robo

TSP Legend

- Reaction score

- 471

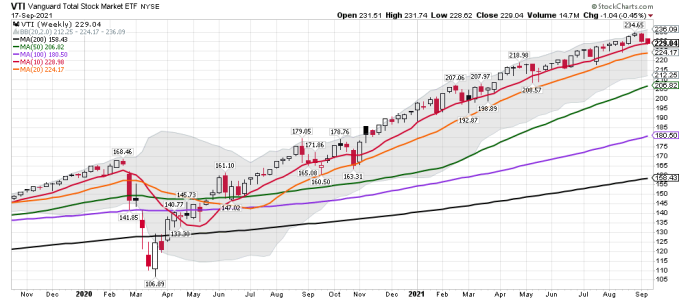

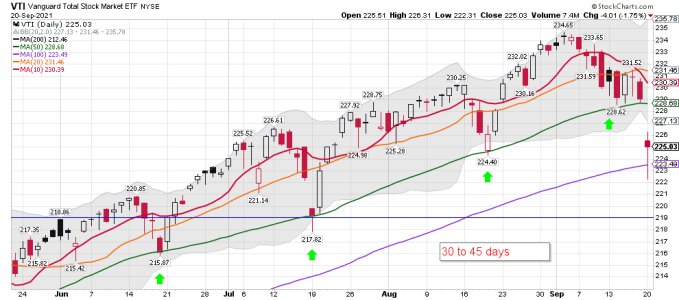

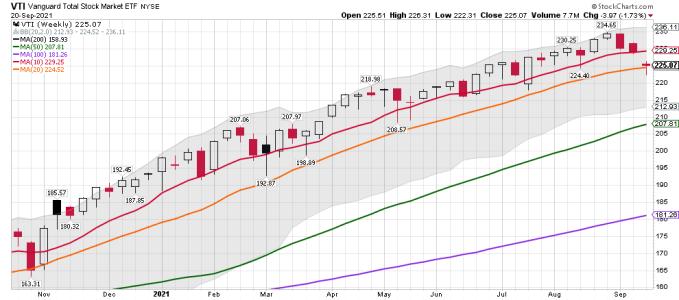

SPX cycle data: Is there a possible weekly cycle low coming? (See my VTI weekly chart below) We are sure do one....... LOL..... We shall see!

The 9/18/21 Weekend Report Preview

Stocks closed below the 50 day MA on Friday.

Closing below the 50 day MA signals the daily cycle decline. The peak on day 10 sets stocks up for a left translated daily cycle formation. A break below the previous DCL of 4367.73 will from a failed daily cycle to confirm the intermediate cycle decline. Stocks are currently in a daily uptrend. But a close below the lower daily cycle band will end the daily uptrend and being a daily downtrend.

The 9/18/21 Weekend Report Preview

Stocks closed below the 50 day MA on Friday.

Closing below the 50 day MA signals the daily cycle decline. The peak on day 10 sets stocks up for a left translated daily cycle formation. A break below the previous DCL of 4367.73 will from a failed daily cycle to confirm the intermediate cycle decline. Stocks are currently in a daily uptrend. But a close below the lower daily cycle band will end the daily uptrend and being a daily downtrend.