-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

SLV/GDX/NUGT: Up some on my SLV/GDX/NUGT ST trading positions. It could still go either way, but I remain long for now. However, these are small trading positions right now. If we were to get a confirmed breakout I would add. Trying to pick bottoms can be tough, but these are only trades based my trading data.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

If this was the bounce it sure was a bearish one

Spoos down today again. The 100 day moving average is some 20 handles lower, but the huge line in sand/psychological level to watch is the big 4300 mark.

Market must find some support soon, or this risks becoming really nasty. Big players have not adjusted risk as the liquidity of this market everybody was so fond off only last week, makes it impossible to reshuffle big risks in an efficient way when things start shaking.

https://themarketear.com/

Spoos down today again. The 100 day moving average is some 20 handles lower, but the huge line in sand/psychological level to watch is the big 4300 mark.

Market must find some support soon, or this risks becoming really nasty. Big players have not adjusted risk as the liquidity of this market everybody was so fond off only last week, makes it impossible to reshuffle big risks in an efficient way when things start shaking.

https://themarketear.com/

Attachments

redbrian

Investor

- Reaction score

- 3

FOMC

I sold everything on the second bounce today for a small profit. GDX is bottoming on a daily/weekly basis. I usually over-trade bottoms and get left behind after a couple successful scalps.

Reasonable Fed members would look at Evergrande, end of unemployment boosts, evictions, looming government shutdown plus vax firings and opt for a dovish tone tomorrow. But are the Fed members who traded off of inside information reasonable people?

Reasonable people wouldn't trade on inside info even if the rules allowed it given the bad optics. I suspect that they are pissed off sociopaths who will want to show us who is boss by talking hawkish and letting the markets drop until we beg them to save us. They would get a triple bonus of getting their insider trading gaffe off the news, bolstering their power and buying back stocks at a lower price.

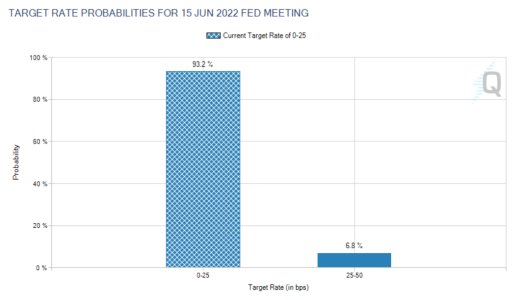

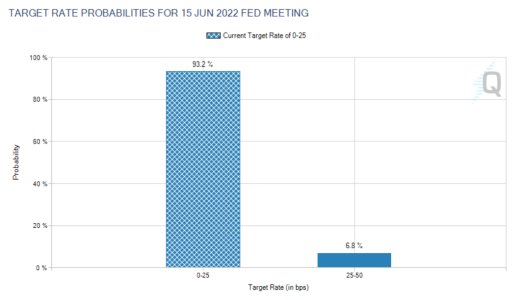

So what am I going to do tomorrow. The markets don't think rates will increase until June. If they hint at before June then cash is the right choice. If they are dovish then I can buy back GDX and SILJ after I speed-read the announcement.

I sold everything on the second bounce today for a small profit. GDX is bottoming on a daily/weekly basis. I usually over-trade bottoms and get left behind after a couple successful scalps.

Reasonable Fed members would look at Evergrande, end of unemployment boosts, evictions, looming government shutdown plus vax firings and opt for a dovish tone tomorrow. But are the Fed members who traded off of inside information reasonable people?

Reasonable people wouldn't trade on inside info even if the rules allowed it given the bad optics. I suspect that they are pissed off sociopaths who will want to show us who is boss by talking hawkish and letting the markets drop until we beg them to save us. They would get a triple bonus of getting their insider trading gaffe off the news, bolstering their power and buying back stocks at a lower price.

So what am I going to do tomorrow. The markets don't think rates will increase until June. If they hint at before June then cash is the right choice. If they are dovish then I can buy back GDX and SILJ after I speed-read the announcement.

Last edited:

robo

TSP Legend

- Reaction score

- 471

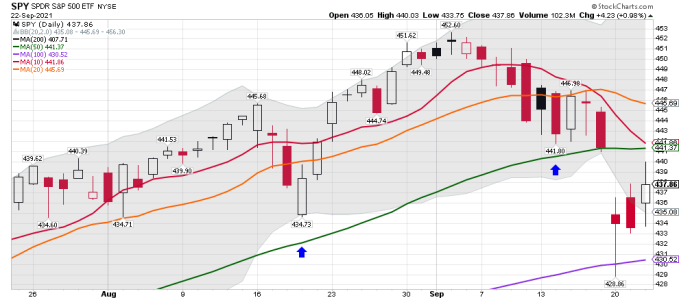

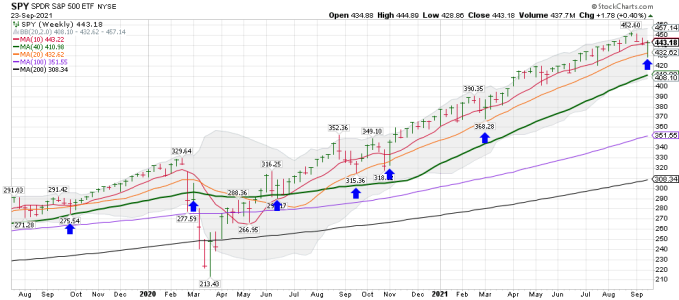

SPY daily cycle data: Waiting on Fed speak.... Will there be any talk about tapering? We shall see!

***Update*** on my pair trade: Sold GDX and added SDS....

Long: SLV and SDS going into Fed Speak. Small position of SDS... Both are still ST trades, but SLV is looking better everyday for a MT position. However, we shall see what Fed speak does to the market!

***Update*** on my pair trade: Sold GDX and added SDS....

Long: SLV and SDS going into Fed Speak. Small position of SDS... Both are still ST trades, but SLV is looking better everyday for a MT position. However, we shall see what Fed speak does to the market!

Attachments

Last edited:

redbrian

Investor

- Reaction score

- 3

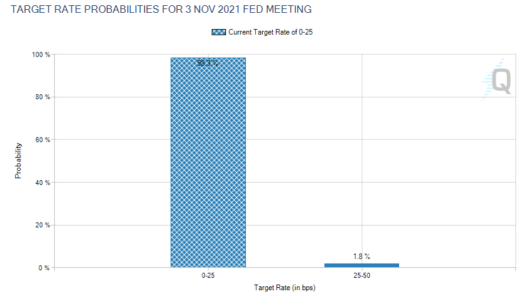

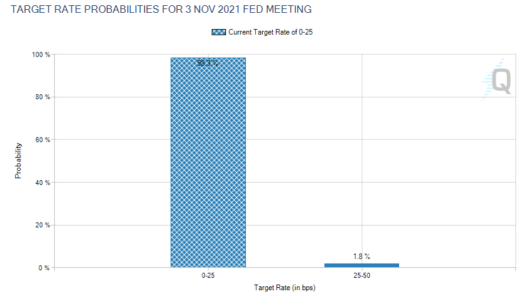

FOMC

Two significant changes.

"Inflation is elevated."

"If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted."

https://www.federalreserve.gov/newsevents/pressreleases/monetary20210922a.htm

Rate hikes odds show a tiny chance for November (zero chance yesterday until June). Bearish?

Guess we wait for the speech in 30 minutes.

https://www.federalreserve.gov/live-broadcast.htm

Two significant changes.

"Inflation is elevated."

"If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted."

https://www.federalreserve.gov/newsevents/pressreleases/monetary20210922a.htm

Rate hikes odds show a tiny chance for November (zero chance yesterday until June). Bearish?

Guess we wait for the speech in 30 minutes.

https://www.federalreserve.gov/live-broadcast.htm

Last edited:

redbrian

Investor

- Reaction score

- 3

Barrick

The 3-year cycle in Barrick Gold (GOLD) seems to set critical turning points every third September. With prices steadily declining for the past 12-months, the odds support a potential bottom brewing in the following days. Perhaps Wednesday’s Fed decision will force a low (possible spike low). From a technical target: closing below $18.00 would be harmful and support a drop back towards the rising 6-year trendline, currently crossing through $16.00.

Longer-term, our work supports a new bull market in precious metals lasting throughout the 2020s. A breakout above the $30.00 level in Barrick Gold would endorse this view and support the next leg higher in precious metals.

https://goldpredict.com/archives/31643

The 3-year cycle in Barrick Gold (GOLD) seems to set critical turning points every third September. With prices steadily declining for the past 12-months, the odds support a potential bottom brewing in the following days. Perhaps Wednesday’s Fed decision will force a low (possible spike low). From a technical target: closing below $18.00 would be harmful and support a drop back towards the rising 6-year trendline, currently crossing through $16.00.

Longer-term, our work supports a new bull market in precious metals lasting throughout the 2020s. A breakout above the $30.00 level in Barrick Gold would endorse this view and support the next leg higher in precious metals.

https://goldpredict.com/archives/31643

Last edited:

robo

TSP Legend

- Reaction score

- 471

Re: Barrick

LOL.....

Repeat after me: "don't buy protection when you have to, buy it when you can"

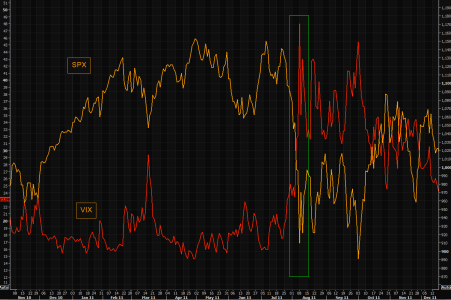

One of the more painful charts this week. First the explosion and the crowd chasing extremely rich protection, and then the implosion of VIX, from 28.66 to 20.87 as the crowd once again has to puke protection because: "bro hedges only cost money".

https://themarketear.com/

LOL.....

Repeat after me: "don't buy protection when you have to, buy it when you can"

One of the more painful charts this week. First the explosion and the crowd chasing extremely rich protection, and then the implosion of VIX, from 28.66 to 20.87 as the crowd once again has to puke protection because: "bro hedges only cost money".

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

Re: Barrick

LOL..... I can't wait to see how they handle this one.

Debt ceiling - what if...?

Below a few points via Washington Post worth reviewing;

1, If US fails to hike the debt ceiling a default would be triggered

2, A default = sovereign credit downgrade

3, Credit downgrade = equities crushed by up to 33%, wiping out $15tn of household wealth

4, Cost of debt would spike, economy would suffer big and US would lose up to 6mn jobs...unemployment would go from 5% to 9%

5, Drop dead date Oct 20

6, Everybody remembers 2011...despite the deal reached 2 days before the debt ceiling deadline it was the S&P downgrade that saw equities plunge and VIX explode

Let's see if they manage the situation better this time around...last time was a mess...

Full article here.

U.S. default this fall would cost 6 million jobs, wipe out $15 trillion in wealth, study says

https://www.washingtonpost.com/us-policy/2021/09/21/debt-ceiling-recession-/

LOL..... I can't wait to see how they handle this one.

Debt ceiling - what if...?

Below a few points via Washington Post worth reviewing;

1, If US fails to hike the debt ceiling a default would be triggered

2, A default = sovereign credit downgrade

3, Credit downgrade = equities crushed by up to 33%, wiping out $15tn of household wealth

4, Cost of debt would spike, economy would suffer big and US would lose up to 6mn jobs...unemployment would go from 5% to 9%

5, Drop dead date Oct 20

6, Everybody remembers 2011...despite the deal reached 2 days before the debt ceiling deadline it was the S&P downgrade that saw equities plunge and VIX explode

Let's see if they manage the situation better this time around...last time was a mess...

Full article here.

U.S. default this fall would cost 6 million jobs, wipe out $15 trillion in wealth, study says

https://www.washingtonpost.com/us-policy/2021/09/21/debt-ceiling-recession-/

Attachments

redbrian

Investor

- Reaction score

- 3

GLD

I just noticed a gap fill on GLD and a potential ABC down. Weekly has a long way to go indicator-wise which is odd. Maybe first daily cycle out of ICL is a retest of the low before it gets moving on the second cycle.

Normal gold DCL timing band is next month.

UUP is overbought on daily with a strong candle and not at previous highs on weekly. Watchout for a false breakout of 25.15 which gets weekly to the right level for it to rollover.

I am sitting on the sidelines waiting for a good entry point. Hope I get another bite of the apple.

I just noticed a gap fill on GLD and a potential ABC down. Weekly has a long way to go indicator-wise which is odd. Maybe first daily cycle out of ICL is a retest of the low before it gets moving on the second cycle.

Normal gold DCL timing band is next month.

UUP is overbought on daily with a strong candle and not at previous highs on weekly. Watchout for a false breakout of 25.15 which gets weekly to the right level for it to rollover.

I am sitting on the sidelines waiting for a good entry point. Hope I get another bite of the apple.

Last edited:

robo

TSP Legend

- Reaction score

- 471

robo

TSP Legend

- Reaction score

- 471

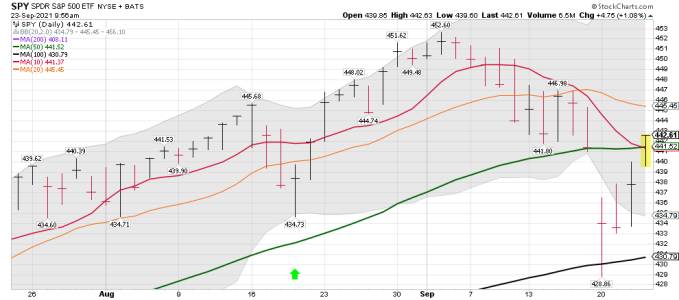

SPY daily: A closer look.... A gap up and a very nice move back above the 10 dma and the 50 dma......

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=0&mn=2&dy=0&id=p53743883565&a=1025881557

SevenSentinels

@SevenSentinels

53m

9:15 AM, September 23, 2021

Markets To Open Near 50% Retrace Of September Decline

https://twitter.com/SevenSentinels/status/1441029092724277252/photo/1

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=0&mn=2&dy=0&id=p53743883565&a=1025881557

SevenSentinels

@SevenSentinels

53m

9:15 AM, September 23, 2021

Markets To Open Near 50% Retrace Of September Decline

https://twitter.com/SevenSentinels/status/1441029092724277252/photo/1

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

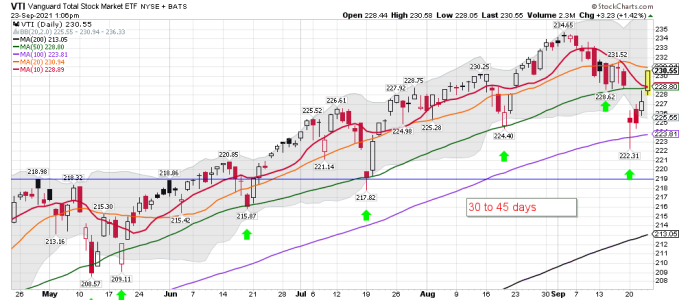

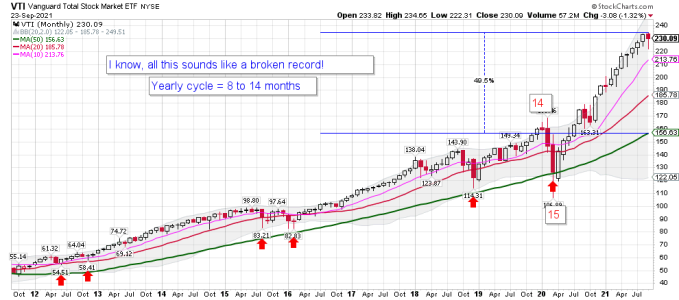

VTI daily (The Total Stock Market) VTI is currently my preferred index to trade at Vanguard. If you BTD when VTI tagged the 50 dma and added when we hit the 100 dma, you be a happy camper today!

https://stockcharts.com/h-sc/ui?s=VTI&p=D&yr=0&mn=5&dy=0&id=p91026361348&a=1026100062

****** UPDATE******** A ST trading comment: If you bought using leverage when we tagged the 100 dma it's time to reduce some in my opinion. I have traded both SSO and SDS since the VTI $234.65 marker printed 15 days ago.

https://stockcharts.com/h-sc/ui?s=VTI&p=D&yr=0&mn=5&dy=0&id=p91026361348&a=1026100062

****** UPDATE******** A ST trading comment: If you bought using leverage when we tagged the 100 dma it's time to reduce some in my opinion. I have traded both SSO and SDS since the VTI $234.65 marker printed 15 days ago.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

SPY daily: Getting ready for "Free Lunch Friday" and "Easy Money Monday" now that we have a confirmed DCL.... Now will this DCL turn out to be a LT cycle? We shall see....

Buying the dip early in an uptrend just doesn't matter with the Fed still printing. All is well! The current pattern has been clear for months now. JUST BTD!

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=0&mn=5&dy=0&id=p35095900129&a=1025882430

Buying the dip early in an uptrend just doesn't matter with the Fed still printing. All is well! The current pattern has been clear for months now. JUST BTD!

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=0&mn=5&dy=0&id=p35095900129&a=1025882430

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

I have to agree with Tom: This has been and remains a market that one just has to hold your nose and BTD's. We could still see a sight pullback and a gap fill, but one would think it will be bought quickly. ( See chart 3 SPY daily)

Waiting to see how this daily cycle plays out!

SPY weekly: (Chart 1) A tag of the 20 wma has been a good place to buy during this nothing maters run. The SPY is trying to get back above the 10 wma for Free Lunch Friday. The Bulls will want a close above the 10 wma going into next week.

VTI monthly: ( Chart 2) When will get the next YCL? During normal times we would normally tag the 20 mma during a YCL. Waiting to see how it plays out. "SO MUCH" for this being normal times"

""So much for the most bearish seasonal week of the year. So much for a post expiration week sell off. So much for Evergrande defaulting on their nine digit debt. So much for a test of the lows. So much for resistance at the 50-day EMA and the top of the open gap. So much for a 10% to 20% correction, although we did finally see a 5% pullback from the recent high to low. So much for investors being nervous before the debt ceiling gets hit. So much for a Fed who was expected to announce a date for tapering their bond buying program.""

Waiting to see how this daily cycle plays out!

SPY weekly: (Chart 1) A tag of the 20 wma has been a good place to buy during this nothing maters run. The SPY is trying to get back above the 10 wma for Free Lunch Friday. The Bulls will want a close above the 10 wma going into next week.

VTI monthly: ( Chart 2) When will get the next YCL? During normal times we would normally tag the 20 mma during a YCL. Waiting to see how it plays out. "SO MUCH" for this being normal times"

""So much for the most bearish seasonal week of the year. So much for a post expiration week sell off. So much for Evergrande defaulting on their nine digit debt. So much for a test of the lows. So much for resistance at the 50-day EMA and the top of the open gap. So much for a 10% to 20% correction, although we did finally see a 5% pullback from the recent high to low. So much for investors being nervous before the debt ceiling gets hit. So much for a Fed who was expected to announce a date for tapering their bond buying program.""

Attachments

robo

TSP Legend

- Reaction score

- 471

Yes Sir: A new daily cycle..... The Bulls - Will be back to the Bubble Talk and Melt up..... The Bears will... Well, whatever they do....

LOL..... Remember all the talk about the "Jaws of Death" in 2020...... (Well, see the last chart)

Stocks Confirm New Daily Cycle

Stocks formed a swing low on Wednesday.

Stocks delivered bullish follow through on Thursday by closing above the converging 10 day MA and 50 day MA to confirm the new daily cycle. Stocks should go on to break above the declining trend line as they rally out of their DCL.

It is quite likely that Monday was not only the DCL but the intermediate cycle low (ICL) as well. And if stocks can quickly break out to new highs then that may trigger a final melt up.

https://likesmoneycycletrading.wordpress.com/2021/09/23/stocks-confirm-new-daily-cycle-2/

LOL..... Remember all the talk about the "Jaws of Death" in 2020...... (Well, see the last chart)

Stocks Confirm New Daily Cycle

Stocks formed a swing low on Wednesday.

Stocks delivered bullish follow through on Thursday by closing above the converging 10 day MA and 50 day MA to confirm the new daily cycle. Stocks should go on to break above the declining trend line as they rally out of their DCL.

It is quite likely that Monday was not only the DCL but the intermediate cycle low (ICL) as well. And if stocks can quickly break out to new highs then that may trigger a final melt up.

https://likesmoneycycletrading.wordpress.com/2021/09/23/stocks-confirm-new-daily-cycle-2/