That would be me, over here in the corner with a heavy blanket over my head.

Scott Harrison

Senatobia, MS

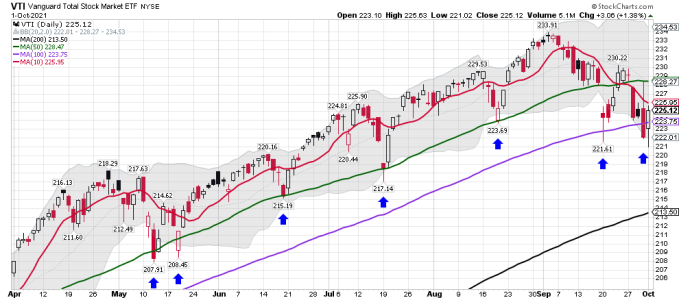

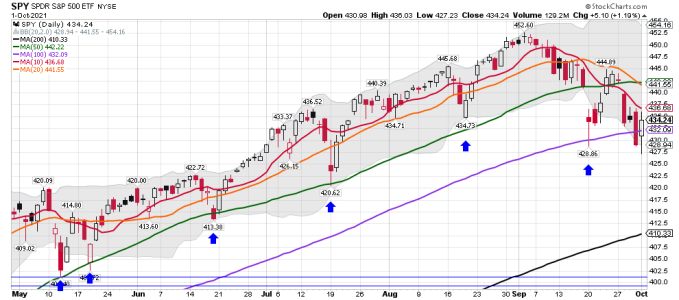

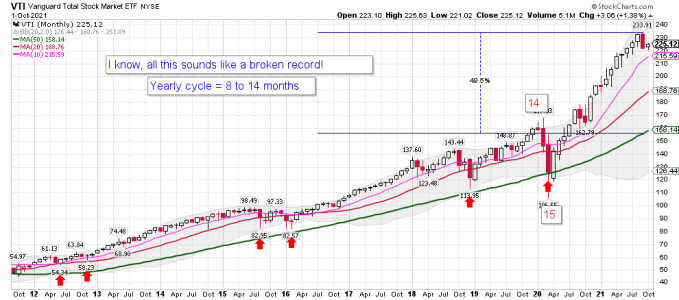

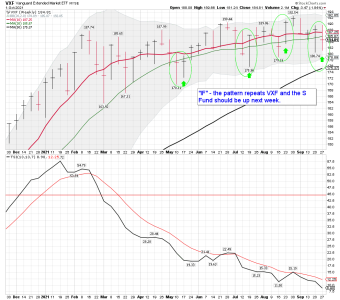

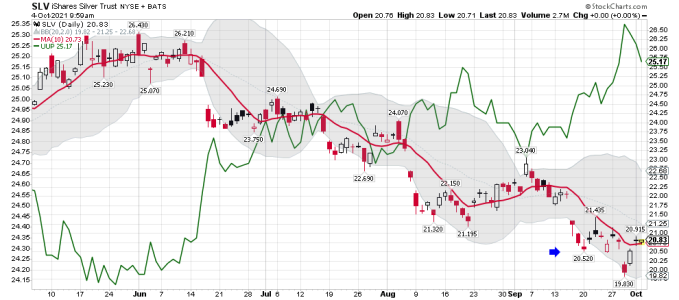

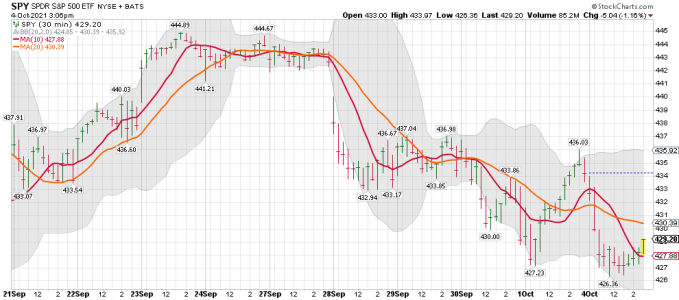

Ignore the first chart for the SPY. You can't see the entire chart. Use the VTI and SPY daily below for my comments.

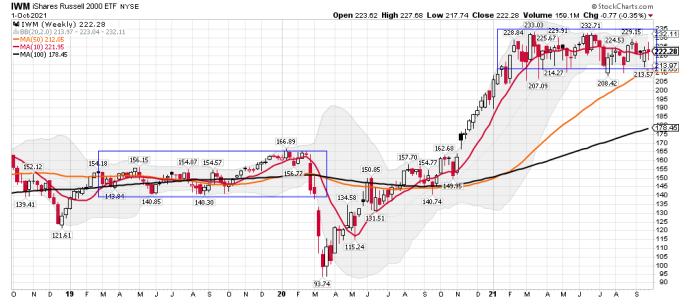

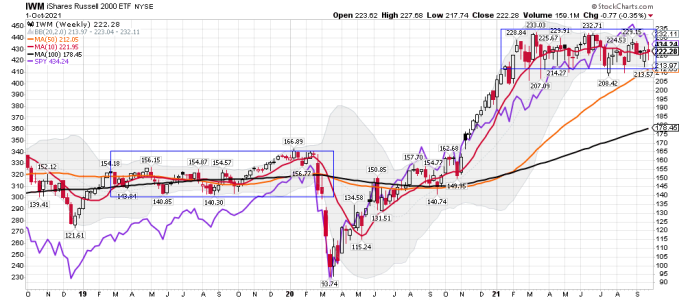

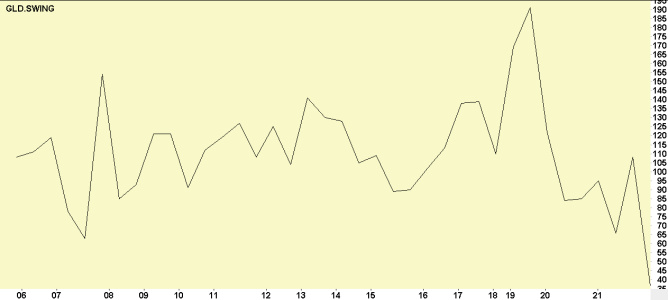

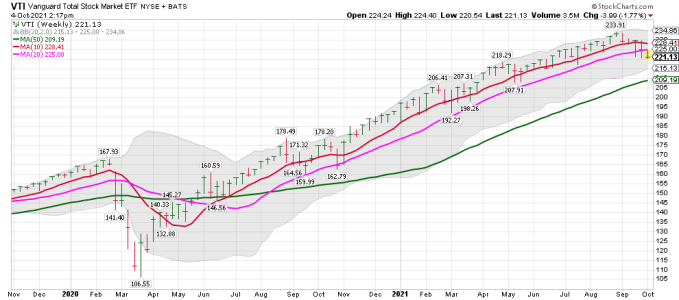

The logic and the odds for a winner trade, based on the patterns I have been using for the last 12 month, was above average for a winning trade today/this week. I didn't ST trade it or go long because I'm waiting on a weekly buy signal, and only ST trade when the indexes are trending below the 10 dma. This is day 5 for the current trend. Going long when the trend is below the 10 dma is counter-trend trading and one should keep it very small. I'm usually short, but shorting this market has been tough. I'm sure you know all this, but I'm just explaining it now now for others that read over my comments.

So, it's early in the week, and it sucks to be down on "EASY MONEY MONDAY". I'm sure lots of folks are with you and probably the PROS are at work here. However, sometimes it just doesn't work out. This trade was like you going double down when you have 11 playing Blackjack, and the dealer has a 3 showing. We shall see if buyers come in later today...... Not sure how much you went long, but for me, and as a general rule I never place a bet over 10%. However, using the TSP for trading can NOT be done very well. It's excellent for MT positions.

Bottom Line: SPY remains below the 10 dma and is still trending down. This could just be the final move down before the next big move up. However, I only trade what is happening and not what I think will happen.

I wait and good luck on your trade Brother!

I will be going long VTI at Vanguard once I like the set-up. The limited moves and having to decided early in the day sucks for sure. It looks like a few buyers are starting to come in. We shall see how we close and maybe we will get Turn around Tuesday. I will continue to only ST trade until I start seeing bigger changes on the 2 hour charts.

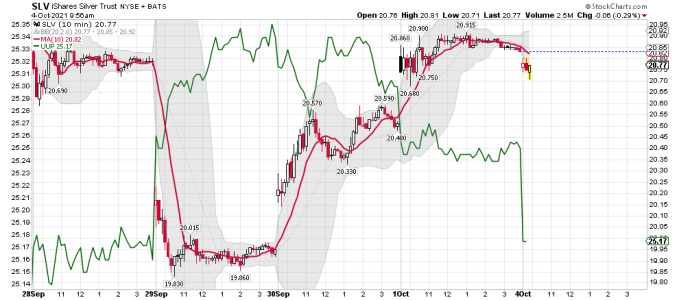

Looking for ST bottom or turn.