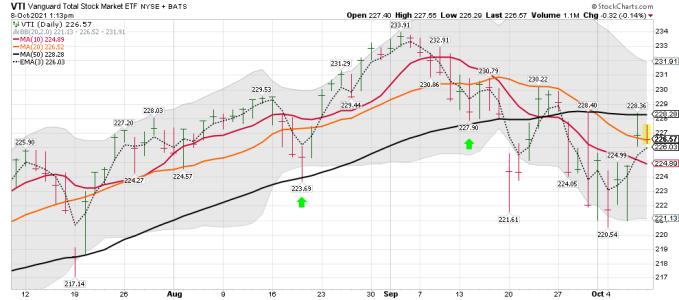

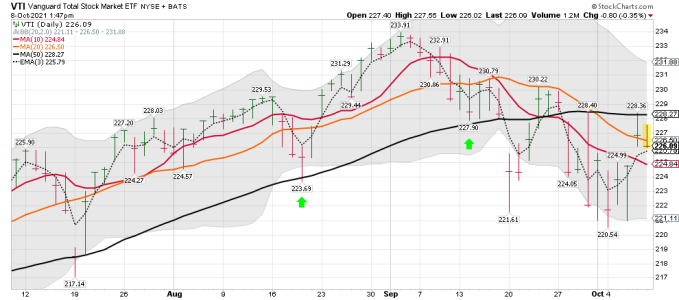

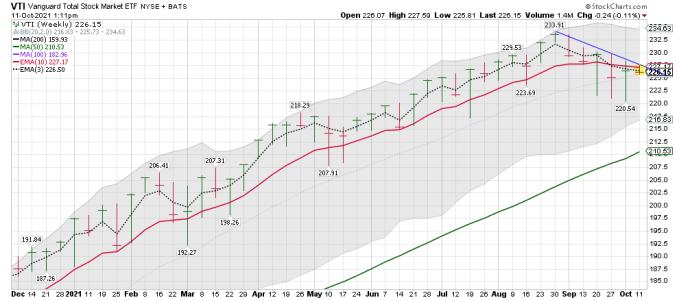

VTI daily chart below with the 3 ema and the 10 and 20 sma and I like to use this for tacking the current market price action. Notice how the 3 ema turned up and one could ST trade that signal if you kept the trade small and stayed nimble. This is day 3 that VTI has closed above the 3 ema and that could turn out to be very bullish after this current downtrend. We shall see how it plays out.

The point of all of this is the 3 ema can help you spot turns on the daily and I use with cycles and the other sma's for helping me to decided when and how big the read should be. I haven't used the ema much in this market because all you had to do is just BTD!..... Maybe that is changing, but I will trade what is happening and not what I think will happen.

Exponential Moving Average (EMA)

By JAMES CHEN

Reviewed by CHARLES POTTERS on April 28, 2021

What Is an Exponential Moving Average (EMA)?

An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period.

https://www.investopedia.com/terms/e/ema.asp