robo

TSP Legend

- Reaction score

- 471

Re: Bearish

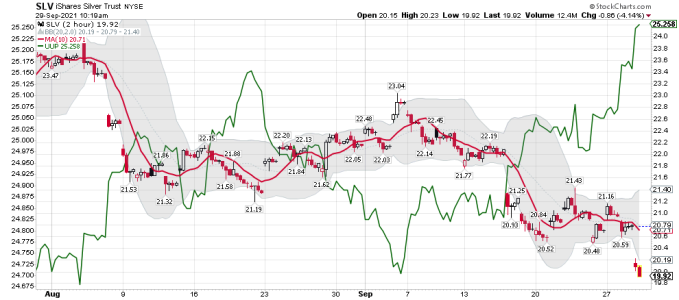

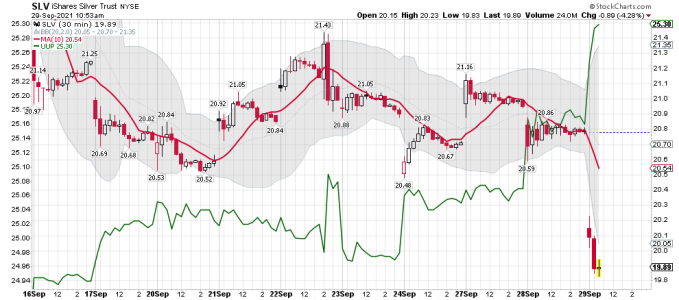

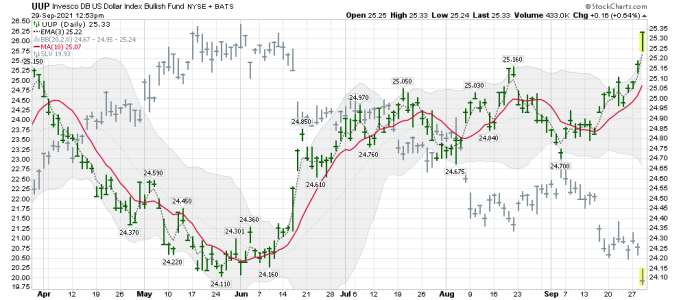

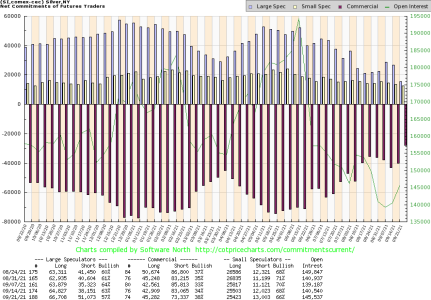

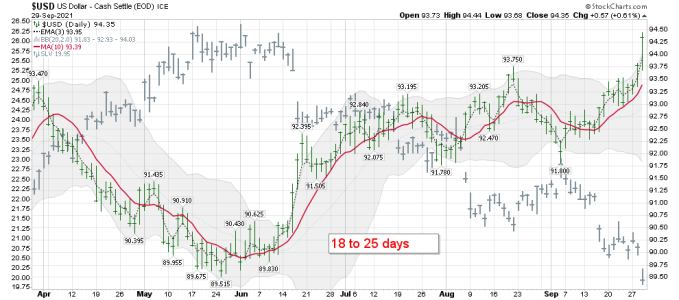

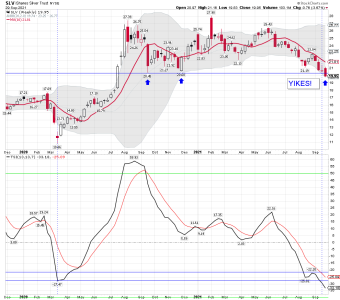

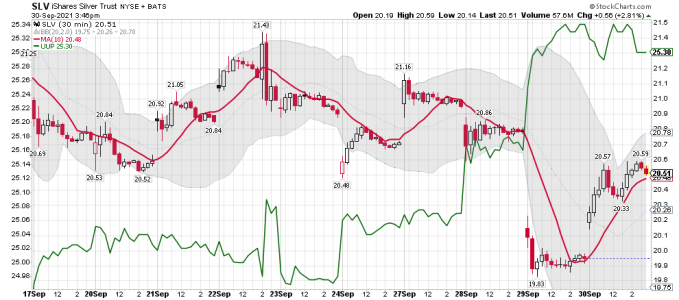

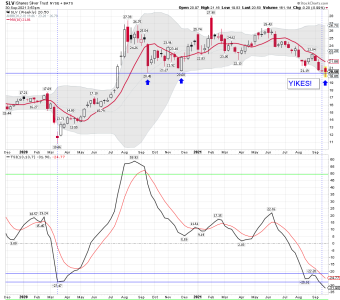

SLV/UUP daily: Pushing up on the 10 dma..... Watching!

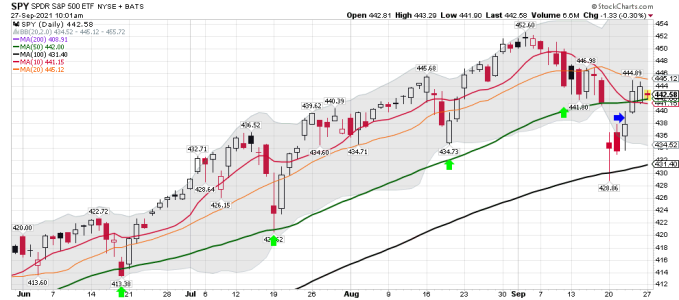

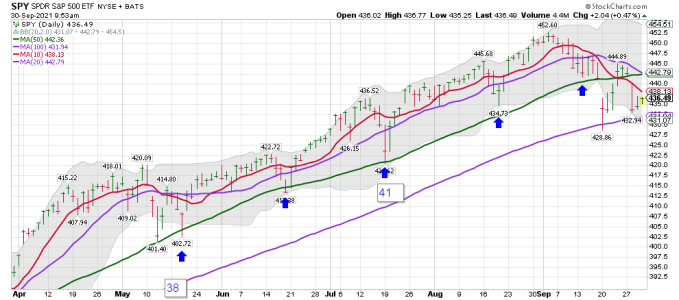

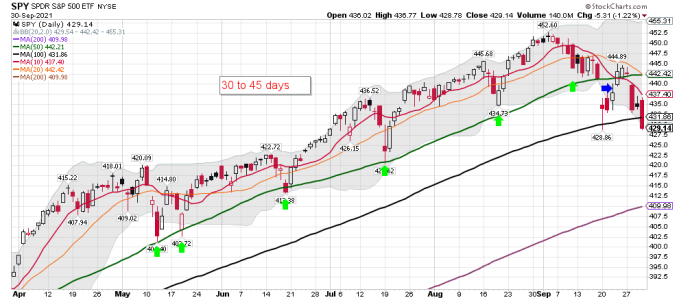

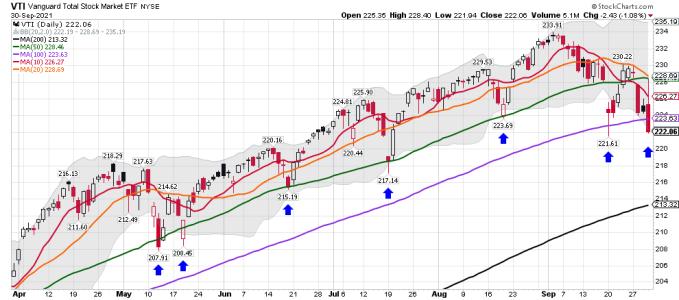

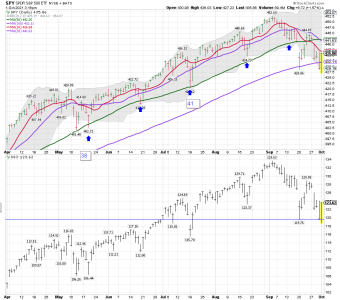

SPY daily: Will we fill that gap this week? Taking a small position of SDS.....

Long SDS and SLV.....

https://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=5&dy=0&id=p41657392815&a=1027369394

SLV/UUP daily: Pushing up on the 10 dma..... Watching!

SPY daily: Will we fill that gap this week? Taking a small position of SDS.....

Long SDS and SLV.....

https://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=5&dy=0&id=p41657392815&a=1027369394

Attachments

Last edited: