robo

TSP Legend

- Reaction score

- 471

Yes Sir: It has been pretty wild trading VXX...... Not recommend for most traders. Not the first time I have posted an article about the VIX.

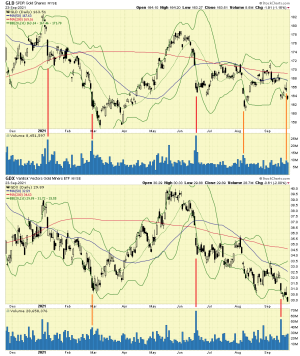

VXX/SPY 2 hour trading chart: It's been wild ST trading these two this week.... VXX looks to be moving back down under $25.00ish

(Chart 2)

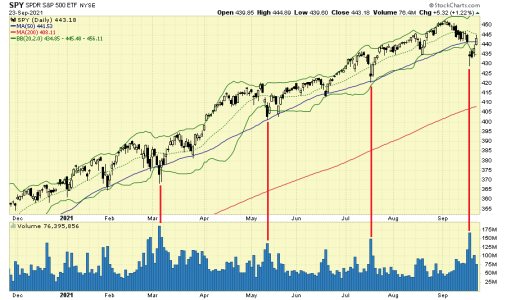

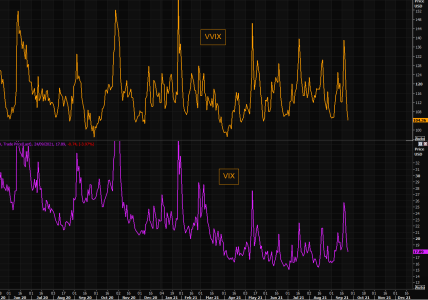

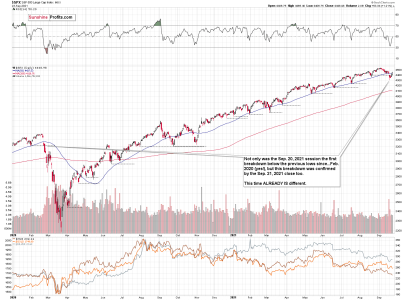

VIX - the master of frustration

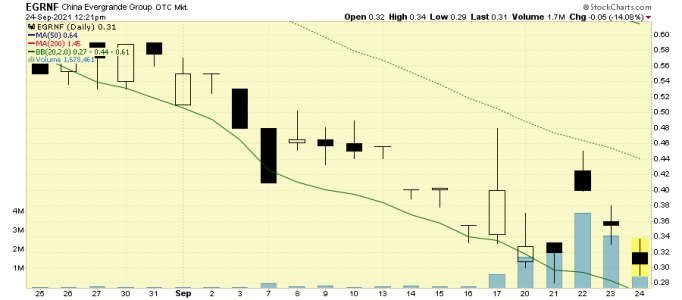

The VIX round trip Evergrande move has now been completed.

VIX is trading well below Friday's close at the moment, currently printing 18.77!

Needless to say, this has produced huge p/l pain, as the crowd managed loading up on protection at too elevated levels once again and are now puking all those hedges...

We stick with our general logic on protection:

Buy protection when you can, not when you must.

VXX/SPY 2 hour trading chart: It's been wild ST trading these two this week.... VXX looks to be moving back down under $25.00ish

(Chart 2)

VIX - the master of frustration

The VIX round trip Evergrande move has now been completed.

VIX is trading well below Friday's close at the moment, currently printing 18.77!

Needless to say, this has produced huge p/l pain, as the crowd managed loading up on protection at too elevated levels once again and are now puking all those hedges...

We stick with our general logic on protection:

Buy protection when you can, not when you must.