robo

TSP Legend

- Reaction score

- 471

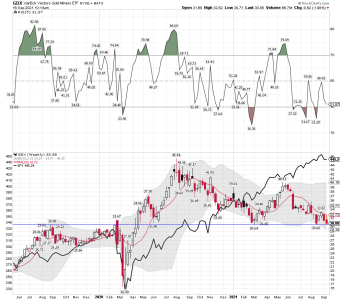

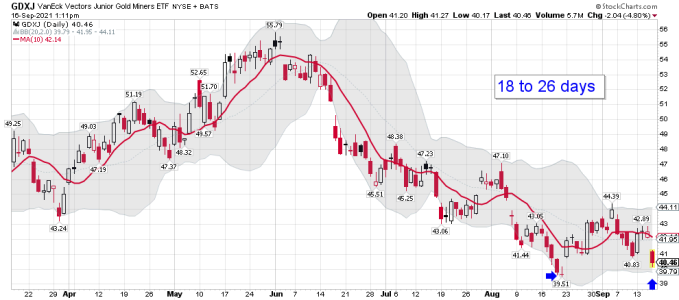

Re: GDX Breakdown

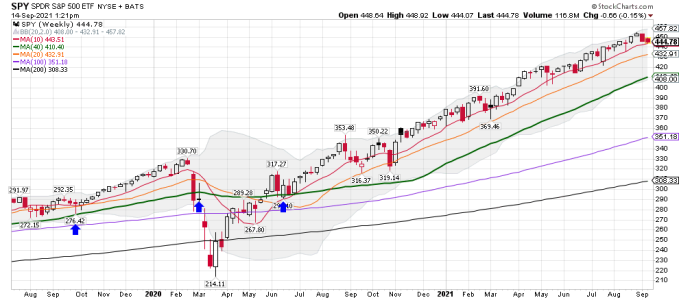

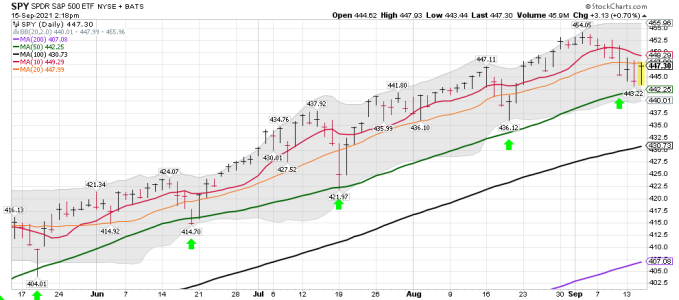

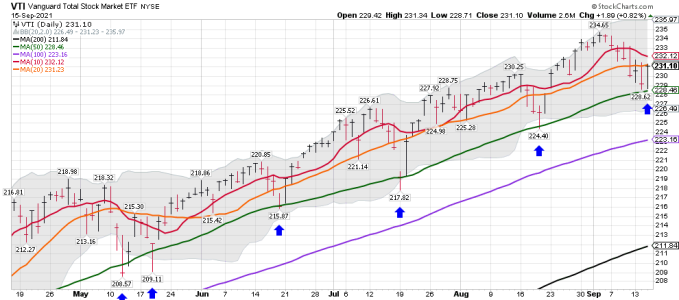

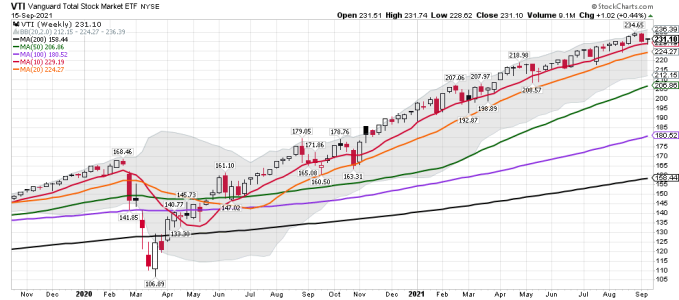

SPY daily after the close Chart 1) The Bulls did manage to close the SPY in the green, but far from my next buy signal. If you bought the low today it could turn out your going to be one happy camper in the days ahead.

Chart 1) The Bulls did manage to close the SPY in the green, but far from my next buy signal. If you bought the low today it could turn out your going to be one happy camper in the days ahead.

Bottom Line: The SPY remains below its 10 and 20 dma's.....

Chart 2

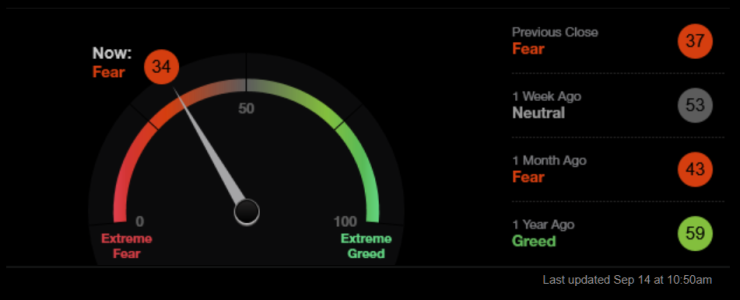

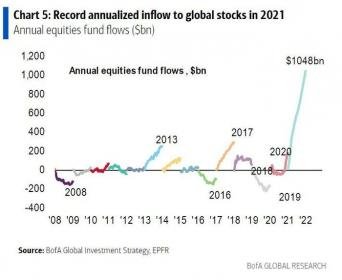

Who will not buy the next dip?

The way this is trading, it seems everybody will want to buy the next dip...

Spoos bouncing on the longer term trend line again, and the dips are becoming shorter and shorter.

Complex psychology becoming even more extreme.

Note the move in VIX, down 7.5% on a Monday just shows you how big the move was late last week. As we explained over the weekend; "...since SKEW remains steep even relatively small moves in Spoos will "translate" into spiky VIX moves".

Let's see how this plays out going forward, but the Pavlovian investor is getting increasingly confident...

https://themarketear.com/

(Chart 3)

Shitty breadth (I)

Not many 52 week highs in this market. It is actually less than 1% of companies in the S&P 500 that trade at 52 week highs. The 5 day average is at lowest since Feb this year.

(Chart 4)

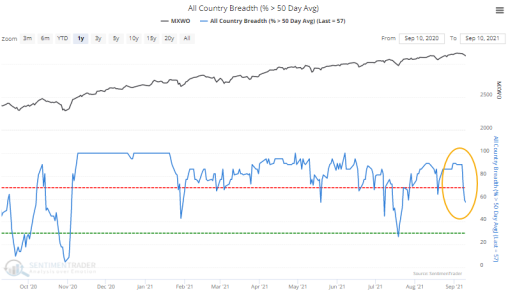

A Plunge in Global Stock Market Trends

Jason Goepfert

Published: 2021-09-13 at 07:35:00 CDT

Fewer countries are in medium-term uptrends, and that's a warning shot for stocks.

The percentage of country equity indexes trading above their 50-day moving average registered a sharp reversal lower over only a couple of sessions late last week. According to our calculations, positive trends plunged from 90% to below 60%.

Over the past 30+ years, there have been 17 other times when the percentage of countries trading above their 50-day average goes from >= 90% to <=60% in two days or less.

For the MSCI ACWI World Index ex USA index, future returns were weak on a short to intermediate-term basis, especially over the next 1-2 weeks.

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-40961a97de-1271291994

SPY daily after the close

Bottom Line: The SPY remains below its 10 and 20 dma's.....

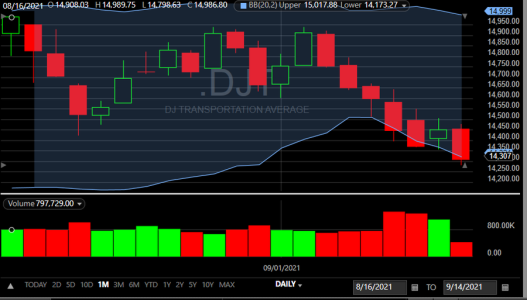

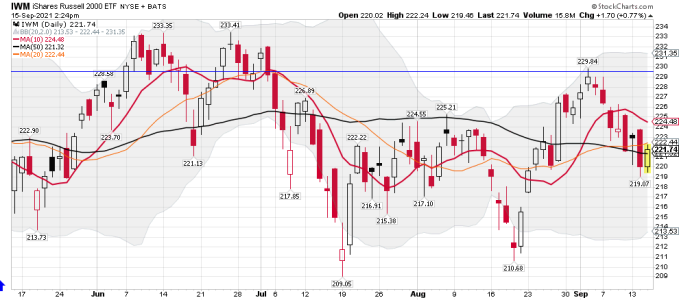

Chart 2

Who will not buy the next dip?

The way this is trading, it seems everybody will want to buy the next dip...

Spoos bouncing on the longer term trend line again, and the dips are becoming shorter and shorter.

Complex psychology becoming even more extreme.

Note the move in VIX, down 7.5% on a Monday just shows you how big the move was late last week. As we explained over the weekend; "...since SKEW remains steep even relatively small moves in Spoos will "translate" into spiky VIX moves".

Let's see how this plays out going forward, but the Pavlovian investor is getting increasingly confident...

https://themarketear.com/

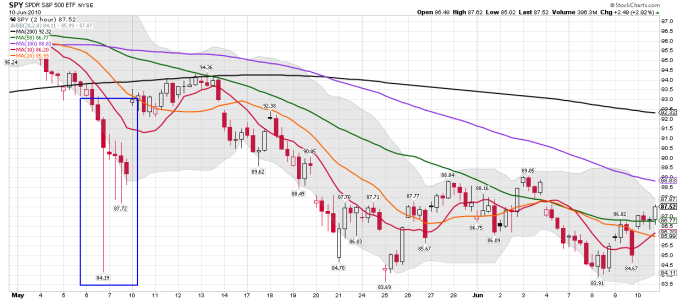

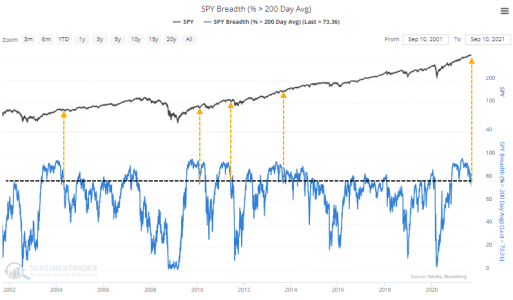

(Chart 3)

Shitty breadth (I)

Not many 52 week highs in this market. It is actually less than 1% of companies in the S&P 500 that trade at 52 week highs. The 5 day average is at lowest since Feb this year.

(Chart 4)

A Plunge in Global Stock Market Trends

Jason Goepfert

Published: 2021-09-13 at 07:35:00 CDT

Fewer countries are in medium-term uptrends, and that's a warning shot for stocks.

The percentage of country equity indexes trading above their 50-day moving average registered a sharp reversal lower over only a couple of sessions late last week. According to our calculations, positive trends plunged from 90% to below 60%.

Over the past 30+ years, there have been 17 other times when the percentage of countries trading above their 50-day average goes from >= 90% to <=60% in two days or less.

For the MSCI ACWI World Index ex USA index, future returns were weak on a short to intermediate-term basis, especially over the next 1-2 weeks.

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-40961a97de-1271291994

Attachments

Last edited: